The grid edge is a wild and wooly frontier. Rooftop solar PV, behind-the-meter batteries, energy-smart buildings and other forms of distributed, customer-owned energy assets represent a significant problem for centrally controlled, one-way power grid operations. They’re also a huge resource -- if they can be aggregated and managed in a way that brings their positive qualities to the forefront.

But to do that, someone’s got to organize them in ways that allow for fast, easy and reliable integration on the IT side. On Wednesday, grid technology provider Spirae launched its Wave platform, aimed at providing just this kind of capability.

The Fort Collins, Colo.-based company says its combination of software and hardware can collect, monitor, manage and control any number of distributed energy assets, from the microgrid level all the way up to utility-wide distributed energy resource management system (DERMS).

“With all of these distributed assets, the tendency is to treat them as one-off devices,” Sunil Cherian, CEO of Spirae, said during the Wednesday unveiling of the Wave platform at the Verge conference in San Francisco. “We need to get past that model and get to virtualization of assets.” In other words, Spirae is hoping to create an “operating system” for distributed energy, much as your PC or smartphone OS manages subsystems, applications and peripheral devices today.

That’s a non-trivial task, as the engineers say. But Spirae, has been doing this kind of integration work for a diverse set of customers since its 2002 founding, including utility pilot projects in Colorado and Denmark, microgrids for the U.S. Navy, billionaire Richard Branson’s Caribbean island, and most recently, a full-scale implementation with San Diego Gas & Electric.

“We’ve taken our several years of experience, the pain and suffering we’ve been through, to design this system,” he said. That includes building massive libraries of all the different makes and models of solar inverters, generators, load control devices and grid gear that makes up a DER ecosystem. It also includes prebuilt applications and user interfaces to allow everyone from repair technicians to distribution grid operators to organize and manage multiple assets, whether individually or in “groups” that represent a specific set of values for the system at large.

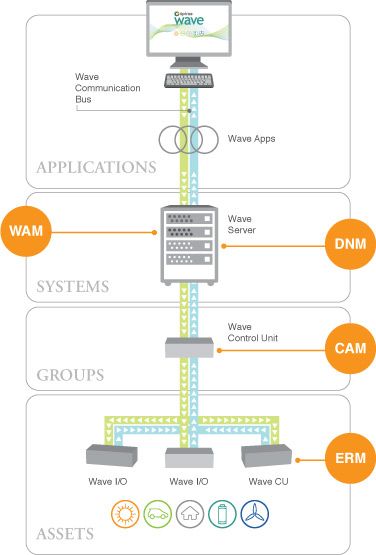

“What we’re doing is merging that software layer that manages all that DER, so nothing upstream has to worry about how to talk to this battery inverter or this generator” and so on, Cherian said in an interview after his on-stage presentation. Here’s a diagram of how Spirae’s Wave platform puts the pieces together:

At the bottom of the chart are Spirae’s Energy Resource Managers (ERMs), the devices that integrate disparate DER endpoints at the local level. Spirae demonstrated its ERM with a “pop-up microgrid” -- a mix of biofuel generators, an EV charging station, a Stem battery, and the circuit powering a section of the Palace Hotel in downtown San Francisco. CTO Oliver Pacific showed off how the “Wave Commander,” a unit combining off-the-shelf computing hardware and Spirae’s control software, could translate equipment protocols like Modbus and DNP3 into Internet Protocol.

From there, groups of assets are hosted and managed by Control Area Managers (CAM), which aggregate these locally controlled “nodes” of DERs into what it calls "dynamic portfolios” of assets. “From the grid’s point of view, it doesn’t care if it’s talking to an inverter or a building management system,” Cherian said. At the same time, Spirae builds in specialized features, such as four-quadrant metering for active and reactive power, that are important for grid operators, he noted.

To tie it all together with system-wide operations, Spirae connects all its CAMs into a Distribution Network Manager, which stores the full representation of the DER portfolio, the moment-to-moment connectivity to different pieces of the system, and what capabilities the aggregated assets can provide at any one time.

Then, to make it all useful to the humans using it, Spirae’s Wave Application Manager allows for a whole host of “Wave Apps” to be applied to this portfolio-wide view. Wave comes with its own set of apps that automatically organize DERs into useful categories, but it invites customers to build their own apps as well, using standard programming languages that make this task a lot easier than finding specialists who can write code for specialized grid gear, he said.

“What they do with it will vary,” he said. “They could use it for voltage optimization, for example. They could use it for peak load management. They could use it for market participation.” In any of these cases, “If you just have the focus on your business logic -- 'I want to create 5 megawatts to participate in the market' -- and that’s quick and easy to do, you can take marginally higher levels of risk; if you’re wrong, you can recalibrate and redeploy,” he said.

Pioneering a new approach

This model stands in stark contrast to the way most microgrids or DERMS are configured today, which typically involves a lot of time and money spent on integration, Cherian observed. Those costs can add up to around one-fifth of the total cost of a typical microgrid system, he said. With Wave, “you could bring that down into the high single digits -- and our objective is to bring it down to 5 percent,” he said.

Beyond that, there’s the matter of laying the groundwork for adding all the new distributed energy resources that are coming on-line, Cherian said. The hardware being deployed on the grid today is “smarter than any of the things that came before it,” he said. “An inverter next to a PV array is a very capable machine. We underutilize these assets, for the most part.” As more and more of these assets become a de facto part of a utility’s grid, “you have to have something here to facilitate this, otherwise you’ll be stuck with platforms that won’t scale,” Cherian said.

Conversely, utilities armed with Wave can use it to help pick the optimal combination of DER assets at different locations on the grid, according to Cherian. “Almost every project we do has that kind of consideration,” he said, since careful planning and optimization should come before customers start spending money on DER systems. This is also something that states like California, New York and Hawaii are going to start requiring their utilities to incorporate into distribution grid planning in future years."

Spirae Wave is now being deployed on-site via dedicated hardware, Cherian said. But the company is also working with customers like Leidos (formerly SAIC) and NRG Energy on a cloud-hosted platform, he added. “They have their own business logic and business intelligence that they don’t want to share with anyone,” he said. “They want to drop that on top, and manage DER almost as a commodity.”

Spirae is also looking at the ability to embed its Wave software in distributed intelligent devices, such as Cisco’s Linux-enabled IOx routers, he said. “We are working with some of our utility customers to standardize on equipment like that,” he said, though that’s still a few years out.

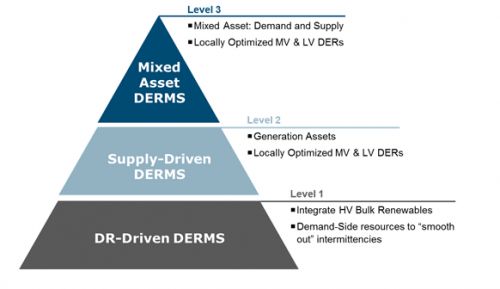

GTM Research’s recent report, DER Management Systems 2014: Technology, Deployments and Market Size, highlights Spirae as one of the leaders in a field that includes a long list of technology providers, all working from different locations in the broader customer-to-grid operator paradigm.

"Spirae is a great example of a microgrid control vendor that has expanded its offerings into the wider utility-scale DERMS market,” GTM Research analyst and report author Omar Saadeh noted. "Expect heightened interest from similar vendors as utilities address the increased adoption of distributed resources in their territories." GTM Research estimates that annual North American DERMS spending will more than double to approximately $110 million by 2018.

There’s no doubt that the distributed energy revolution is driving utilities toward technology solutions that can help them manage these grid edge resources in a cost-effective manner. At the same time, new models are emerging that could allow non-utility actors to play a role, whether as aggregators of thousands of individual solar, energy storage and demand response-enabled homes or businesses, or as providers of what Cherian called “microgrids-as-a-service” for big corporate or government clients.

“This is the type of tool that could unlock those possibilities,” he said.