New York is in the midst of transforming its energy regulations to afford distributed energy resources (DERs) a much larger role in the state’s future grid mix. But what are New York’s DER assets, anyway -- and how does that mix compare to other states on the vanguard of the distributed energy revolution?

Last week, the New York Independent System Operator (NYISO) released a report (PDF) that goes a long way toward answering that question. In simple terms, New York has a lot less rooftop solar PV than states like California, Arizona or even neighboring New Jersey. But it has a lot more combined heat and power (CHP) systems -- on-site power generation at the municipal, campus and facility scale -- that could play an important role in the state’s grid resiliency and reliability goals.

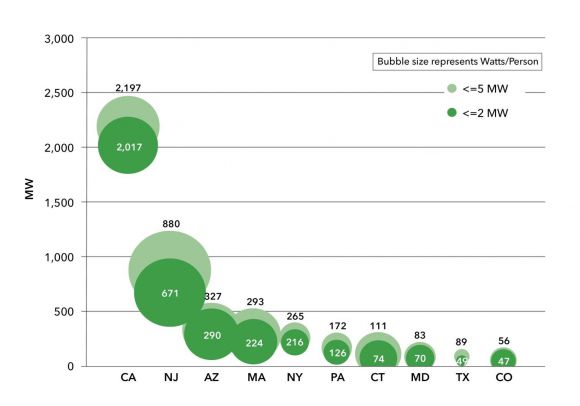

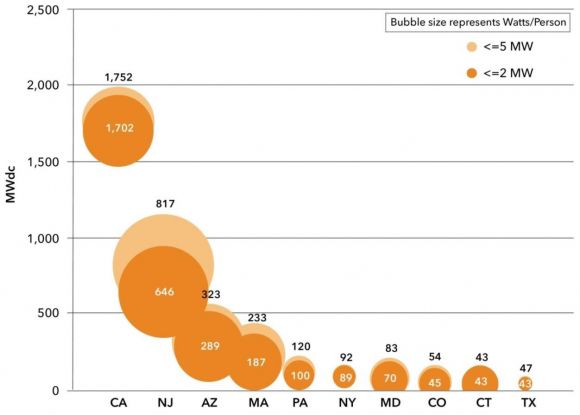

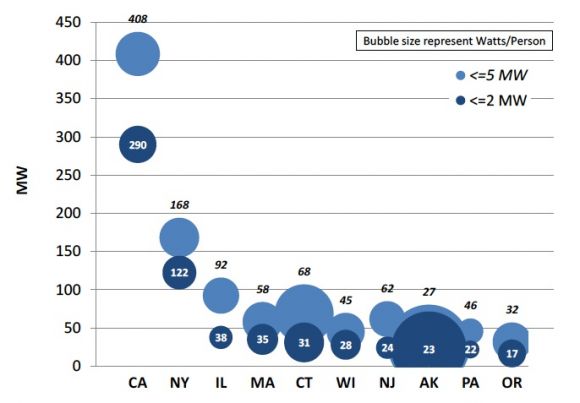

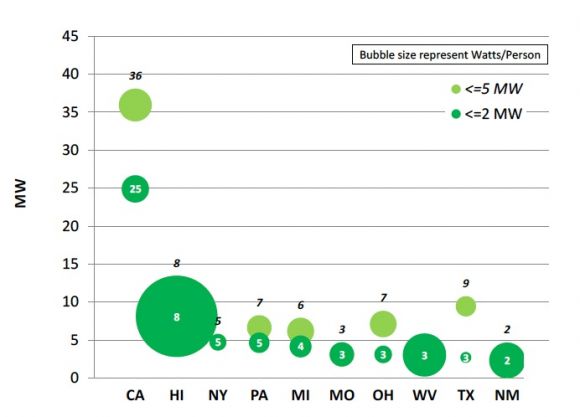

Overall, “New York ranks within the top five states, but is the exception in terms of the DER technology driving total penetration,” according to the report prepared by consultancy DNV GL (formerly DNV Kema). Here’s a state-by-state comparison using “watts per person” as a metric, tallying up all energy resources of less than 2 megawatts and 5 megawatts in size, respectively.

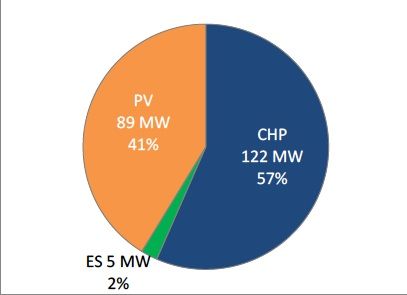

But New York gets a full 57 percent of its distributed energy from CHP and cogeneration systems, as DNV GL notes. Almost all the remaining share is solar PV, with a tiny sliver representing the state’s energy storage mix. (DNV GL’s report looked specifically at DERs that are capable of actually injecting power into the grid, versus demand-reduction assets like energy efficiency and demand response, although these will play an important role in balancing the ups and downs of distributed energy.)

In terms of distributed solar alone, New York drops to sixth in the nation, behind California, New Jersey, Arizona, Massachusetts, and even Pennsylvania in terms of watts-per-person. According to DNV GL, the state has 89 megawatts of PV sourced from installations under 2 megawatts, a figure that increases to 92 megawatts when installations between 2 megawatts and 5 megawatts are taken into account.

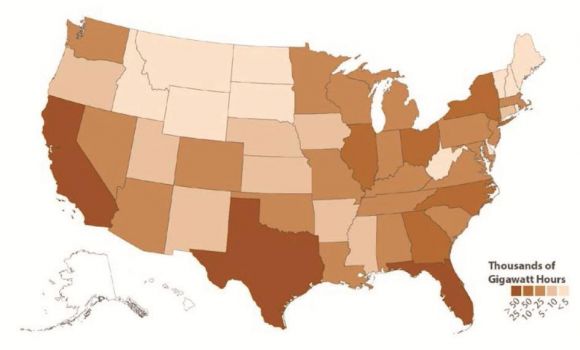

There are many reasons for this, including more generous incentives and policy support in other states. But part of it is the fact that New York isn’t as sunny as other states, and that it has more multi-family housing. According to a 2012 analysis of rooftop space and solar availability from DOE’s National Renewable Energy Laboratory (NREL), New York ranks seventh in the country in terms of “technical potential” for distributed PV, with a possible 25 gigawatts of capacity.

That’s a perfect-world figure, but the New York State Energy Research and Development Authority (NYSERDA) has calculated that the state could have significantly more PV by 2020 -- 881 megawatts in cumulative peak capacity from residential systems, and another 1.174 megawatts from commercial building systems.

With CHP systems, by contrast, New York ranks second in the nation behind California, the report found -- and it has a lot more potential, given its urban landscape. While much of the state’s CHP base is very large -- about 60 percent consisted of units of more than 100 megawatts each as of 2000 -- it also has a growing share of CHP systems that are less than 2 megawatts in size, with about 122 megawatts installed, most of it natural gas reciprocating engines.

As for CHP’s technical potential, a 2002 study by NYSERDA tallied up 8.5 gigawatts of possible capacity, with 6.3 gigawatts coming in units of less than 100 megawatts in size. In other words, “Overall, New York is estimated to have a large technical potential for smaller-scale CHP,” the report found.

That’s important, because CHP systems could be valuable sources of dispatchable, controllable power to help balance the intermittency of solar PV. Of course, local air quality regulations limit just how much fossil-fuel-burning distributed energy can be sited in densely populated areas. But as the report notes, the benefits of delivering power locally include reducing transmission and distribution line losses, which can actually improve overall emissions profiles compared to big, central power generators in some circumstances.

Energy storage and microgrids represent two more approaches to balancing solar with grid needs. New York ranked third in the nation behind California and Hawaii in energy storage watts-per-person deployed to date, though it’s important to note that New York is way behind those two states, which have both already set mandates for grid-scale storage. New York City has several grid-scale battery projects underway, ranging from cargo container-sized systems at substations and commercial centers to closet-sized batteries at convenience stores and EV-charger-equipped rental car lots.

As for microgrids, New York has projects underway from New York City to the Hudson River valley and has launched a $40 million program for new projects that can help the state meet its post-Superstorm Sandy grid resiliency goals. The New York State Smart Grid Consortium has started a microgrid inventory that should provide clearer data on statewide power, energy and grid services capacity represented by these projects, DNV GL noted.

All of this data collection will help inform New York’s Reforming the Energy Vision (REV) initiative, launched in February by Gov. Andrew Cuomo to reconfigure the state’s utility and energy regulations to adapt to all this grid-edge innovation. Solar panels are getting cheaper and cheaper, as are batteries and even fuel cells, providing more green options for utility customers. Grid operators and utilities are struggling to implement the metering, telemetry and software systems to manage all these customer-owned assets in real time, as well as to create new rates, programs, platforms, and markets to encourage their growth in ways that help, rather than hurt, grid stability.

Here’s DNV GL’s short list of the challenges facing the expansion of DERs in New York:

- Technical requirements limiting the development and integration of DER technologies, such as transmission interconnection and grid-reliability concerns

- An escalating variety of regulatory policies, requirements and tariffs across utility jurisdictions

- The issue of fair compensation and associated cost allocation for the benefits of integrating DERs onto the grid

- The lack of “turnkey” solutions and the need for complex, costly and project-specific engineering analysis to support project financing and implementation

The New York Public Service Commission recently released a straw proposal for the REV initiative, laying out the first steps utilities must take in testing out DERs as long-term grid solutions and asking for comments to help answer questions like these.

Some will be solved politically, with regulators, lawmakers, utilities, customers and the private sector wrangling over who is owed what share of the benefits to be derived from a distributed-energy-rich grid. Others represent billions of dollars in potential revenue, for technology and business models that can provide cost-effective and reliable solutions.