Utilities have for the most part taken a "fit-and-forget" approach to consumer-owned distributed generation.

But the past decade has seen a drastic shift toward the decentralization of generation, spurred by diminishing deployment costs, increasing incentives (e.g., net energy metering, investment tax credits), and changing consumer behavior. This proliferation of DG is having a profound and real effect on the utility industry, threatening to disrupt existing business models, as well as the stability of the grid.

Due to factors such as reverse power flows, feeder voltage increase, and harmonics, distribution grids were not originally designed to accommodate large DG penetrations. Combined with the political pressure to adopt more renewables, utilities in states like California, Hawaii, and New Jersey are understandably worried.

Distributed energy resource management systems might be the solution utilities are looking for.

DERMS

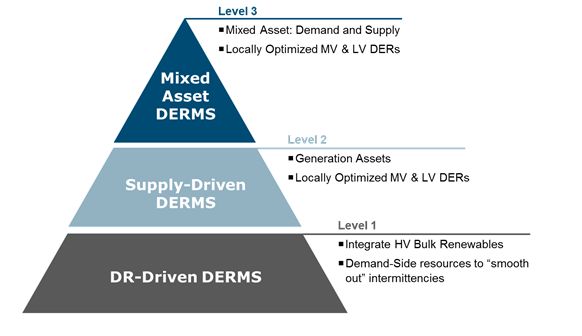

A distributed energy resource management system is a software-based solution that increases an operator’s real-time visibility into its underlying distributed asset capabilities. Over the past several months, GTM Research has investigated the global trend of managing distributed resources, categorizing DERMS deployments as DR-driven, supply-driven, or mixed-asset DERMS.

Source: DER Management Systems 2014: Technology, Deployments and Market Size

Here's an explanation of the above chart, from the bottom up.

DR-Driven DERMS

DR-driven DERMS integrate demand-side resources such as controllable loads, electric and thermal storage, and electric vehicles to meet system objectives. Such systems are typically deployed to distribution networks and aggregate demand response to offset intermittencies created by transmission network integrations of large-scale renewable generation.

A prime example is the Leidos-developed Power Shift Atlantic project in the Canadian Maritimes. The region has a wind penetration of 9 percent, the highest in North America, and a renewable generation goal of 40 percent by 2020. Leidos’ Intelligent Load Management system is able to provide 15 megawatts of up/down ramping load (commercial and residential) to “smooth” power variation created by 800 megawatts of transmission-level wind generation.

Source: DER Management Systems 2014: Technology, Deployments and Market Size

A DR-Driven DERMS can be compared to a demand response management system (DRMS), aggregating siloed demand response, and then using it to offset variable generation. As a matter of fact, Alstom incorporates its DRMS product into its DERMS solution.

Supply-Driven DERMS

Though more prevalent in Europe than North America, a supply-driven DERMS increases system visibility into DG resources, enabling greater local and global system functionality. It enables a utility to leverage existing generation resources (e.g., smart inverters, customer-sited DG) to provide enhanced services such as generation curtailment, conservational voltage reduction, and/or volt/VAR optimization.

Supply-driven DERMS have a greater potential in European countries with high DG penetration such as Germany. The French-controlled islands of Réunion and Guadeloupe are early adopters of a supply-driven DERMS, deploying an Itron-developed system in 2008 to measure total intermittent generation, prioritize activities, and subsequently curtail solar PV generation.

Mixed-Asset DERMS

The mixed-asset DERMS class aggregates the capabilities of both distributed generation and demand-side resources through a common interface. These systems, however, are characterized by extreme disparities in functionality, since distribution systems are composed of differing assets and, depending on the region, are subject to diverse operating conditions.

As one might guess, no two utilities are alike and each faces a unique set of challenges that may require different solutions. The DERMS market is characterized by highly customizable offerings, making it difficult for most vendors to produce an off-the-shelf product. Still, despite the challenges of integrating legacy equipment and a changing regulation landscape, some companies are seeing opportunity and taking a big step forward.

Vendors Testing the Waters With New Products

Grid incumbents such as Alstom and Siemens are offering quasi-customizable products that promote an increased internal memory and processing capacity to accommodate the potential of thousands, if not millions, of new data points. Others like GE have yet to release a DERMS offering, citing the newness of the market and lack of client interest.

Smaller vendors such as Colorado-based Spirae and Ontario’s LocalGrid have leveraged their experience in hierarchical microgrid controls and applied it to distribution networks. Such an approach pushes intelligence to the grid edge, simultaneously enabling fast-responding local resources, while also addressing global objectives.

Examining the North American Picture

GTM Research has found the North American market to be largely DR-driven, though mixed-asset DERMS deployments are becoming increasingly popular, especially in regions that have experienced high distributed PV penetrations (e.g., California and Hawaii).

Source: DER Management Systems 2014: Technology, Deployments and Market Size

The Pacific Northwest Transactive Energy project, supported by a $178 million DOE grant, serves as an example of the high degree of diversity in this market. Price-based incentive signals connect eleven distribution utilities and provide 60 megawatts to 70 megawatts of responsive resources throughout the system. Other notable DERMS deployments include the Duke Energy Carolinas project which utilizes an Alstom DERMS, as well as the recently announced SDG&E distributed grid, developed with microgrid controls vendor Spirae.

Although this may be the beginning of the inevitable transformation of distribution grids, the surge in DG penetration must be addressed by not only utilities, but regulators and vendors as well.

***

Grid Edge Executive Council members gain access to all GTM Research grid edge reports, including the upcoming DER Management Systems 2014: Technology, Deployments and Market Size. Learn more here.