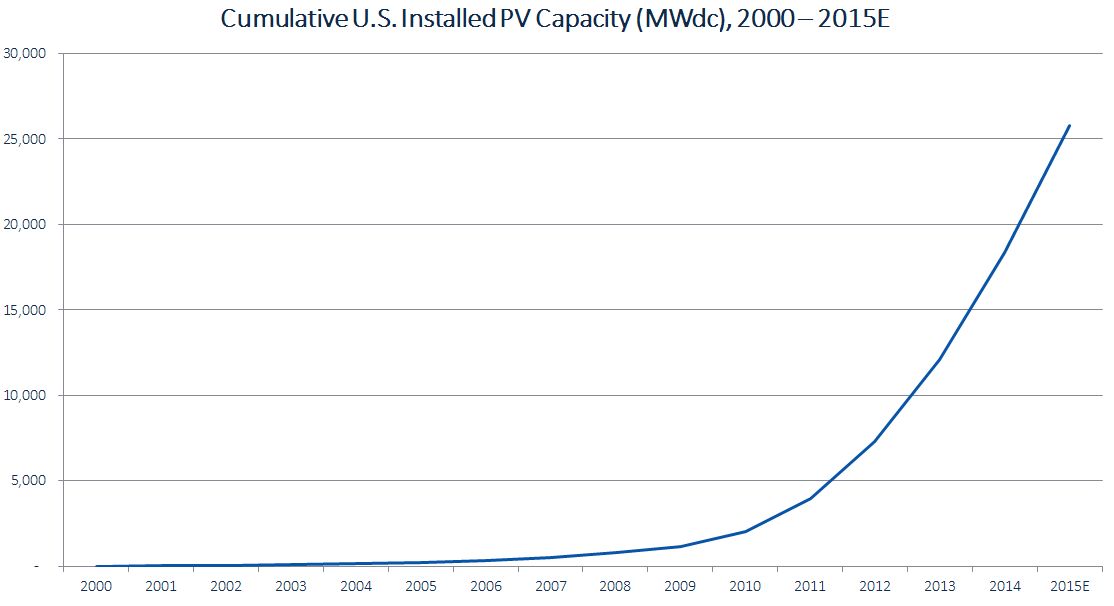

After landmark deals in Paris and Washington, D.C., and the continuation of the U.S. market's hockey-stick growth, the solar industry ended 2015 on a high note.

Source: GTM Research

What will 2016 bring for the industry? GTM Research analysts weigh in with the latest Executive Briefing, delivered to solar clients today. Here are some high-level findings.

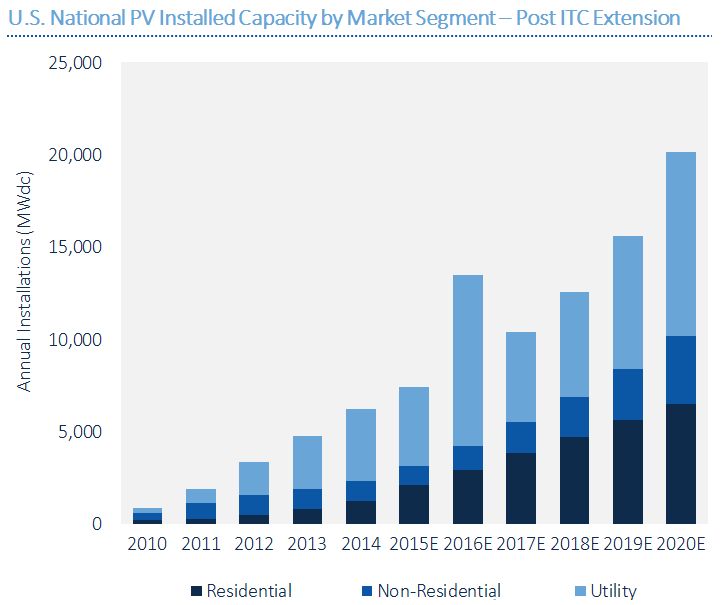

The U.S. will install more than 10 GW of solar PV in 2016

2016 is on track to be a milestone year for U.S. solar, with more than 10 GW added on annual basis for the first time ever and the number of homeowners with solar installed eclipsing the 1 million mark. And with the ITC extension, 10 gigawatts is not a one-time peak, but more likely a floor, with U.S. solar installations reaching 20 gigawatts per year by 2020.

Source: GTM Research / SEIA U.S. Solar Market Insight

U.S. policy risk shifts from the federal to the state and utility levels

With the federal ITC extended, policy risk in 2016 shifts from the federal to the state and utility levels. Expect net-metering and rate-design reform debates to come at an accelerated rate as major state markets grapple with growing rooftop penetration levels. Factors such as net metering with lower export rates, switching customers to time-of-use schedules and questions on grandfathering existing customers join fixed and demand charges as hot button risks for the economics of solar.

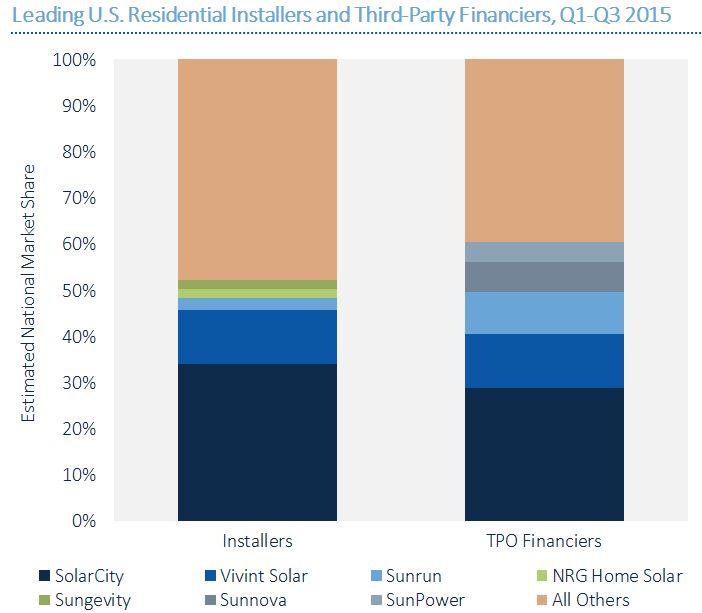

A shake-up among the top U.S. residential solar installers is likely in 2016

SolarCity will keep its position as the No. 1 ranked installer, but Sunrun and Sungevity have significant growth potential, while Vivint Solar and NRG Home Solar could slip in the rankings.

Source: GTM Research U.S. PV Leaderboard

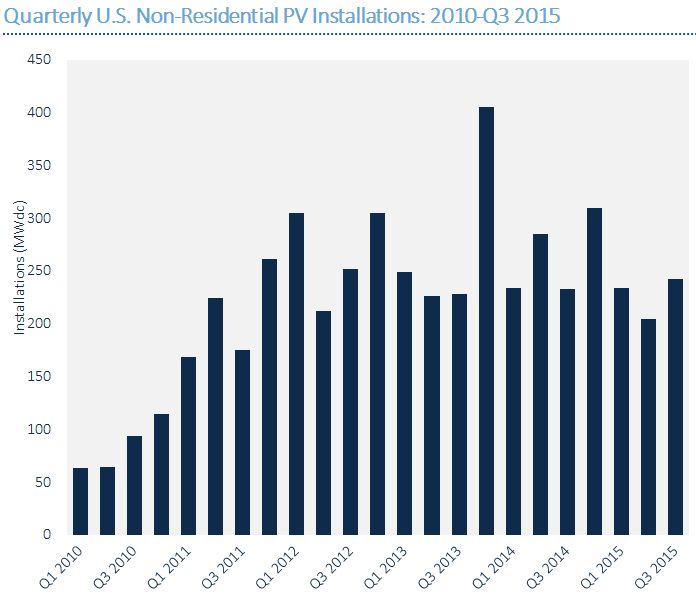

U.S. commercial solar remains lumpy

According to the briefing, 2016 will not be the year that the non-residential solar sector finds the comprehensive solutions to its financing woes and other bottlenecks in the development process. There is no rush to complete projects this year now that the ITC has been extended, so aside from a few key opportunities like community solar, developers may choose to refocus on scaling residential and utility solar. Efforts to increase access to financing and standardization will continue, but we don't expect these to fundamentally accelerate growth in the sector until at least 2017.

Source: GTM Research / SEIA U.S. Solar Market Insight report

Expect a realization of emerging markets in South and Southeast Asia

India will emerge as an established market, but new secondary markets like Bangladesh, Pakistan and the Philippines will support continued growth in the region. The PV story remains tied to government-supported, subsidized PV in the region, presenting downside risk around policy uncertainty, but this will also provide tremendous upside for early movers.

Latin America will build on its momentum of 2015

According to GTM Research's Latin America PV Playbook, the pipeline of announced projects will continue to swell, but 2016 is the year when the region will be tested for project execution, especially in countries such as Brazil. Mexico, another leading player in the region, will see stalled demand in 2016 as the market transitions to a deregulated one under the new energy law, creating tremendous short-term uncertainty for solar but overall a more viable market environment for the following years.

The global PV module market maintains balance

Overall global module supply and demand will be in balance, with slight undersupply in the wafer value chain. However, according to GTM Research's PV Pulse, analysts expect continued investment in capacity as suppliers look to stay in line with an accelerating demand landscape over the next few years.

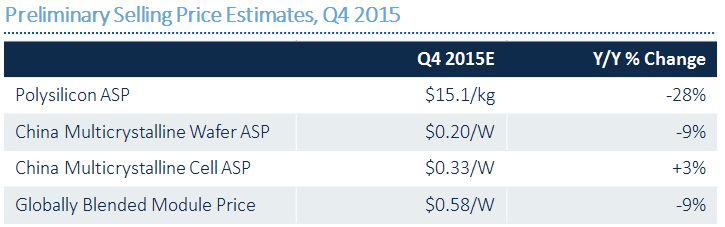

PV module component prices will fall

PV module component prices are generally expected to fall, but tight supply-demand levels and continued geopolitical factors (i.e., import tariffs) mean that price reductions will not match expected cost reductions.

Source: GTM Research PV Pulse

BOS suppliers look to integration

Balance-of-system component suppliers will increasingly focus on integrated modular PV systems that combine modules, electrical BOS and structural BOS components to reduce system hardware, installation labor and design requirements in all market segments. While turnkey “blocks” produced by vertically integrated players have been popular in utility systems, third-party hardware vendors are now partnering to create similar systems and proliferating similar concepts in residential and commercial markets.

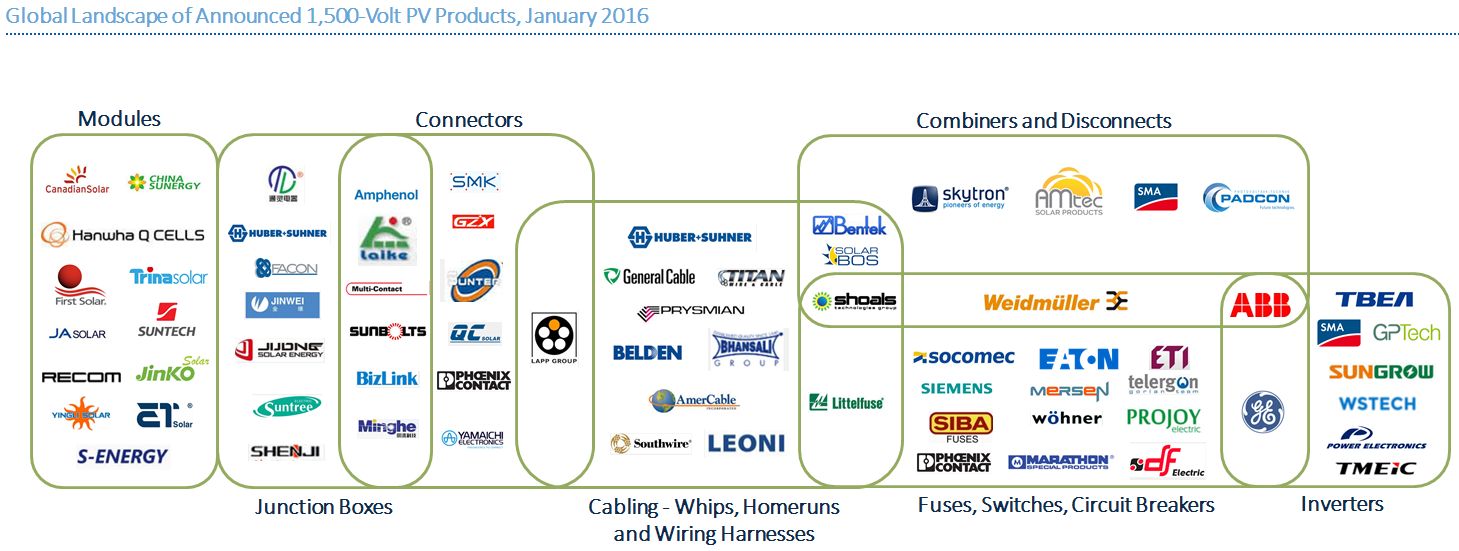

1,500-volt system space will grow 15x in 2016

According to the latest report from GTM Research, 1,500-volt systems in the utility sector will grow 15 times globally in 2016, with the U.S. being the primary near-term market. All major regions reach nearly full penetration in the utility sector by 2020.

Source: GTM Research's report 1,500-Volt PV Systems and Components, 2016-2020

***

GTM Research's quarterly Solar Executive Briefing is a 58-slide report covering the most important findings of the last three months and predictions going forward. For more information, contact [email protected].