PV module test facilities generally begin with procedures certifying that modules meet IEC or UL standards. PV Evolution Labs (PVEL), a small facility that began doing module evaluation in 2010, has been referring manufacturers seeking certification to other labs.

“We have the capability and will start offering the service soon,” explained PVEL CEO Jenya Meydbray, “but it is not a strategic focus.”

PVEL’s focus, Meydbray said, is the downstream PV market. “The needs of bankers and developers are different than those of manufacturers. They want more than just raw data test reports. They need higher-level advisory services.”

Advisory services are a PVEL differentiator, Meydbray said, setting it apart from more established testing labs.

PVEL’s testing may be different from the bankability testing described by Renewable Energy Testing Center and Intertek representatives in this series (see previous articles Testing and Ranking Solar Module Quality and What Do Solar Module Test Procedures Prove?).

“If bankability is the ability to get institutionally financed,” Meydbray said, “that is what we provide. But it is not enough to provide a third-party test report. PVEL services start with the test report to the manufacturer, they don’t end there.”

With its diverse relationships on the “buy side,” Meydbray said, “we can help established manufacturers access buyers. If they do well on our extended reliability testing, we can introduce them around, circulate their test reports, and support getting their product allocated.”

There are two key sets of PVEL test protocols, Meydbray said. The first set has to do with energy forecasting.

After a developer’s extensive -- and expensive -- effort to make a project happen, Meydbray explained, the majority of the return comes from a “development fee” when the project goes on-line. “That fee is determined by its forecasted lifetime output in kilowatt-hours made by an independent third-party engineering firm like Black & Veatch or BEW on behalf of the bank.”

A per-kilowatt-hour price determines the potential cash flow, the bank’s loan and the developer’s fee, Meydbray said. “Developers live and die on that fee. A 1 percent higher energy forecast can increase a developer’s profitability by 10 percent.”

PVEL’s first protocol characterizes panel performance in varying environmental conditions and therefore provides some certainty around the energy forecast. “[Just] 1 percent can mean millions of dollars. We can do these tests for around $15,000, depending on the details. It becomes a no-brainer.”

The first of the three tests in the energy forecast protocol is a PAN file.

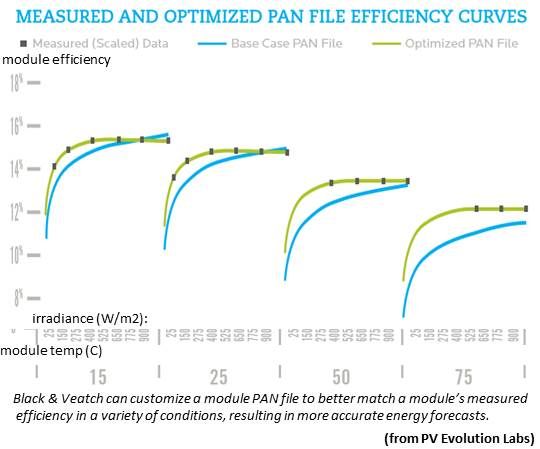

“It is a software file used to project energy and cash flow,” Meydbray said. “It contains raw data from twenty-two varying temperatures and irradiances. Black & Veatch, with whom we have a strategic partnership, turns that raw data, using a software platform called PV Syst, into PAN file coefficients that characterize the panel’s output for energy forecasting.”

The second test is a third-party report on the light-induced degradation (LID) of a panel. “That can be a half percent to 3 percent of output, and every fraction of a percent really matters. The test is easy and not expensive.”

A third measurement done by PVEL is called the Incidence Angle Modifier (IAM). “A solar panel’s ratings are done with light at a normal incident angle, but in the field, a panel is hit by light from many angles, depending on the time of day, the season and the installation,” Meydbray explained. “We characterize performance as the light angle changes.”

The IAM measures output at ten different incidence angles from zero to 90 degrees, Meydbray said. The method was developed by PVEL’s David King when he was a Director at Sandia Labs. It is performed at PV USA, PVEL’s outdoor solar testing facility. “PV USA was built in 1986,” Meydbray said. “PVEL took it over in early 2011.”

The first three tests are focused on increasing the accuracy of the energy forecast and characterizing the product’s out-of-the-box performance, Meydbray said. “But of course, the product does not perform over 25 years in the same way. It degrades. That’s what most labs are looking at: accelerated lifetime testing.”

Product certification “does not catch most panel problems seen in the field because it is performed before high volume manufacturing ramps,” Meydbray said. Most field problems are due to manufacturing quality control failures. “Once you start producing 10,000 modules per day, you start to get deviations in the process that impact product quality.”

Current UL and IEC certification requirements are limited and are done before manufacturing ramps up. “This regulatory regime doesn’t provide the protection investors need. That is the gap we are filling.”

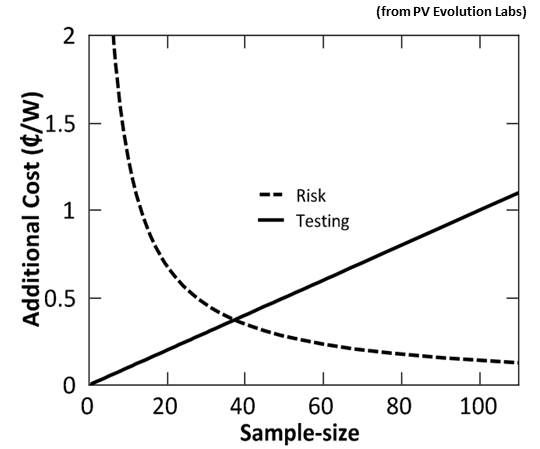

PVEL has developed statistical models for randomly sampling modules, Meydbray explained. “If you want 100 percent certainty that all the modules are defect-free, you have to test every one. Nobody will do that because it is too expensive and takes too long. We have a statistical model that lets project owners decide their risk tolerance.”

The decision, Meydbray said, “has implications on cost of capital, insurance premiums, residual value, resale value -- real commercial things that influence the success and profitability of a project.”

The PVEL statistical model allows developers to choose a level of certainty and a cost. “The cost for 99 percent certainty," Meydbray said, is usually “between $0.005 cents per watt and $0.007 cents per watt.”

The cost for the first set of three tests is $15,000 to $25,000, depending on variables, Meydbray added.

PVEL and PV consultant SolarBuyer are developing an Approved Vendor Program “that puts this all together,” Meydbray said.