Trade shows, including the recent Solar Power International (SPI), have historically been a good way to take the vitals of the solar industry. However, the perspectives of the solar industry are starting to concentrate on a single topic: quality.

The rhetoric surrounding long-term quality has been consistently overshadowed by cost per watt. This is something that must change, and finally, it appears to be changing. There is fear that unprecedented downward pricing pressure on PV panel manufacturers will compromise quality but it won’t be because manufacturers don’t care. The reality is, buyers are demanding the lowest price that the banks can tolerate and manufacturers are racing to comply. A majority of the manufacturers will continue to employ best practices and it will be the negligence of a few that’ll end up costing the industry as a whole.

Related to this is consolidation. A necessary transition in an emerging market, this is happening now and it is as scary as we expected. However, this consolidation is not just an aggregation of quality companies to remain competitive; there is an undertow of unprofitable marketplaces forcing good companies out. This exit from the marketplace creates two challenges. First, investors and banks cannot tolerate uncertainty, and when large global players decide to abandon or sell a business, it sends a signal of an uncertain future. Second, this consolidation is leaving existing asset investors with less certainty of the product warranty because the protection of a large balance sheet may be eroded or simply gone.

Buying solar panels reminds me of shopping for wine in my early days of college. I was careful to find the lowest price with the trendiest label. I didn’t consider much beyond that. If it had a good name and wasn’t the absolute cheapest, it must be good, right? I assumed that the "market" would set the price to compensate for higher quality. As one can imagine, I found that wine was inconsistent at best. Solar PV today is suffering from a similar challenge: the perception that "top-tier" modules are inherently higher quality just because they are top-tier. So then it is a question of price and "label." Unfortunately, this mindset has left an assumption of quality based on the brand and less on the actual product delivered. And as is typical, this paradigm will leave a lot of quality manufacturers fighting for a top-tier distinction through marketing rather than relying on better quality.

As the dialog shifts from price per watt to levelized cost of energy (LCOE), both of these paradigms stop short of the underlying and more complex story, and both require an open acknowledgement that the performance of the asset is uncertain. The answer, then, is to embrace the uncertainty with rigorous control of the solar project quality control chain. The modes of failure for solar are mostly known and testing exists to uncover those latent defects.

The bankruptcies and wholesale abandonment of the solar business is not over, yet PV is a proven technology and can have a successful and profitable life. It is important to note that the investors are -- now more than ever -- betting on the underlying technology as warranties and performance commitments are based on deteriorating financials. Financiers will become more active in the technical discussion, ensuring that debt coverage ratios are sufficient to cover any lack of confidence in the asset to perform in aggregate. Because PV panel manufacturers will face increased pressure to shave pennies, the industry needs a stronger presence for review and compliance. A perfect factory audit is not the end… it is just the beginning.

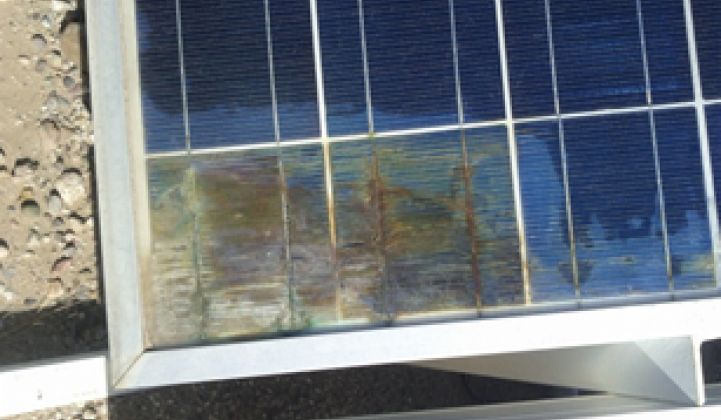

A broken quality chain has negative consequences not just for the project, but also for the industry. The volatility and fast growth of the solar industry is inevitably creating opportunities for the chain to be broken. Solar energy is pre-paying for fuel twenty years in advance. The longevity of these assets gives ample opportunity for poor decisions or honest oversight to manifest in a field issue. In extreme but rare cases, there are physical consequences of safety and property, but more often, field issues damage investor confidence, which leads to higher costs of capital or limited capital availability. It is therefore critical that as an industry we have third-party verification that the chain remains intact to protect developers, manufacturers, owners and the industry at large.

The quality chain is not a new concept for solar, but it does matter more today than in years past.

The solar industry is at a crossroads. Globally, project sizes are growing, the geography is rapidly expanding, and it is becoming clear that the panel supply landscape will look different in twelve months. It is essential that the industry not attempt to hide the fact that modules are not all created equal. It is also important to be united across the industry about the fact that that underperforming assets will exist, but will be a small minority. Remaining competitive requires that all stewards of the quality control chain increase concern but not perpetuate fear.

There is a silver bullet: well, sort of, maybe more like silver buckshot. Solar projects should trust and defend their suppliers, but only with verification procedures in place. The added cost of substantially increasing confidence is a fraction of a penny per watt to assess the risks. PV Evolution Labs and GTM Research are addressing this need with a new program called the PV Module Reliability Scorecard. Buyers are increasingly demanding that their suppliers participate in this Consumer Reports-style program. Scorecard test results could highlight whether a panel is appropriate for a specific climate or system configuration. Buyers are leveraging PV panel technical experts at firms like SolarBuyer, BEW, and Black & Veatch to provide factory audits. Buyers should always test to verify IEC compliance, and demand validated PAN files to ensure actual performance meets predicted performance. Today's buyers understand that procuring modules without any testing or independent evaluation is a risk they no longer have to take. In today’s market, quality is no longer binary. By thinking less about how a top-tier name is marketed and thinking more about the underlying technology, we help the industry support the strength of the quality control chain.

***

David Williams is the CEO of Dissigno and former Chief Risk Officer of CleanPath Ventures.