In a record-setting year, the U.S. wind industry’s 28 percent growth boosted its job count back to 80,000 and had a discernible impact on the U.S. gross domestic product (GDP) by putting $25 billion in private investment to work, according to the industry’s newly released Annual Market Report.

When the U.S. Department of Commerce revised its estimate of Q4 2012 GDP growth up from 0.1 percent to 0.4 percent, it noted as significant the increase in its estimate for nonresidential structures growth to 16.7 percent, up from 5.8 percent, according to IHS Global Insight (NYSE:IHS) economists and verified by the Commerce Department’s Bureau of Economic Analysis (BEA).

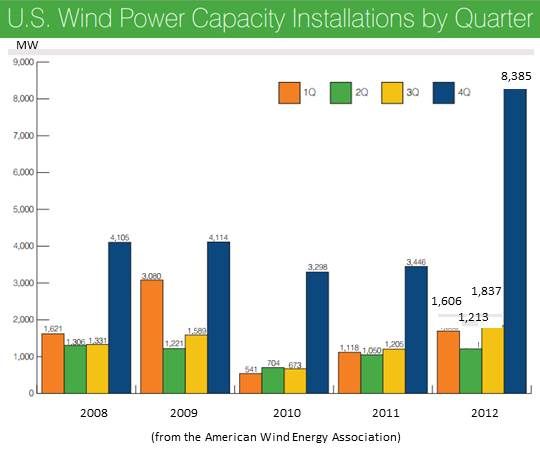

Electricity power sector spending alone, according to BEA statistics, accounted for almost 37 percent of Q4’s increase in nonresidential structure spending. And that sector’s numbers included the 8,385 megawatts of wind added in Q4, which was almost 64 percent of the year’s total of 13,131 megawatts of new installed capacity and which IHS economists called “massive.”

It was, therefore, reasonable for IHS economists to identify the wind industry’s fourth quarter as a major boost to U.S. GDP.

The U.S. wind industry’s 45,125 operational utility-scale turbines represent an installed nameplate capacity of 60,007 megawatts, according to the new American Wind Energy Association (AWEA) industry report. That is about equivalent to 60 nuclear power plants.

The over 13 gigawatts of new capacity made wind the year’s leading builder of new U.S. generation capacity with a 42 percent share. It took leadership away from natural gas and become the only renewable to ever rank first.

The Q4 burst of new development, driven by uncertainty about the fate of the industry’s vital $0.022 per kilowatt-hour production tax credit (PTC), pushed the U.S. past even China and back into first place internationally for new wind construction.

A PTC extension was finally approved by Congress on January 1. It included new language that will allow the benefit to apply into 2014.

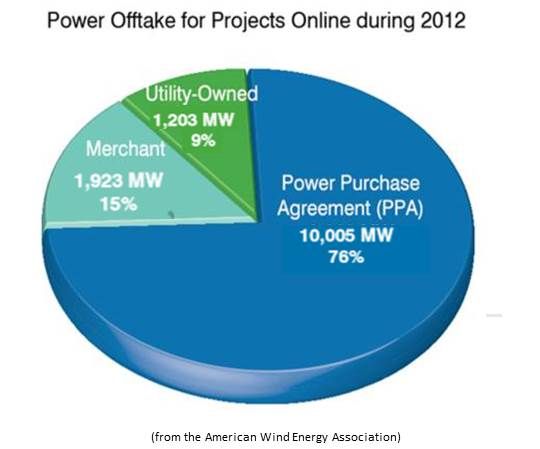

There are 74 U.S. utilities now purchasing wind-generated electricity through PPAs or direct ownership, AWEA Senior Policy Analyst Emily Williams noted in a briefing. More significantly, 43 percent of all electricity providers now have wind-generated electricity in their systems through various agreements.

The top twenty investor-owned utilities account for roughly 26,500 megawatts, 44 percent, of wind’s installed capacity, Williams added.

GE (NYSE:GE) was once again the U.S. market turbine manufacturing leader, with a 38.2 percent share. Siemens (NYSE:SI) captured a 20.1 percent share to move from its third place standing last year to second, and Vestas, at 13.8 percent, dropped a notch to third. Gamesa jumped up from ninth to fourth place and Acciona made the top ten this year at ninth place. Suzlon fell to tenth but REpower, its subsidiary, moved up from eighth to fifth.

Active U.S. manufacturers grew to 28, a 57 percent increase over 2010. The sector was so busy, Williams noted, that developers were getting turbines wherever they could.

The average size of the 6,751 turbines built during 2012 was 1.95 megawatts, down slightly from 2011’s 1.97-megawatt average size.

The dip was indicative of a shift in industry preference toward turbines that take advantage of technology breakthroughs in electronics, mechanics and materials to incorporate taller towers and/or bigger rotors and longer blades, Williams noted. Such turbines can achieve higher capacity factors and harvest winds that are slower and/or higher up, in places where wind projects have not been built before.

GE’s 1.6-megawatt machine, considered among the best in the world for low-wind regions, led the 1.5- to 1.6-megawatt platform that constituted almost 40 percent of turbines installed.

The new turbine technologies and advances in siting evaluation “have enabled most wind project owners to achieve capacity factors in the range of 30 percent to 40 percent,” the report added.

There were 559 U.S. wind-related manufacturing facilities in 44 states producing 67 percent of the 8,000 component content of turbines installed in the U.S. last year. There were thirteen utility-scale blade facilities, twelve tower facilities, and twelve turbine nacelle assembly facilities. Combined, they have a 13-gigawatt capacity.

Here’s the catch: Most of the 1,400 megawatts of wind turbine orders in 2011 were for 2012, but the bulk of the 1,500 megawatts of turbines ordered in 2012 were for, and were installed, in 2012. “The lack of 2013 certainty over federal tax credits precluded developers from placing orders for wind turbines during 2012 for future development,” AWEA’s report observed.

With the one-year PTC extension and its new in-construction language in place, the industry is getting back to building. But by the end of 2013, uncertainty could again become an imposition on growth and fiscal conservatives and wind opponents could move to do away with federal support.

This figure from AWEA’s report suggests that though wind may again be a political football, the industry will keep its PTC: “Some 70 percent of all U.S. congressional districts have an operating wind project, a wind-related manufacturing facility, or both.”