Commitment to wind by U.S. utilities leapt by 57 percent in 2012 and continues to grow.

The number of utilities that bought or owned wind projects grew from 42 in 2011 to 66 in 2012, according to the American Wind Energy Association AWEA) Q4 2012 report. More importantly, “the utilities that directly purchase or contract wind cover more than 36 million customers,” noted AWEA Chief Economist Elizabeth Salerno, equating to “one in every nine Americans.”

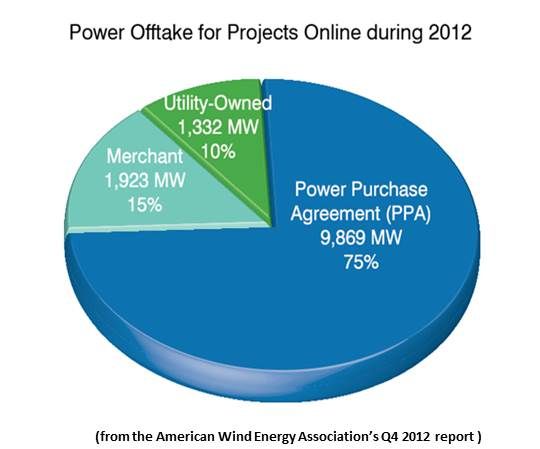

In 2012, utility ownership of projects, along with power purchase agreements between utilities and wind project developers, accounted for 11,201 megawatts, or 85 percent, of the 13,124 megawatts of new installed capacity.

In 2011, utility ownership of projects, along with power purchase agreements between utilities and wind project developers, accounted for 5,201 megawatts, or 76 percent, of the 6,819 megawatts of new installed capacity.

Though they represent only a tiny fraction of U.S. utilities, the 66 are some of the biggest and most influential. MidAmerican Energy, a subsidiary of Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A), leads in wind ownership. Other important utilities consuming wind include Xcel Energy (NYSE:XEL) throughout the Midwest, First Energy in New England, Progress Energy (NYSE: PGN) in the Southeast, Detroit Edison in Michigan, APS in Arizona and PG&E (NYSE:PGC) and SCE (NYSEAMEX:SCE-E) in California.

In recent months, a slew of utilities have announced PPA opportunities or pursued new wind ownership initiatives, including Hawaiian Electric Company (HECO), We Energies in Wisconsin, American Electric Power subsidiary Indiana Michigan Power (I&M), Tri-State Generation and Transmission Association, Oklahoma Gas & Electric, Interstate Power & Light Co. subsidiary Alliant Energy Corp. (NYSE:LNT), the Nebraska Public Power District, the Omaha Public Power District and Lincoln Electric.

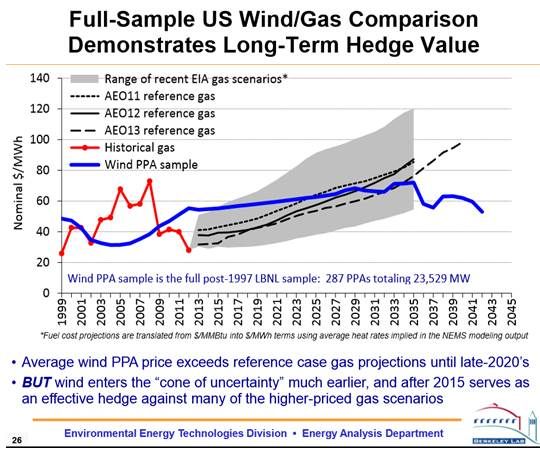

The reason for this increasing commitment to wind is that utilities realize it’s a good deal despite record low -- but always unpredictable -- natural gas prices.

“Short-term gas price risk can already be effectively hedged using conventional instruments like futures, options, and bilateral physical supply contracts,” noted Lawrence Berkeley National Lab (LBNL) researcher Mark Bolinger in the report Revisiting the Long-Term Hedge Value of Wind Power in an Era of Low Natural Gas Prices. “It’s only when one tries to lock in prices over longer terms -- e.g., greater than five or ten years -- that these conventional hedging instruments come up short. It is over these longer-term durations where inherently stable-priced generation options like wind power hold a rather unique competitive advantage.”

That is the conclusion of both utilities like the Public Service Company of Colorado (PSCo) and large-scale private energy consumers like Google (NASDAQ:GOOG).

“We think of this wind contract as an alternative fuel, with known contract pricing over 25 years, that will displace fuels where the pricing is not yet known,” PSCo said of its 25-year PPA with the 200-megawatt Limon II wind project. “That is the essence of the fuel hedge.”

“Electricity is our number-one operating expense after head count,” a Google official told Bolinger about the PPAs the company has signed with wind developers. “We want to lock in the current electricity price for twenty years.”

Because wind and natural gas can support each other on the grid and can work together to support the best electricity prices for ratepayers, Bolinger concluded, “greater and more widespread recognition of wind’s portfolio value among other potential wind power purchasers could help the nation to move forward -- even in an era of low natural gas prices, and even if the PTC is eventually phased out -- with both gas-fired and renewable generation.”