President Obama’s reelection is only the first step in undoing the layoffs, shuttered plants and disappearing supply chain caused by Congress’ refusal to extend wind’s vital production tax credit (PTC).

The PTC will be extended, Capitol Hill insiders agree, either in the current lame-duck session or soon after the 113th Congress is seated in January. But 2013 is lost.

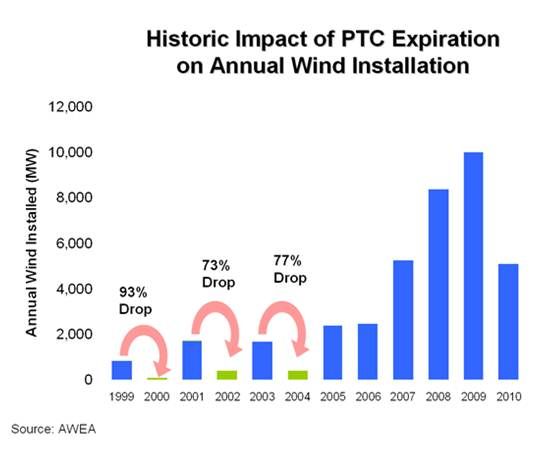

Because wind manufacturing and development takes twelve months to twenty-four months to get geared up and producing, consultants predict it will drop from this year’s likely ten-plus gigawatts to, at best, three gigawatts.

This is the fourth time since 1999 that congressional conservatives, many of whom state that they are ideologically opposed to federal incentives, put U.S. wind through a boom-halting bust cycle.

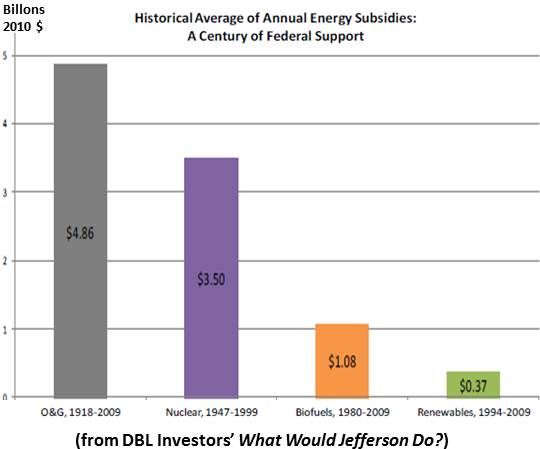

"The oil depletion allowance has been in the tax code for 86 years,” observed Jonathan Weisgall, Legislative & Regulatory Affairs Vice President at MidAmerican Energy Holdings, a subsidiary of Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A). “Oil hasn’t exactly been on a boom-and-bust cycle.”

Weisgall said the PTC will be altered and extended, most likely for one year, in a tax extenders package. “The year-to-year cycle,” he said, “is what we are stuck with.”

But extension of the PTC is “no small thing,” Terra-Gen Power Governmental Affairs VP Gregory Wetstone said recently, “given the general atmosphere of hostility [on the part of] a portion of the House to such incentives and the larger problems requiring compromise to avoid the fiscal cliff.”

“Not having a PTC would be disastrous in the short term for the wind industry,” said Bracewell & Giuliani energy specialist Frank Maisano. It is “built into the economics” of projects in development and the pipeline and of manufacturing and its supply chain. “It would be disastrous to pull the rug out from under all that. It would also be hugely unfair, given the investments people have made, to suddenly not just move the goal posts but take them away all together.”

But that won’t happen, Maisano said, “because 80 percent of wind projects and manufacturing are in Republican districts, so there is widespread support both on the Democratic and Republican sides.”

Weisgall, Maisano, Wetstone and several other Washington insiders said a version of the PTC will most likely be passed early next year, after the lame-duck session is used up on “kick the can down the road” legislation to avoid the tax cut, spending and debt ceiling issues that comprise the fiscal cliff.

But opposition from House ideologues will make a revised PTC necessary. “It gets renewed in the short term under the caveat of addressing it over the long haul,” Maisano said. Doing that “must include some principles like a phase out or something similar” that will “tee up the future deal.”

Weisgall, Maisano, and another D.C. lobbyist who did not want to be named all said the deal could involve language introduced last fall by the Senate Finance Committee.

The present PTC provides $0.022 per kilowatt-hour produced by a wind project over its first ten years if it is in service by the last day of its mandated term.

In exchange for cutting the $0.022 or the ten-year period, Maisano said, the Senate Finance Committee language changing “in service” to “start of construction” might be substituted, “which would in essence give you an extra year.”

To get an extension past opponents, Weisgall said, the PTC must be revised “to justify it against tax reform, to justify it against deficit reduction, to justify it against the charge of corporate welfare and to justify it against the charge of being a special interest carve-out.”

He listed five possible revisions: (1) An extension that freezes the $0.022; (2) an extension that cuts the $0.022 to $0.011; (3) an extension that cuts the eligible period in half; (4) an extension that ratchets down the eligible period by two years each year to reach three years by 2016; or (5) an extension that institutes a domestic content requirement and ratchets that up.

The eligibility period is the most likely target, Maisano said. It can’t be so short it threatens projects’ viability, but if it is too long it won’t be politically viable. “If you’re a big development company, like a NextEra (NYSE:NEE), you may have more flexibility. If you are a one-off developer and without the PTC you can’t finance the project, it’s a much bigger deal.”

“The odds of at least a one-year extension are pretty good,” Weisgall said, “but it really [highlights] the larger question of what the fate of it will be.”

Most Washington watchers expect comprehensive tax reform in the 2013-14 period. It will be designed to level all energies’ tax credits and incentives, a 30-year Hill veteran said. “They will try to harmonize the energy sector incentives so nobody gets favored or disfavored.”

Such tax reform, most observers agree, could make Master Limited Partnerships (MLPs) and Real Estate Investment Trusts (REITs) available to renewable energy developers.

“It will certainly be part of the discussion,” Maisano said, “But people in the oil and gas and pipeline industries who use MLPs and people in the real estate business who use REITs won’t want to share their products.”

Without a PTC, Weisgall said, “the wind development cycle may well correlate to the price of natural gas, which I think will remain volatile. I think the domestic manufacturing industry will have to consolidate to survive and renewable technologies will have to compete on an unsubsidized basis."