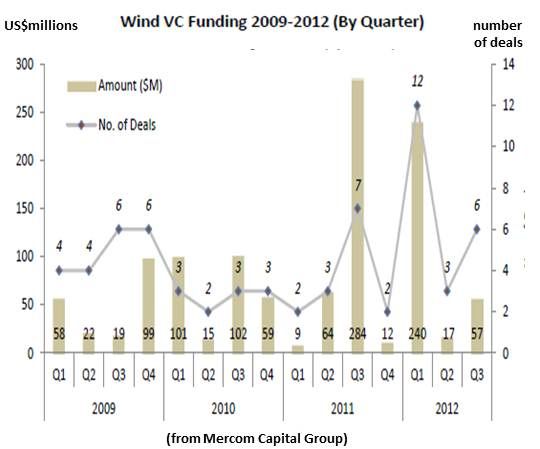

Venture capital (VC) investment in the wind sector for Q3 2012 was up more than threefold, from three deals and $17 million in Q2 to six deals and $57 million, according to the newest report from Mercom Capital Group LLC. But those numbers really only make sense when compared to the fact that Q1 2012 saw twelve VC deals for $240 million, Q3 2011 saw seven deals for $284 million, and no other quarters in the last three years came close to those two.

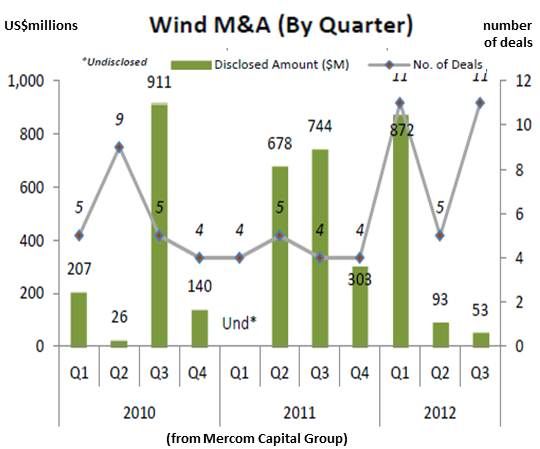

Merger and acquisition (M&A) activity in the wind sector dropped in Q3 2012, falling from Q2’s $93 million to $53 million. The Q3 number came from eleven deals, whereas the larger Q2 number came from only five deals. But that dropoff was of no real significance compared to this: Q2 2011 M&A activity was at five deals for $678 million, Q3 2011 saw four deals for $744 million and Q1 2012 saw eleven deals for $872 million. The point: The last two quarters were drastically unimpressive compared to three of the four quarters that preceded them.

Large-scale wind project funding in Q3 2012 was at $1.1 billion, covering eleven deals. The top five on the projects list were in Morocco, Turkey, India, Taiwan and Mongolia. The other six were in Mexico, the U.S., Croatia, Brazil, the U.K., and the U.S.

The numbers reveal the damage already done since the U.S. Congress failed to extend the wind industry’s vital 2.2 cents per kilowatt-hour production tax credit (PTC).

They show, first, the money is going to projects outside the U.S. because, without the PTC, developers are moving to foreign projects that come with subsidies from their host countries.

Congressional insiders have told GTM that there is a high level of confidence there will be legislative action on the PTC after the November election. But wind projects take one year to two years to plan, and wind turbine manufacturing requires twelve months to eighteen months to ramp up.

The decision of Congress not to extend the PTC’s December 31 expiration has already, in the judgment of wind industry watchers, made 2013 a lost year. Announced layoffs are already estimated at more than 10,000, plants are shuttered or idled across the country, and supply chain manufacturers have shifted to other sectors.

Congress instituted a three-year PTC in 2009 as part of the Recovery Act. VC investment in the sector rose with that certainty. After the 2010 midterm election, when conservatives captured the House of Representatives, many saw that further extension of the PTC would be compromised.

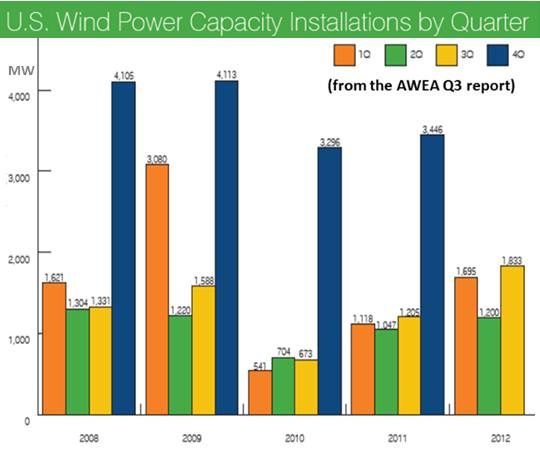

Developers reprioritized their activities to finish projects by the end of 2012 because installations in production before the deadline would continue earning the PTC for ten years. VCs, realizing that wind supported by the PTC had in many places become cost-competitive with the cheapest fossil fuels, reprioritized investments to back them while the subsidy was available. And while money was coming into the sector, M&A wheeling and dealing went on.

New installed capacity for 2012 will spike as a result of the frenetic activity. But even if Congress extends the PTC after the election, VCs likely will not come back into the U.S. market until the industry’s foundation can be rebuilt. There may be some U.S. M&A activity as the result of consolidation, but it probably won’t involve impressive numbers.

Most observers expect the bulk of the money that goes into wind in 2013 to be invested in emerging economies.

That’s what the numbers say.