There are a number of patterns emerging in the wind industry.

First, and most obvious, major manufacturers and developers are making plans to leave the U.S. for greener horizons due to Congress' decision not to extend the production tax credit (PTC).

First Wind, based in Boston, took $211 million plus a $150 million loan from Canadian utility Emera Inc. for 49 percent of Northeast Wind Partners, a partnership which will handle First Wind’s eight-project, three-state, 385-megawatt northeastern business. Looking to Canada, where renewable energy retains big mandates and incentives, First Wind said the new partnership could lead to $3 billion in future investment and 1.2 gigawatts of new wind.

EDP Renewables North America, the second biggest wind U.S. developer after NextEra Energy, reportedly wants to sell 707 megawatts of operating wind projects and a 1.4-gigawatt development pipeline and Spanish utility Iberdrola Renovables is reportedly re-evaluating its U.S. strategy.

The town of Gillett, Wisconsin, population 1,256, will lose 45 jobs when Wausaukee Composites, a plastic and fiberglass wind turbine component maker, closes its Gillette factory August 31. Many small businesses in wind’s supply chain across the U.S. will soon be following suit.

At Windpower 2012 in June, GE Energy announced recent deals in Turkey, Canada and Brazil, and CEO Vic Abate called Europe, Canada, China, Brazil and India “the growth markets of the immediate future.”

A different pattern is emerging in China.

In June 2011, new wind industry guidelines mandated that Chinese government support for turbine manufacturers would be restricted to those making 2.5 megawatt or larger machines with up-to-date, transmission-ready technology. The guidelines set off a still-unfolding consolidation in the Chinese wind industry. Some 80 percent of China’s wind makers may eventually fall or be absorbed.

The consolidation is driving heightened competition.

_540_449_80.jpg)

Vestas, burdened by stalled investments in the U.S. while Congress fumbles with the PTC and by European financial crisis-imposed credit limitations, will close its 850-kilowatt turbine manufacturing facility in China’s Inner Mongolia Autonomous Region.

The increasingly hard push toward bigger and more transmission-friendly turbines was likely one of the factors that drove Sinovel, one of China’s wind manufacturing leaders, to pirate software and electronics from American Superconductor (AMSC). It remains to be seen whether AMSC will obtain restitution in China’s legal system.

Goldwind, China’s second biggest turbine maker, has been as tight-lipped as always about the motives behind its sell-off of 50 percent of its interest in subsidiary Shangdu Tianrun, a development arm. Proceeds appear to have been channeled into a fund that likely will give Goldwind a wider and therefore more hedged investment position. Subsidiary Goldwind USA has been focusing as much attention in Latin America as in North America over the last few months.

Haizhuang, which owns barely 1.5 percent of China’s domestic market, appears to be reacting to the increased competition by taking its efforts to friendlier markets. It just announced a €400 million expansion into eastern Europe in partnership with with Chongqing Foreign Trade Group (CTF). Its two-megawatt turbine may eventually be able to compete in the Chinese domestic market. Or Haizhuang, currently in the process of developing a five-megawatt machine, may be biding its time in the incentive-driven eastern European market where slightly smaller turbines are still economic.

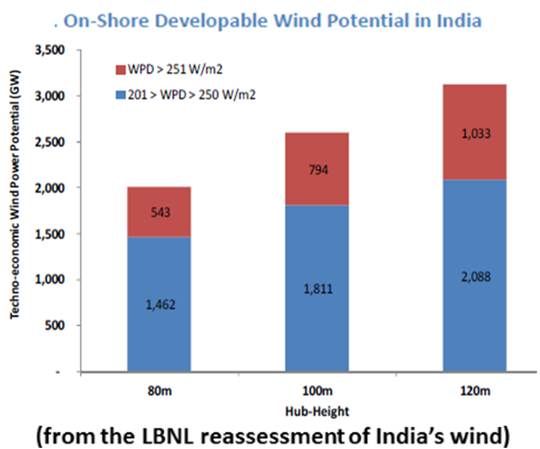

The wind industry and its backers are also becoming interested in India’s wind market. Researchers at Lawrence Berkeley National Labs recently reported that smaller, lower wind regime turbines make India’s undeveloped potential far greater than previously estimated.

Indian wind powerhouse Suzlon sold Chinese subsidiary Suzlon Energy Tianjin to a domestic developer for $60 million. Though there is no clear word on how it will reassign the assets, this obviously opens up the opportunity for more work in India. And Morgan Stanley Infrastructure Partners just spent $210.1 million for a controlling interest in India wind project developer Continuum Wind Energy.