Newly appointed GE Renewable Energy VP Anne McEntee, who will run the world leading wind division, met with a group of reporters to talk shop at Windpower 2013, the industry’s annual conclave.

McEntee replaces Vic Abate, who had led the Renewable Energy division since 2005 and oversaw its rise. She talked a little about her previous fifteen years at GE (NYSE:GE), much of which was spent in the oil and gas technologies international division, and then jumped in. “What’s on your minds? What can we help you with?”

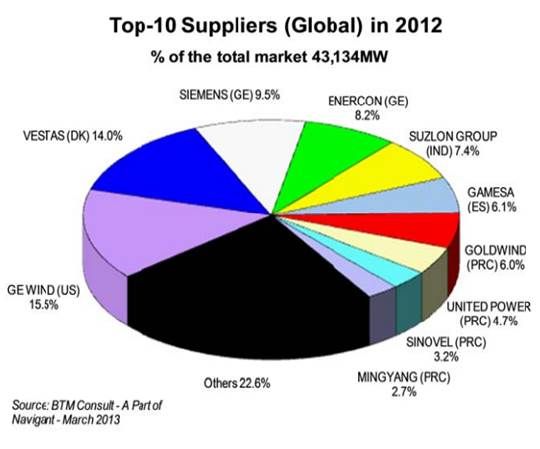

The first question was about taking over as the world’s biggest wind original equipment manufacturer (OEM):

We’re very excited that we’ve been listed as number one. Our whole strategy is about technology differentiation and innovation. We win by giving our customers the lowest cost of electricity. Nobody can predict the future, but our strategy is to stick on that path.

We also want to continue to globalize. We’ve had some successes in Mexico, in Europe, in Turkey, and I bring experience on the globalization front. I think we can do more.

About the 2013 turbine market:

The U.S. market last year, of which we had about 6+ gigawatts, was 13 gigawatts. We think the overall market this year will be 3 gigawatts to 4 gigawatts.

But 60 percent of our deals last year were outside the U.S., and we are going to continue to explore global opportunities. We go where our customers go. Where the economics are good for them, we try to be there to partner.

About natural gas:

Natural gas and wind are complementary. In some places, where you have new load and demand, you have new wind, because it competes on basic economics.

In places like the U.S., where there is flat load growth and a high reserve margin, wind is competing against the variable price of natural gas.

In some places, we compete head to head. In others, we still need policy support to be competitive.

About the production tax credit (PTC):

We like that the PTC extension included the start-of-construction deadline for qualifying instead of the in-service date. That gives us a little time.

It is clear we have needed policy support over the last ten years to keep this industry more stable. But constant stops and starts are not good for the technology innovation that helps us reach improved cost positions. The main thing we need is stable, predictable policy.

The key to managing the future is to have the best technology at the lowest possible cost. That is the journey we are on.

About a PTC phase-out:

We are all about certainty. A phase-out is something the industry needs to talk about. We need to decide on our position. But the number-one goal is certainty.

How long a subsidy will be needed is anybody’s guess. It depends on natural gas prices. The key for us is to drive technology differentiation, invest in things that lower the total cost of electricity, and help our customers with the best economics for their projects.

About wind industry consolidation:

Those with the best technology and the best structure are going to win. There are a lot of changes now, in policy, in pricing, and in cost positions, so over time it is probably inevitable that there will be some consolidation.

We are committed to the wind industry. For us, it is a long-term, sustainable business. We have invested over $2 billion in the wind space. We believe it has a bright future and we are excited about the technology advancements we are making.

About offshore wind:

The cost of offshore wind is three times to four times that of onshore. Our challenge is to continue the R&D to see if we can get a good cost position. Right now, we have more work to do.

About other markets:

We are exploring what it is going to take to be successful in Brazil. If you want to play in Brazil, you have to comply with the local regulations. The Canadian market also looks decent.

About the integration of storage into the new 2.5-megawatt, 120-meter-rotor Brilliant turbine designed to leverage data analytics and wireless technologies to achieve 15 percent more power and a 25 percent higher capacity factor than its predecessor:

We are linking big data with big machines. We collect 400 data points in a turbine. That is tens of thousands of data points in a wind farm. We have an opportunity, as we think about reliability, availability, performance, to use that data to come up with better product and service offerings and get more out of the existing fleet.

We are putting the storage at the turbine level instead of the plant level. That takes some unneeded equipment out, yet is still doing an overall wind farm optimization [with half as much storage].

We have acquired some businesses, such as Smart Signal (now GE Intelligent Platforms). And we have an R&D facility in San Ramon, California, where we are increasing research into data analytics. We are excited about what we can do to bring the industrial internet idea into our existing fleet and our new turbines. We are just touching the tip of the iceberg on what we can potentially deliver.