Over the past few years, energy management technologies have started to percolate down from the largest and most sophisticated buildings into the fast-food restaurants, retail chains and other sites of 10,000 square feet or less. For Powerhouse Dynamics, however, the path to the small commercial market came through the smart home.

The Newton, Mass.-based startup was funded in 2008 to create an energy monitoring and control technology platform for the residential sector. But in 2011 it raised $3 million to pivot to the small commercial field.

Since then, it has landed customers including Arby’s, Ann Taylor, AT&T, Dunkin' Donuts, Panera, Pinkberry, T-Mobile and Wendy’s, with “several thousand” sites using its combination of monitoring, analytics and control, according to CEO Martin Flusberg.

That growth has come largely through channel partners, including one big one that’s just announced it’s taking the relationship to a new level -- Ecova, the efficiency and sustainability software and services provider that works with about one-quarter of Fortune 500 companies.

On Tuesday, the Spokane, Wash.-based company announced it’s offering Powerhouse’s platform to its customers, including an as-yet-unnamed nationwide retail chain, with an eye on expanding beyond the 1,500 sites they’ve set up to date. “This is a way for them to provide services to those smaller facilities they did not have before,” Flusberg said.

“For us, it’s a big partner that gives us the ability to scale up far more rapidly,” he said. The startup raised a $6 million B round last year, and secured a $2.5 million venture loan last week to provide working capital for its expansion plans.

Ecova can also provide its hefty customer support services, including an operations control center to monitor customers’ sites down to individual pieces of equipment, he said. “We provide call-center services for some of our small customers,” he said. “But when you’re getting up to customers with 1,000 locations, we don’t necessarily have the ability to support customers that large. This gives us a partner we can rely on.”

These are the same dynamics that are driving a host of new partnerships between large-scale corporate energy management providers and startups with technology adapted for the small commercial field. Take the example of Powerhouse Dynamics competitor GridPoint, which has landed EnerNOC and ADT as partners. Another startup, EnTouch Controls, has its technology being offered to Texas small business customers of Green Mountain Energy, the retail energy provider owned by EnTouch investor NRG Energy.

Powerhouse Dynamics is working on a similar tack with Constellation Energy, an investor in its B round. Flusberg said that Constellation is offering SiteSage platform as an upgrade for business customers enrolling in its Efficiency Made Easy program, which allows customers to pay for the cost of efficiency upgrades through their monthly utility bills. Another investor-partner is Ingersoll Rand, the big HVAC provider with its own line of smart thermostats under its Trane brand, he said.

SiteSage can yield typical payback on investment of two years or less, he said. On the energy front, the SiteSage system can help site or regional facility managers find efficiency improvements in the 10 percent to 30 percent range -- a fairly typical achievement for the technology platforms specializing in the field.

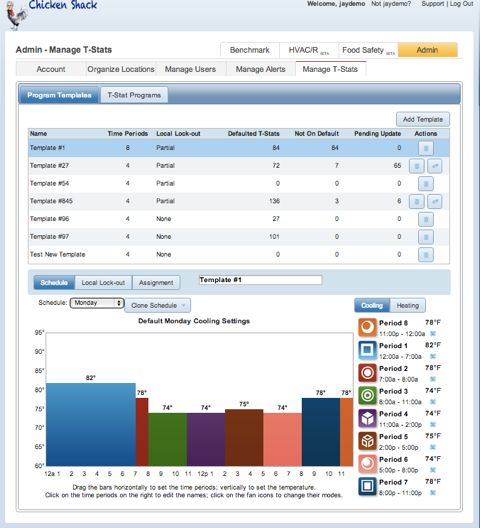

Beyond that, the system helps monitor air conditioning units and HVAC systems, stoves and refrigerators, and other equipment to catch failing systems before they break, guide maintenance and equipment planning across multiple properties, and other asset management tasks, he said. That’s important for the “continuous commissioning” process to keep efficiency gains persistent over time, as well as for other asset management functions that can be worth as much as the energy savings involved.

“We actually have an asset capture and tracking component that we just rolled out,” he said. “We rank every piece of equipment from zero to 100, and present the ability to see this in maps and charts, filtered by equipment manufacturer, by region, by all sorts of different factors.”

“One of the other new modules we’ve announced is the ability to track utility bills within the system, and integrate that with the monitoring data,” he said -- a capability that could get a boost from Ecova’s long-running expertise in the utility efficiency program field. “We’re looking for basic things -- missed bills, duplicate bills, suddenly getting hit with gigantic demand charges.”

These multiple value streams are increasingly being collected under single cloud-based offerings from big energy services companies like Siemens, Schneider Electric, Honeywell, Johnson Controls and Elster’s EnergyICT. Software-centric startups like FirstFuel, Retroficiency and Pulse Energy (acquired by EnerNOC) are providing hands-free energy audits, and energy disaggregation startups like PlotWatt are using single-building energy data feeds to diagnose wasted power and faulty equipment.