The home energy management market has made plenty of promises, but has yet to broadly deliver deep insight and significant reductions in home energy usage.

Microsoft tried and failed with the Hohm energy platform. Google.org tried with the PowerMeter home energy suite -- only to later abandon the effort and acquire the Nest thermostat brand instead. Hardware-centric energy management firms such as Tendril, EnergyHub and Onzo have had to make drastic pivots in product and channel strategy in order to stay in the hunt for the customer. Finding a profitable business plan that navigates utility spend cycles, regulatory shifts and energy customer behavior has proven challenging.

Nest has moved thermostat technology into the year 2008, while IPO-bound Opower saves residential utility customers an average 1.5 percent to 2.5 percent on their electric bill.

But "the disaggregation train is coming," according to Bidgely CEO Abhay Gupta. Disaggregation could save the customer real money and significant amounts of energy, change the relationship of the utility to its customer, and ignite the home energy management market.

Appliance-level energy data from Bidgely

Bidgely's CEO claims that its “deep pattern recognition” software can deliver appliance-level energy consumption data -- using nothing but the signal of a home's smart meter.

We met with Bidgely CEO Abhay Gupta earlier this month, and he spoke of moving energy feedback from "a motivational level like Opower to an empowerment level."

Provided with Green Button or AMI data at hourly intervals, Bidgely can single out and detect heating, cooling and pump loads, as well as rooftop solar. Home area network data from the smart meter can provide enough information to identify additional appliances such as water heaters, stoves, dryers, hot tubs, or EVs.

The CEO said that "utilities are pulling us into new uses." He gave an example of a utility pool pump program where Bidgely performs measurement and verification of the devices. He also suggested that the utility could pinpoint the homes in a territory that had inefficient pool pumps.

The Khosla Ventures-funded firm gains access to usage data not from plug-level sensors but through large data sets and smart analytics (although it partners with hardware vendors such as Blue Line Innovations). If Bidgely truly can parse out individual appliances from the data stream, consumers can really begin to understand their usage and start making more meaningful energy decisions. Utilities can segment the market in ways they never could before. Does the utility need to target 1,500 homes with pool pumps for an energy efficiency program? Bidgely could potentially identify those pool pump owners.

The firm is currently working with five unnamed utilities, with others now evaluating the software, which offers customer engagement, demand-side management and business intelligence.

Preston Roper, marketing head at the firm, emphasized the sales end of the business and the necessity of making it simple for a utility to easily roll out an end-to-end solution. Roper described the firm as being in the stage of commercializing and selling aggressively. He said he has "hungry salespeople and hungry customers who want to do more with data." (It's notable that Opower spent $30.5 million on sales and marketing in 2013 -- its largest expense, just ahead of R&D, according to its S-1.)

"Opower has done a fantastic job in energy efficiency through behavioral sciences," said the Bidgely CEO. He added that Opower had "opened up buckets of dollars and opened up the channel, but we are taking it to the next level."

PlotWatt disaggregates at Wendy's, KFC and Dunkin' Donuts

PlotWatt has its own spin on cloud-based disaggregation software. The CEO of the startup, Luke Fishback, told GTM that "disaggregation in and of itself is less interesting than the sort of intelligence we can deliver based on disaggregation."

"An itemized electricity bill is neat, but in our experience, it is not [enough]. The thing that really disrupts the sector is all the cool, actionable intelligence that can be derived from the data."

In theory, the data from a smart meter or from a Green Button data set has the potential to indicate if there's an inefficient second refrigerator in the garage or a rogue pool pump drawing power in the afternoon, or to detect whether a restaurant's walk-in freezer is about to fail.

PlotWatt's CEO told us that the firm is "already delivering an unbelievable level of savings" with "a level of engagement" way beyond that of a monthly kilowatt-hour statement.

According to Fishback, "What Opower has done a brilliant job at is addressing the pain points of utilities." But while Opower can elicit savings of 2 percent, Fishback suggests that his firm's technology can approach savings levels of 10 percent to 15 percent. He said, "You don't see a lot of programs that deliver the level of energy efficiency that we can. Maybe 2 percent is how utilities are optimally incentivized. They're not incentivized to deliver 5 percent or 10 percent savings."

While Bidgely is focused on utilities, PlotWatt's Fishback spoke of going where the data was -- and in one of the firm's market strategies, PlotWatt has found franchisees of fast-food chains Wendy's, KFC and Dunkin' Donuts to be enthusiastic customers, given the product's claimed one-year ROI and more than 10 percent electricity savings. The subscription service offered by PlotWatt can lower bills, detect broken and breaking appliances, and provide business intelligence such as whether a particular location shuts down early or if deliveries are late. PlotWatt uses hardware at the breaker box as the data logger. There is no utility involvement, according to the CEO.

The CEO emphasized that it's not the raw data that saves a Wendy's location 14 percent in electricity -- it's the email sent to the store manager that notifies him that the oven was left on at closing time or that a walk-in freezer is about to fail.

PlotWatt's market strategy addresses any node where smart grid data aggregates. So in addition to restaurants, the firm is focused on residential and utility data streams.

The CEO said that the residential part of this market is the "sleeping giant," adding, "We want to build a business so that when the giant awakes or when it's provoked, we are ready."

Market leader Opower not standing still

Market-dominating Opower and its IPO-bound customer engagement engine is a startup success story. The VC-funded software company created a new market with an IT slant and scaled big and fast.

Opower just revealed that it seeks to raise $110 million through an IPO. As GTM's Stephen Lacey recently reported, Opower's revenue grew from $28.7 million in 2011 to $88.7 million in 2013. More than 90 percent of its revenue in 2013 came from subscriptions with Opower's 93 utility customers.

Lacey notes that Opower's sales cycles ranges from as little as six months to as long as twenty-four months. Many of Opower's largest customers will see their contracts expire in 2014 or 2015. Opower identifies its competitors as Aclara, C3 Energy, Nest Labs, Oracle, SAP, and Tendril, "as well as many other smaller providers." The firm has its own patents on disaggregating load data.

Opower remains the force to be reckoned with and would likely insist that this "Opower 2.0" I keep hearing about is going to come from Opower itself.

A business driven by utility efficiency programs

The contracts and revenue being won by Opower and targeted by Bidgely, PlotWatt, and the rest of the energy efficiency industry are typically from utility energy efficiency or demand response programs mandated by a state's PUC. These programs provide significant incentives for reductions in annual energy consumption, as well as imposing penalties for non-compliance.

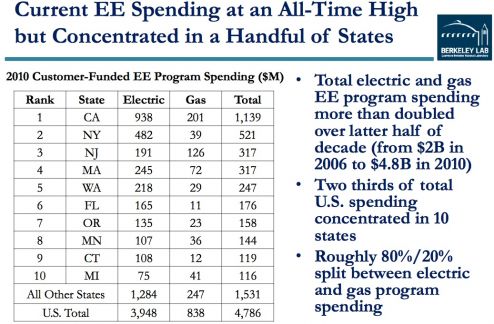

Ratepayer-funded utility energy-efficiency programs have more than doubled from 2006 to 2010 to $4.8 billion, and the programs are expected to double again by 2025, according to a study from Lawrence Berkeley National Laboratory.

Human behavior

Jeff St. John reported on the findings of an EPRI study which looked at how energy disaggregation technologies can yield very different levels of accuracy.

"Understanding the human-behavior, human-science part of it is as important, if not more important” than the technical challenges involved in energy disaggregation, said Peter Porteous of Blue Line Innovations in St. John's report. “The companies that will be successful will be the ones that have both.”

“I think credibility trumps accuracy” when it comes to detailed home disaggregation data, said Porteous. “What I mean by that is, if this is your home, and you’re connected, and all of a sudden the data comes back and tells you you're spending $10 a month on a hot tub, and you...don’t have a hot tub, well, you’re never going to look at the data again.” That fundamental understanding of human nature is why Bidgely or PlotWatt take a “very risk-averse, conservative approach to revealing usage."

That’s not just valuable for the homeowners, he noted. “The response from the utilities, when they see that they can now have access to this data, it really is game-changing,” he said. “That’s their main frustration -- they have no idea what their customers are doing inside the home, and spend gobs of research trying to figure that out.”

Opower has had a big head start and will soon have access to public capital. The firm's programs allow utilities to meet efficiency mandates without threatening the utility's livelihood. As PlotWatt's CEO suggested, "Maybe 2 percent is how utilities are optimally incentivized," and 15 percent savings may just be too disruptive to encourage at this juncture.

In any case, watch for the convergence of Opower's behavioral science with the technology of the disaggregators in the coming years. If the disaggregation genie is real -- it can't be put back into the bottle.