Intelligent efficiency software for buildings can be lumped into three broad categories: dashboarding and visualization; actionable energy intelligence; and enterprise sustainability.

The actual products within those categories vary widely. Dashboarding is a staple of all offerings. Supply chain management and carbon accounting are core to sustainability offerings. And utility bill analysis, demand response and continuous commissioning are key components to actionable intelligence -- an area that some call the "enterprise smart grid."

Up until a few years ago, simple dashboarding and sustainability/carbon accounting offerings were getting a lot of attention. Before the 2008 financial collapse, "sustainability" was on the lips of every major CEO. With the U.S. close to establishing a carbon cap-and-trade market, all the major software providers were looking to help big companies track their carbon. And it seemed like every developer had a dashboard to sell to newly minted sustainability officers.

But in recent years, the market has shifted in favor of enterprise smart grid offerings, which allow customers to take a much more targeted approach to saving energy use. These products focus on controlling lighting and HVAC systems, fine-tuning buildings in real time, and connecting facilities to the energy markets where they can earn money based on efficiency actions. The combination of cheaper data and a better regulatory environment for demand-side resources has made this possible.

"We voted with our feet," said Jon Guerster, CEO of the energy services company Groom Energy. "We've seen a move toward the enterprise smart grid where companies are tracking metrics to save kilowatt-hours."

However, that doesn't mean sustainability is out as a driver. For some, it's central.

Ecova, a software provider with 700 customers in the commercial and industrial sector, is still seeing large corporations buying products to achieve sustainability goals. And the company is out with a new platform today that ties together energy management and sustainability offerings in all three broad categories for customers with big portfolios of buildings.

"The two go hand in hand. Customers want to understand what they’re spending and saving, which amount to gains in sustainability," said Seth Nesbitt, senior VP of marketing and technology at Ecova.

Ecova already counts one-quarter of Fortune 500 companies as its customers. They include airlines, retail chains, manufacturers and large real estate firms, most of which have hundreds or thousands of buildings. The company said it now has a "complete picture" of 8 percent of the commercial and industrial sector nationwide, and processes more than a billion data points per day. But until now, that picture has been scattered across Ecova's different software platforms for utility billing analysis, energy management, carbon tracking and customer engagement.

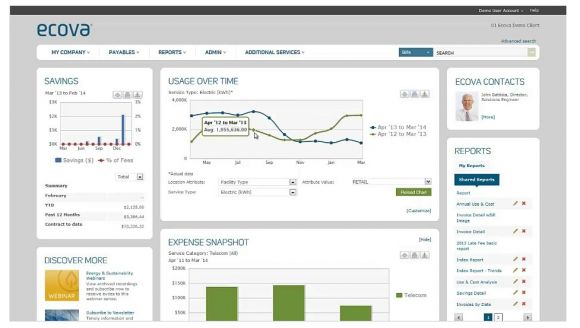

Now, Ecova is rolling all of those offerings into one package that will give its customers a central tool for tracking sustainability metrics across thousands of facilities.

The company's entire dashboarding and reporting process has been overhauled to make it easier to create extremely detailed reports, rank and map buildings, analyze energy market conditions, and, soon, to monitor emissions. Virtually every single metric a large corporation might want to track related to energy and sustainability performance will be included on the platform.

"We're looking for scalable ways to track energy usage," said Nesbitt. "There are a lot of individual solutions in the market, but many of them have to be stitched together to create this platform. We don't think there's anyone with a straight fit with us."

Ecova is largely an energy management company with a heavy focus on utility billing and facility analysis. It also works with utilities on demand-side management. But its core mission is to use those metrics for sustainability reporting, which is still important for large corporate customers. According to a recent report from the Carbon Disclosure Project, 81 percent of Fortune 500 companies have carbon reduction targets. (Interestingly, the top 50 companies in the world are still increasing their emissions, not reducing them.)

"We tend to interact with the people who are very interested in sustainability," said Nesbitt. "We look for key champions who are driving sustainability goals. We want to have the enterprise system of record for them."

At a time when many intelligent efficiency companies are moving away from sustainability, Ecova is somewhat unique in this space. But in talking to customers before starting the new redesign of its offering eighteen months ago, Nesbitt said it was clear that sustainability reporting is still a strong driver of sales.

"Our clients are looking for efficiencies that ultimately lead to reaching sustainability targets," he said. "The two are not independent from each other."