As the IT sector converges with the energy efficiency sector, there's a clash underway between the startups and established vendors pushing products to make buildings smarter.

The range of software and hardware options is immense, causing confusion for potential customers looking to track and manage their energy use.

Heck, there's not even an agreement on what to call the solution. Smart buildings? Intelligent energy management?

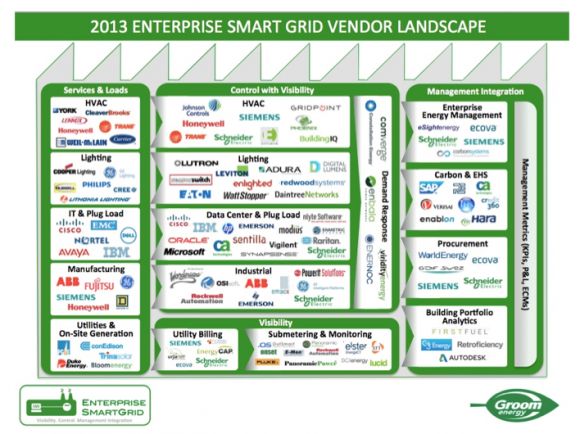

Groom Energy, an energy services company that works in the commercial/industrial sector, likes to call the intelligence embedded in buildings the "enterprise smart grid." Rather than thinking about buildings separately from the smart grid, Groom thinks of them as an extension. From meters and submeters to building controls and software analytics, the solutions eventually interface with the utility.

Whatever we call the solution, a problem still remains: customers are baffled by the increasing number of vendors in the space.

Groom is out with a very helpful new report analyzing the range of startups and established firms operating in the enterprise smart grid sector. The report also outlines some of the top concerns from customers considering new technologies to smarten up their facilities. (Full disclosure: GTM worked with Groom on last year's enterprise smart grid report.)

"The hype around new technology from cleantech startups and expanding offerings from traditional providers has created an incredibly confusing market for these eventual corporate consumers. Already, more than 200 vendors offer 'energy management solutions,' a vague and all-encompassing term," wrote Groom's Paul Baier in the report.

So what does the landscape look like? Here's a taxonomy from Groom outlining the dozens of firms operating in the space:

If that taxonomy makes you dizzy, you're not alone. After surveying 158 companies considering enterprise smart grid solutions -- 63 percent with revenues over $1 billion -- Groom found a general sense of bewilderment about the growing ecosystem of vendors.

Groom's survey found that no single vendor was known by more than 31 percent of the companies surveyed. That translated into concerns about quality and inflated performance claims.

To avoid initial confusion, Groom created a detailed checklist of things to consider when picking a vendor, including some obvious -- but very important -- advice.

"Be skeptical of vendor savings claims. [...] Do not be enamored with glossy dashboards and analytics in vendor demos. All vendors now have these. Focus instead on data acquisition, usability, and vendor expertise."

So whom should we trust, particularly on the software side, which has lower barriers to entry? The report provides a thorough ranking of 200 energy management software vendors and rates 40 of them based on their business model, strength by industry, product differentiation and source of data.

Of those 40 vendors, Groom created a top-ten list. Here's an alphabetical list (along with Groom's selection rationale) of the strongest companies providing software intelligence solutions for enterprise smart grid applications:

- BuildingIQ: "Strong customer savings through visibility and control of HVAC. Secured investment from Siemens and Schneider Electric."

- Ecova: "Aggressively broadening product line via acquisitions and building on strengths in utility bill management. Expanding interval data software and service management."

- EFT Energy: "Customers include General Motors and Simon Properties."

- EnergyCAP: "Large customer base of utility bill management vendors, mentioned multiple times in our customer interviews."

- EnerNOC: "Successfully leveraging demand response success and acquisitions to broaden product line; expected 2013 revenue of $380M."

- eSight Energy: "Solutions for interval and utility bill energy data. Good references."

- GridPoint: "Offers hardware and software solutions to drive savings to small retailers."

- Phoenix Energy Technologies: "Deployments with Cinemax and Office Depot that have remote control of HVAC for hundreds of locations."

- Schneider Electric: "Very broad product line from BMS to enterprise energy management software, which manages interval and bill-based energy data."

- Siemens: "Broad product line; acquired Site Controls and Pace Global, leveraging BMS installed base."

Groom estimates that the worldwide market for software and fees from demand response is upwards of $6.2 billion, and is growing at 30 percent annually. It expects many of the companies currently operating to go out of business or get acquired by existing large energy management firms.

You can check out a sample of the full report and buyer's guide here.