Solar assets are valued according to the income they generate. Because flawed modules constrain income, manufacturers, investors, and developers are evolving ways to identify and reject them.

Ian Gregory and Peter Rusch, co-founders of the firm SolarBuyer, contend that their procurement and quality assurance services help to ensure the quality of solar modules and allow for more accurate forecasts of ROI.

Gregory and Rusch, veterans of the module manufacturing industry, were both at Evergreen Solar when it folded. They decided to move their experience to the buyer side.

“Buyers did not understand what they were buying and the risks they were taking,” explained Gregory. “They were spending millions, perhaps billions, but when they visited factories they often ignored really essential things.”

Gregory and Rusch formed SolarBuyer in 2011. They now have fifteen to twenty clients, mostly larger companies, and, in 2012, Rusch said, “we helped on procurement and quality assurance with 200 megawatts of solar.”

The quality assurance service evolved because, Gregory said, “we found poor quality modules to be so prevalent, we needed to provide buyers with solutions.”

Module buyers have assumed, Rusch said, the best available security is in the supplier’s balance sheet, warranty and insurance. SolarBuyer challenges this assumption.

Companies with strong balance sheets, like Shell, Siemens, and BP, have left the solar business, Rusch said, and despite Q Cells’ balance sheet, it went bankrupt.

“Even a good warranty cannot prevent field failures,” Rusch said. Often the warranty will not cover expenses incurred by a field failure and they usually don’t cover lost kilowatt-hours from down time.

The most affordable insurance simply backs the manufacturer’s inadequate warranty. And better insurance policies are often too expensive for project economics. Most importantly, none of these options prevent problems.

“Most buyers, including 99 percent of banks, start their quality assessment when the modules arrive,” Rusch said. “That has at least two major disadvantages. One, the modules have shipped and may have already been installed by the time test results reveal flaws. Two, modules have invisible production line defects that are extremely difficult to detect.”

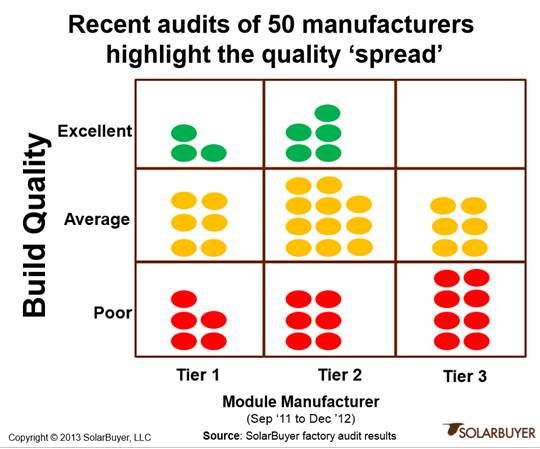

Gregory and Rusch decided SolarBuyer’s services must include factory audits. “We decided it is a much better idea to start at the source,” Rusch said. “We have audited over 50 manufacturers, many multiple times. We check the build quality, the product design and the company itself. When that is done, we create a risk profile of the manufacturer.”

“This is investment-worthiness grading,” Gregory said, “and it goes beyond bankability.” It is derived from SolarBuyer’s detailed independent audits.

“Each is done,” Rusch added, “by at least two, and often three people, engineers and people with long experience in panel manufacturing.”

SolarBuyer's prices are confidential, but Gregory said they represent a fraction of a total project’s cost.

Financiers appear to trust the company's process. When a developer recently sought backing from De Lage Landen for a project using modules unknown to the financier, it turned to SolarBuyer, explained Global Asset Management Sr. VP Matthew Frankel. The developer suggested a SolarBuyer evaluation.

“These guys had a deep appreciation for how module factories are run,” said Frankel.

On a factory audit in China, Frankel said, he witnessed SolarBuyer “unearth practices another visitor would never see, things that created problems in modules that probably wouldn’t get picked up in testing and might not emerge until the modules had been fielded for years.”

“SolarBuyer knows what can go wrong and what to look for,” AllEarth Renewables COO Doug Goldsmith said. “When up to 17 percent of modules can be bad, having a third party to lean on gives us confidence we are buying a good product rather than depending on a warranty.”

SolarBuyer reports its manufacturer audits in a very simple way, Gregory said. “A good manufacturer is green, one where it is necessary to put conditions on financing is yellow, and red means don’t touch.”

“The manufacturers we have audited represent about 80 percent of the modules in the market,” Rusch added. “SolarBuyer has found tier ones and tier fours with good and bad quality. Quality is all over the map. The tier structure no longer makes any sense.”