China is in the midst of a wholesale rebuilding of its power grid, and that’s going to make it the biggest smart grid market in the world someday.

Over the course of this and last year, China has been updating parts and pieces of its future national energy and smart grid plans, as contained with its twelfth Five-Year Plan. Those include carbon emissions reduction, renewable energy growth, and a whole host of projects that fall under China’s “Strong and Smart Grid” initiative as well.

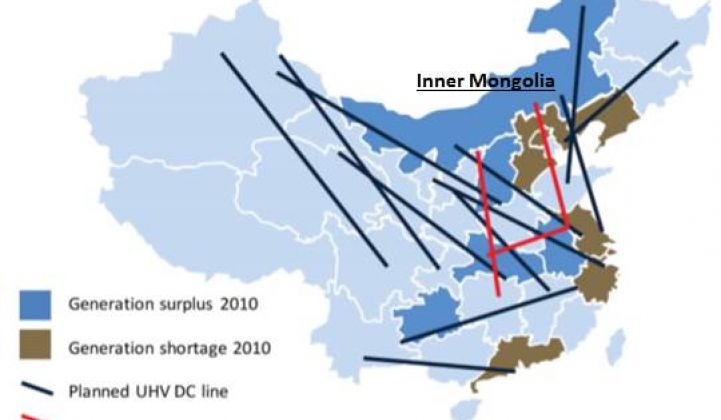

On the “strong” side, State Grid Corp. of China, the government-aligned utility responsible for about 80 percent of the country, plans to invest $269 billion in transmission lines through 2015 to carry far-off wind and solar power to western population centers, adding the equivalent of three-quarters the length of a new American transmission grid in just five years.

On the “smart” side of the grid, SGCC, Southern Grid and other big Chinese utilities are working with a multitude of domestic and international partners, with on-the-ground distribution automation, smart meter, plug-in vehicle and smart city “pilot projects” that can stretch into the millions of customers per project.

This week brings an update to the country’s current smart grid picture, courtesy of research firm ResearchInChina.

According to the firm, smart meter bids for future projects across China added up to 76 million units in 2012, with single-phase meters that serve homes and small- to medium-sized businesses accounting for 92 percent of that total. By point of comparison, North America had about 62 million smart meters installed as of 2012, according to GTM Research. But while North America’s smart meter deployments have peaked, China’s are only beginning, and China has a lot more customers to serve.

ResearchInChina also reports a highly fragmented market for smart meters in China, with the country’s top three companies, Wasion Group, Linyang Electronics, and Ningbo Sanxing, all holding less than 6 percent market share at present in single-phase meters.

It’s important to remember that China’s definition of a “smart meter” may vary from the global standard. For example, because China has decided to split up its smart meter deployments into separate metering and communications components, many of the next-generation meters being rolled out today may not yet be supported by the network and back-office technology needed to make use of them.

China is also asking for much cheaper smart meters -- about $50 apiece or less for mass-market residential units, compared to the $150-and-up ranges seen in North America and the $100-and-up common for European smart meter projects.

At the same time, the technologies being chosen and contracts being awarded for smart grid projects in China so far have indicated that, as with China’s wind and solar power deployments, domestic manufacturers and technology providers are going to reap the lion’s share of the country’s smart grid projects.

Still, there’s plenty of room for international partners in China’s smart grid future, with a who’s-who list of smart grid giants (GE, Siemens, ABB, Schneider Electric, Alstom, Toshiba, Mitsubishi, etc.) working in the country. On the smart meter front, we’re seeing big Chinese vendors form partnerships, such as Echelon’s joint venture with Holley Metering and eMeter's and Siemens’ partnership with Wasion. Itron, Toshiba’s Landis+Gyr, General Electric and Silver Spring Networks have set their sights on China as part of a broader push into emerging Asian markets.

Here are some more details from Greentech Media’s coverage of China’s broader five-year energy plans:

- In wind: Get to 100 gigawatts of installed and grid-connected wind power capacity by 2015

- In solar: The original target of 10 gigawatts was raised three times since the plan was published and is now at 35 gigawatts of installed and connected solar by 2015

- In “other” non-fossil fuels: Increase to 11.4 percent of the national energy mix by 2015

- In natural gas: Increase to 8 percent of the national energy mix by 2015 and 10 percent by 2020

- In energy efficiency: Reduce energy intensity 16 percent below 2010 levels and cap annual energy consumption at 4 billion tons of coal equivalent by 2015

- In air quality: Cut carbon intensity 17 percent, sulfur dioxide emissions by 8 percent, nitrogen oxides by 10 percent and particulate matter by 15 percent by 2015

- In financial mechanisms: Experiment with carbon taxes and carbon trading markets