We’re barely one quarter beyond SolarCity’s $350 million acquisition of U.S.-based module manufacturer Silevo, but the solar industry doesn't rest on its laurels.

In Greentech Media’s original report on the acquisition and a recent Energy Gang interview of SolarCity CEO Lyndon Rive, the company has been equivocal about whether further vertical integration through the acquisition of power electronics is desirable, simply noting, “Anything that will reduce our total installed cost, we will be interested in acquiring.”

The move would be odd to say the least. Whereas SolarCity’s acquisition of mounting structure provider Zep Solar in December 2013 had some precedent (SunEdison’s internal development of commercial rooftop racking and acquisition of tracker manufacturer OSolar, SunPower’s acquisition of PowerLight, and First Solar’s acquisition of RayTracker serve as examples in the distant past), the PV power electronics space has mostly been untouched by other pieces of the solar value chain.

Except for some uniquely positioned companies, such as TBEA in China and ABB’s discontinued foray as a solar EPC, most vertically integrated players have completely avoided the manufacturing of power electronics; instead, a few OEM deals (e.g., “SunPower” inverters) are used to unify product branding when desired.

And indeed, the inverter landscape is a tricky one, subject to a manufacturing supply chain that is almost entirely separate from solar, as well as to the need for grid-integration technical expertise. Yet there’s certainly been M&A interest in the space, with major moves just this year by SMA-Danfoss, TMEIC-AEG, and Yaskawa-Solectria, not to mention last year’s blockbusters of Advanced Energy-REFUsol and ABB-Power-One.

As a purely intellectual exercise, let’s assume that SolarCity is ambitious enough to take on a challenge that no one else has -- after all, who else expected the company to swim upstream and acquire a high-efficiency solar module manufacturer?

Who stands out in the inverter crowd?

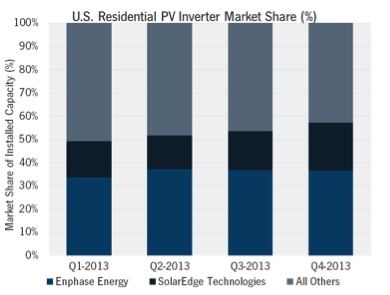

While the global landscape for manufacturers remains fragmented, surprisingly few players operate successfully in the U.S. Some may point to Enphase Energy and its 37 percent share of the U.S. residential market; however, we believe that SolarEdge Technologies is poised as the more attractive option. With nearly $100 million of venture capital raised, SolarEdge has been open about its IPO ambitions, but strongly valued SolarCity stock could give the investors a promising return, too. Furthermore, in contrast with the Silevo purchase, SolarEdge’s manufacturing remains firmly with Flextronics, meaning SolarCity wouldn’t be taking on more supply-chain challenges, nor would it have to worry about additional capital expenditures for ramping up capacity.

We've identified five reasons why SolarEdge is a uniquely attractive and fitting acquisition target for SolarCity.

1. An opportunity for cost reduction through product integration

First and foremost, an acquisition has to lead to system cost reductions, not necessarily for the power electronics, but for the overall PV system installation. In GTM Research's report The Microinverter and DC Optimizer Landscape, we walk through the shifting value proposition of module-level power electronics (MLPE) from a pure cost vs. production benefit analysis to one centered on installers’ operational efficiencies and installation speed. This shift is part of the same storyline that led to SolarCity’s acquisition of Zep Solar, which reportedly halved SolarCity’s average installation time through a unique roof attachment and module-integrated racking system.

National residential installers like Vivint Solar (the second-largest U.S. residential installer) and Astrum Solar (recently bought by Direct Energy and ranked seventh nationally) feature an all-Enphase Energy microinverter fleet geared specifically to tackle soft costs by:

- Eliminating simple design elements such as string sizing constraints for shaded and multi-orientation roofs, incrementally increasing the usable area and amortizing soft costs over more installed power and energy production

- Reducing the need for redesigns or change orders due to unexpected obstructions, and thereby reducing the aggregate cost of installation labor

- Streamlining inventory by requiring only one SKU for all projects, reducing shipping and logistics costs

While these benefits may seem trivial from an individual project perspective, the cost savings add up in a large aggregated fleet. DC optimizers don’t necessarily bring together a streamlined inventory (i.e., various inverter sizes are still needed) and can also add an extra MLPE installation step, but they also cost less than microinverters.

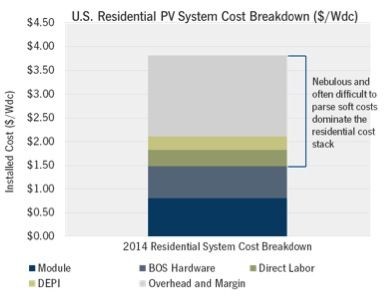

Innovative PV hardware must target soft costs to drive holistic system cost reduction.

Source: GTM Research's Global Balance of Systems 2014 report (forthcoming)

Now consider the additional synergies that could be achieved by locking up three major pieces of PV systems. SolarCity would be able to assemble Silevo modules with Zep framing. Add to that the Zep-compatible SolarEdge DC optimizer in the near term and a fully integrated DC optimized “smart module” further out. In essence, SolarCity locks in significant reductions in installation costs without worrying about multiple vendors managing disparate supply chains.

2. Exclusive ownership of another disruptive BOS vendor

Through its supply agreements with SolarCity, Vivint and many other leading residential installers, Zep Solar was easily the mounting-structure leader in a fast-growing U.S. residential market that exceeded 800 megawatts in 2013. With its acquisition of Zep, SolarCity not only locks in a unique technology advantage, but it also delivers a devastating blow to many installers now scrambling to find a residential mounting solution that can deliver similar installation benefits.

Enphase remains the leading PV inverter vendor in the U.S. residential market, commanding close to 37 percent share of the residential market in the first half of the year, and an acquisition would deliver a second blow to Vivint Solar and other leading residential installers. While alternatives exist through suppliers like ABB, APS, SMA, SolarBridge and a prospective offering by KACO New Energy, none of these options have the performance history and volume that Enphase brings to the table.

In contrast, SolarEdge, a newer entrant into the U.S., is well behind Enphase in terms of market share, but it has been growing tremendously. In the first half of 2014, SolarEdge supplied nearly 20 percent of U.S. residential systems and has quickly leapt to the third-ranked spot in the market. In addition, SolarEdge is among SolarCity’s top three inverter suppliers already, indicating a strong existing relationship. This leads us to the primary reason SolarCity should choose SolarEdge over Enphase: SolarCity has already vetted and currently uses SolarEdge's devices, whereas it rarely uses Enphase microinverters.

FIGURE: More Than 50 Percent of U.S. Residential Systems Use Module-Level Power Electronics

Source: U.S. PV Leaderboard Q3 2014

3. Overlapping product proficiencies

SolarEdge’s portfolio fits far more easily into SolarCity than Enphase's would. Both products slot nicely within the residential space (arguably with the microinverter as a stronger fit), but DC optimizers shine brighter in the commercial market, where companies can leverage the economies of commercial string inverters. Simply put, a sub-$0.20 per watt (AC) commercial string inverter presents a challenging price obstacle for current microinverters, system savings included. This aligns well with SolarCity, the U.S.’ second-largest commercial solar developer in 2013 and the first half of 2014. Furthermore, SolarEdge’s portfolio does not extend beyond commercial solutions, meaning SolarCity doesn’t have to overpay for a robust utility product line, a segment in which it has only dabbled.

4. An asset for geographic expansion

The product synergies don’t end with SolarEdge’s product line. Part of SolarCity’s mandate for Zep Solar is to go forth and explore international markets, focusing on top residential markets like Germany, the U.K., Australia, Japan and perhaps Mexico. While it’s true that the global market is becoming increasingly dominated by the utility space, global residential PV markets could reach 10 gigawatts by 2016.

According to GTM Research’s forthcoming market report on the global PV inverter landscape, well over half of SolarEdge’s optimizers end up in European markets, primarily in commercial systems. However, the company still has a small presence in target residential markets like Germany, the U.K., Australia and even Japan -- and that has brought knowledge that can help the Zep team in the near term and open up the markets to SolarCity’s full installation and ownership model further down the road.

5. A joint exploration of the storage market

The final piece of upside? SolarEdge offers a unique proposition that can aid SolarCity’s desire to crack the storage nut. Not to be constrained by its moniker, SolarEdge is developing a soon-to-be-launched storage optimization solution, the punnily named StorEdge. As with DC optimization within the PV array, SolarEdge is looking to optimize the DC-based battery arrays. In contrast to SolarCity’s current deployment proposition in the U.S., SolarEdge’s differentiated foray into the storage power electronics space could be another attractive asset for SolarCity to lock down. While the energy storage industry remains nascent relative to solar, large investments continue to pour into the industry, although they have mostly ignored the balance of storage systems. (Gentle plug: GTM Research will be exploring the opportunities in the U.S. energy storage market in a pre-conference seminar before our 4th annual U.S. Solar Market Insight conference December 8-10 in San Diego.)

Caveat emptor

As with all nice-sounding ideas, the devil is in the details and execution. Valuation and integration prospects trump all paper synergies in any potential deal, and the desire to secure a differentiated power electronics company must justify the premium paid to keep it off the open market. Meanwhile, margins for inverter manufacturers remain tight, reducing the potential savings from utilizing inverters at cost, and prices continue to drop as Asian and other foreign manufacturers look to the U.S. market as a demand sink and point of expansion.

In short, an acquisition now would have to place a significant premium on exclusivity and international market prospects. More likely, continued price competition in an inverter sector that is poised to see additional consolidation will justify a wait-and-see approach, relegating a blockbuster deal such as SolarCity and SolarEdge to little more than the pipe dreams of idle solar analysts. Or maybe we’ll just have to explore whether SolarCity will settle for half the optimized power electronics piece in a deal with Tigo Energy in another article.

***

MJ Shiao is the Director of Solar Research at GTM Research. When not occupied by the visions of PV balance-of-systems innovations dancing in his head, he leads GTM Research’s solar market analyst team and its coverage of the global solar PV value chain.