Trina Solar (NYSE: TSL) is “headed toward a near-term insolvency,” according to analyst Richard Pearson.

Pearson cited an array of market analysts (Raymond James, Barclays, RBC, Roth, Credit Suisse, Macquarie, China International Capital Corp, Maxim and Axiom) who saw the stock price, now at over $5.00, dipping to $3.00 or lower.

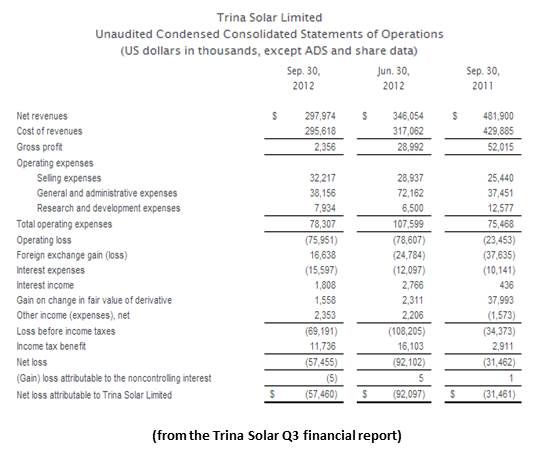

“While the headline numbers already look bad, they fall far short of reflecting the full details of Trina's financial condition,” SeekingAlpha’s Pearson wrote.

Two events stirred recent jumps in solar stock prices that Pearson does not expect to last. China announced in December it will redouble its backing of its solar manufacturers with $2 billion in new federal support. And Warren Buffett’s Berkshire Hathaway (NYSE:BRK A) subsidiary MidAmerican Holdings last week finalized its purchase of SunPower's (NASDAQ:SPWR) 579-megawatt Antelope Valley Solar Projects (AVSP), the world’s biggest permitted PV solar power plant.

Subsequent to Pearson’s analysis, China announced it will up its 2013 solar installed capacity target by ten gigawatts.

Pearson referenced Barron’s analyst Bill Alpert’s reasons to believe stocks in the solar sector are currently overpriced. They included reductions in European feed-in tariffs, an oversupply of Chinese-made modules, low and falling polysilicon prices, and lower-than-hoped-for permanent jobs numbers at solar power plants.

Alpert neglected to mention offsetting feed-in tariff increases in Eastern Europe, Latin America, India, Japan and other countries, a rationalizing in the Chinese module making sector, and remarkable job growth in residential solar.

Pearson’s analysis took on a sense of self-fulfilling prophecy with his disclosure that he “is currently short shares of TSL and may initiate a short position in other stocks mentioned in this article within 72 hours.”

This was Trina Solar’s take on Pearson’s analysis: “If nothing more,” Trina Solar Investor Relations VP Thomas Young responded, “we respect the blogger’s transparency in announcing the short-selling agenda behind his comments.”

“The $400 million company is already deeply insolvent with over $14 billion in off-balance sheet liabilities,” Pearson wrote. “Now that Trina is selling its products below cost in advance of nearly $800 million in near-term debt maturities, the company is unlikely to survive as a public company in its current form for more than six months.”

The $14 billion liability, according to Young, is primarily the result of a polysilicon supply deal with GCL Poly subsidiary Jiangsu Zhongneng. It is a framework deal “based on forecasted price levels of two and three years ago,” Young said. Prices were set “subject to periodic adjustments [... and] we have negotiated actual polysilicon and wafer purchase amounts and prices on a monthly, quarterly or annual basis.”

Trina negotiated actual 2012 polysilicon prices and amounts last March and expects, Young said, to continue to renegotiate according to market conditions going forward.

Pearson wrote that Trina can be expected to benefit from the $2 billion in Chinese government support announced in December, but not enough to rescue it from having to cope with what it called in its Q3 2012 financials “irrational pricing by our competitors, especially those at risk of financial insolvency.”

Only a “one-time accounting provision” kept Trina selling above cost in Q3, Pearson wrote, adding that “Trina is now selling its products at below cost -- meaning that the ability to generate profits or cash to repay debt is highly questionable.” This “negative gross margin,” Pearson added, “is expected to continue.”

This depends on the definition of cost, Young said. “In U.S. Generally Accepted Accounting Principle (GAAP) terms, which we report in, the ‘cost’ can reflect a higher manufacturing cost than that at the time of the sale,” Young said.

In Q3, he explained, “we sold significant inventory that was made in the second quarter.” As panel prices fell precipitously in the last two years, Chinese manufacturers’ sale of inventory has often meant sales at market prices below previous quarters’ costs for materials and operations. Young termed this a “mismatch” in the market that creates a “false impression of negative gross margin that may look like dumping.”

This is the rationalization with which Chinese module manufacturers are struggling. Pearson is not wrong about Trina’s gross margin, Young said, but China’s better performing companies have the support of China’s government and banks to see them through the period of losses.

“Trina Solar has said it has nearly $800 million in cash, but much of its cash is restricted and cannot be used,” Pearson wrote.

Young termed this “non-factual.” He referenced the company’s Q3 financial report showing almost $600 million in cash and cash equivalents and another $103.5 million in restricted cash, the former more than adequate to meet ongoing obligations and the latter available for operating purposes.

“Although Trina had $599 million in cash as of September,” Pearson wrote, "it now has nearly $800 million in debt coming due over the next few weeks and months.”

"Trina’s debt is not due in the next few weeks and months, but historically renewed over the financial year," Young said, explaining that this allows the company to meet its debt obligations with its more than adequate operational cash and balance sheet cash.

Finally, Pearson wrote that anti-dumping tariffs in the U.S. and Europe will have a dampening impact on module sales “right as Trina's substantial debts are coming due.” But many industry observers expect China’s manufacturers to circumvent the tariffs by shipping through non-involved countries.