More than 400 solar industry experts got together in Phoenix, Arizona last month at Greentech Media's Solar Summit. By all measures it was a successful event. The panels and debates were thought-provoking. Information flowed in all directions. The weather was amazing. There was bocce for those interested in that type of thing. ABB acquired PV inverter firm on the eve of the event.

Here are some videos and articles that might give you a flavor of this great and still-growing annual event from GTM Research. We hope to see you there in-person next year.

***

Full house @greentechmedia's #GTMSS13 twitpic.com/clfjmk

— Andrew Krulewitz (@KruleWatts) April 23, 2013

The GTM Solar Summit kicked off with a pre-conference look at how states solar markets are faring. With more than 3.1 gigawatts of capacity installed last year, the U.S. market seems healthy and continues to grow. However, some states are in better shape than others. On the state level, there are some major differences. GTM Research analysts led four panel discussions on the state of play in Arizona, Colorado, California and Texas. Here are some top-level takeaways from those discussions.

***

The panel with the most fireworks looked at the solar industry in a post-subsidy world.

As Stephen Lacey wrote, "The conversation around how to handle subsidies -- which has become more heated as renewables scale -- is where facts and opinions start bleeding together," adding, "Sunrun's CEO, Ed Fenster, came ready to throw some punches at Arizona Public Service for its solar policies. The relationship between utilities and solar companies has always been somewhat tenuous. But this week's panel discussion was a notable change in tone."

Inspired panel discussion at #GTMSS13 with @shaylekann CEO Sunrun and APS!! I felt like I was ringside!!

— Dick Rauner (@dickrauner) April 23, 2013

Pull up a chair, get some popcorn and watch the session below.

***

GTM Research Senior Analyst Shyam Mehta shared some of his data.

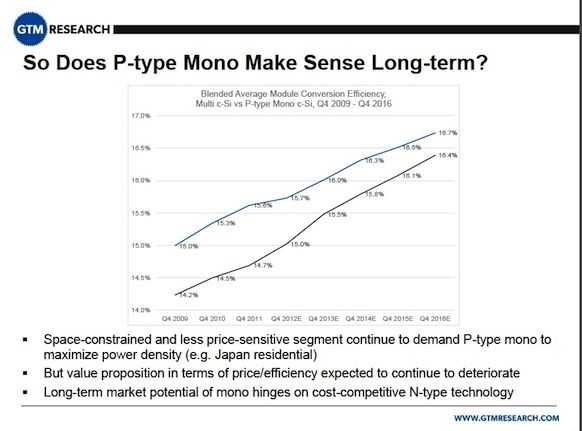

One of Mehta's observations was that the performance gap between p-type mono-crystalline silicon and multi-crystalline silicon is narrowing. Efficiency gains in conventional multi c-Si have accelerated, and the gains have come "without significant increases in capex or material cost," according to Mehta. Yet mono crystalline still commands a 4 cent to 8 cent per watt premium in sales price. Mehta suggests that the value proposition for p-type mono continues to deteriorate. P-type might make sense in highly real-estate-constrained Japan, but in the long term, Mehta sees n-type mono as a key to maintaining the efficiency advantage of mono. Panasonic, SunPower and Yingli are working on n-type cells.

***

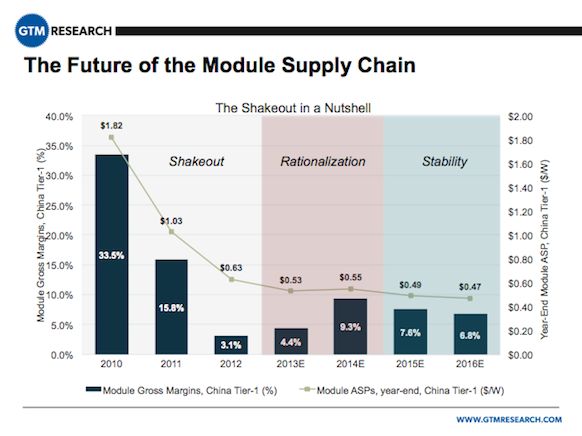

Shayle Kann, vice president of research, shared his outlook on consolidation, module prices, and the shifting global demand through 2016. Here is one of four charts from his presentation that provide a glimpse of what the world may look like in the next three years:

***

Is the solar industry marketing itself successfully? Are solar firms reaching consumers? Is branding important? Can the average consumer name even one solar panel manufacturer?

These were some of the questions that moderator Scott Clavenna, CEO of Greentech Media, posed to two solar equipment firms and two downstream solar companies at the Solar Summit.

Danny Kennedy of Sungevity said the fact that "GTM [hosted] this panel" was a sign of progress for marketing solar. He added that his goal is to lower customer acquisition costs (CAC) and keep the firm's referral momentum going. "At the end of the day, solar is not about the technology; it's about the customer," said the Sungevity founder. He notes that Australia went from 900 PV roofs to 300,000 rooftops in six years -- and that scaling was all due to word-of-mouth.

"We are a service business," said Kennedy, adding, "Southwest isn't an airline; it's a service business. That's how we have to think about solar."

So how important is marketing to PV? Did you learn about Yingli from their ads at the World Cup? #gtmss13

— Eric Wesoff (@ewesoff) April 24, 2013

***

The coming 10-gigawatt solar market in China may not offer the business boom the industry hopes, according to a panel of experts at the Solar Summit.

“There are market forces [to contend with] and good companies do survive, but peeling back the layers, it is also the companies with very good relationships to the government that survive,” explained Azure International Managing Director Chris Raczkowski.

“We see China as a centralized state, and it is true that the decisions are made centrally, but execution of the polices is at the local level,” added Sky Solar COO Petra Leue. It is difficult to do business as an outsider unfamiliar with the provinces “in the same way it would be difficult for a developer from Arizona to do business in New York state or Hawaii.”

“It is difficult, but it is also possible,” said Clean Energy Associates Founder/CEO Andy Klump, "as long as you partner with the right state-owned entity [SOE] or local company. But expect a much lower margin. And the payment terms are horrific. There are competitors out there willing to not take any payment for two years, and sometimes it is four years before they get 100 percent of the payment. You really have to know who your partner is. It takes years and a long-term focus.”

Petra Leue, @skysolar: "EU decision won't affect #Chinese companies b/c European market is drying up." Truly interesting. #GTMSS13 #SOLAR

— Frank Andorka (@SolarFrankA) April 24, 2013

***

Is there a relationship between the "tier" of a solar company and the quality and reliability of its module?

“The tier structure became a way for buyers to differentiate the rapidly proliferating multitude of manufacturers, particularly those from China,” explained SolarBuyer Managing Director Ian Gregory. The tier was primarily defined by the manufacturer’s size and balance sheet and by brand awareness. “It was used to make default bankability assessments. It didn’t look at the quality or reliability of the finished product. There was no information on that.”

SolarBuyer has made an assessment of tier versus manufacturing quality, he said. “We have not found a clear correlation. In fact, we’ve audited one manufacturer six times and each time the picture is different. The relationship between quality and tier structure seems to change every six months.”

***

And lastly, the GTM Solar Analyst team distills the huge week's ideas into eight takeaways here.