Silver Spring’s new $24 million round of funding will come along with a new partner. That’s EMC, the data storage giant, which is joining the smart grid metering startup to build a smart grid analytics solution for the utility industry. Looks like Big Data for the smart grid has another contender.

The Silver Spring-EMC partnership news comes two days after Silver Spring revealed it had raised $24 million out of a $30 million round in debt and options financing, bringing its total VC haul to just under $300 million. EMC confirmed Wednesday that it was the investor.

“Together, Silver Spring and a team of EMC data scientists are creating purpose-built algorithms capable of analyzing smart grid data to make it actionable and valuable to utilities and their customers,” is how the two companies describe their partnership. EMC will be integrating Silver Spring's data with its newly launched Greenplum Unified Analytics Platform. The two didn’t announce any target customers, though one might imagine that Silver Spring could pitch the product to big customers like Pacific Gas & Electric, Pepco and Florida Power & Light, among others.

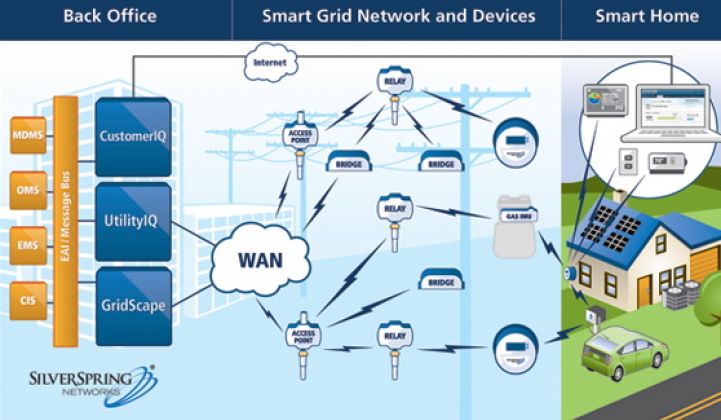

Utilities around the world are adding billions of new data points from smart meters, smart grid devices and customer-side IT systems to their back-office systems, and they’re in dire need of software to make sense of it all. We’re seeing lots of smart grid-IT partnerships on this front.

Smart meter giant Itron is working with IBM, SAP and Teradata to help utility Southern California Edison manage data from its millions of new smart meters. Verizon is providing cloud services to eMeter, the big meter data management software startup that was bought by Siemens last week. On the back-office side, IT giants like IBM, Oracle and Capgemeni are helping utilities manage smart meter data as part of their overall enterprise management.

It’s also a new line of business to add to Silver Spring’s multi-pronged smart grid networking strategy. The Redwood City, Calif.-based startup is a leader in networking North America’s smart meters, but it also relies on a few big smart meter customers for the bulk of its revenues. That means it’s under pressure to broaden its business into other smart grid functions as it prepares for an IPO to raise up to $150 million.

Opening up new revenue streams will be important for Silver Spring. Its latest S-1 amendment showed that billings fell to $183.3 million in the nine-month period ending Sept. 30, 2011, compared to $193.9 million in the first nine months of 2010. The company said fourth-quarter 2011 billings could drop further as one key customer nears the end of its smart meter deployment.

Beyond expanding its smart meter networking business into foreign markets such as Australia, Europe and Brazil, Silver Spring has been pushing into home energy management, distribution grid sensors, plug-in vehicles and demand response as well. Examples include its home energy and solar-panel communications projects with Maui Electric and Oklahoma Gas & Electric and its car charging work with ECOtality and ClipperCreek.