For all of the chatter about smart meters, the conversation rarely wanders far from the realm of electricity. But action is starting to heat up in the smart gas meter market, and water isn’t far behind.

Last week, consulting group Capgemini announced it was chosen by Southern California Gas Company (owned by Sempra) to install more than six million smart meters in the next five years, the largest gas-only utility smart meter project in the U.S. SoCalGas’s project is part of a nearly three-fold increase in the penetration of smart gas meters worldwide estimated by Pike Research between 2010 and 2016.

“The gas grid is certainly a different animal,” said David DuCharme, vice president of Utility and Smart Energy Services at Capgemini. “The largest issue is safety and management.”

In Europe, there is already more activity in the gas market; the U.K. government has mandated dual gas and electric smart meters for every home and business by 2020. Italy will install smart meters for all of its commercial gas customers and most residents by 2016.

Yet in the U.S., gas metering has not received as much attention -- or as many federal dollars -- as electric smart metering. However, the challenge of managing gas smart grid data can be less complex than electric meter data management, according to DuCharme. As prices continue to drop for the smart meter market, this will benefit the gas market, as well.

Like their electric brethren, gas utilities have struggled with integrating IT and OT when implementing the new metering systems. Capgemini, which has doubled its accounts in the smart energy space to 40, is finding increasing success with gas utilities. In the case of SoCalGas, about 30 different vendors will provide the meters; Aclara is providing the MDM system.

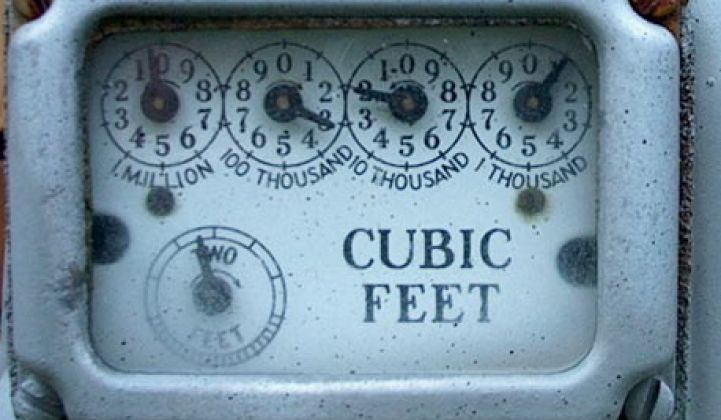

Water is also on the horizon. “The cost of efficiently managing infrastructure in the gas and water industry is extremely important,” said DuCharme. For those who think the electric grid in the U.S. is aging, the water infrastructure in much of the world is downright elderly. One study from Frost & Sullivan estimates the European smart water meter market will be worth $20 billion by 2020 and will see double-digit growth in the next decade.

In some cases, “The cost of failure in the distribution grid can be significantly higher in gas and water than the electrical industry,” said DuCharme. This is one driver for the growth in those two markets.

But without the same kind of government mandates in the U.S. and Europe, the markets will not see the boom that the electric meter has seen in the past few years. Customers who have to foot the bill -- such as the anticipated $1 billion it will cost for the new SoCalGas meters -- are also likely to question the benefits. Like electricity, the business case often centers on fewer truck rolls and improved efficiency, although in the case of SoCalGas, DuCharme said the average customer's savings was only estimated to be about one percent.

A pilot of 10,000 meters will begin in 2012, with a planned deployment of about 1.2 million meters a year over the next five years. DuCharme said that many other gas utilities are watching. “It’s always great to go down a path others have walked down before,” he said.