Renewables have grown powerful enough to alter the workings of power markets, which will in turn affect the future growth of wind and solar.

This unprecedented collision course creates uncertainty for the markets, but also opportunity, according to the combined insights of GTM Research, Wood Mackenzie and MAKE Consulting. The key will be thinking through the unintended consequences of the wind and solar acceleration and adjusting behavior accordingly.

Renewables already compete on price with conventional generation

Wind already beats coal and combined cycle gas plants on levelized cost of energy. That number is expected to drop another 12.7 percent over the next five years, while solar costs sink 31.5 percent.

"Renewables have become so much more competitive versus traditional fossil-fuel generation sources in the United States," said Dan Shreve, head of Americas at MAKE Consulting, in the opening address of the Power and Renewables summit in Austin, Texas. "With all the gains that have been made over the last decade, there’s still more to come."

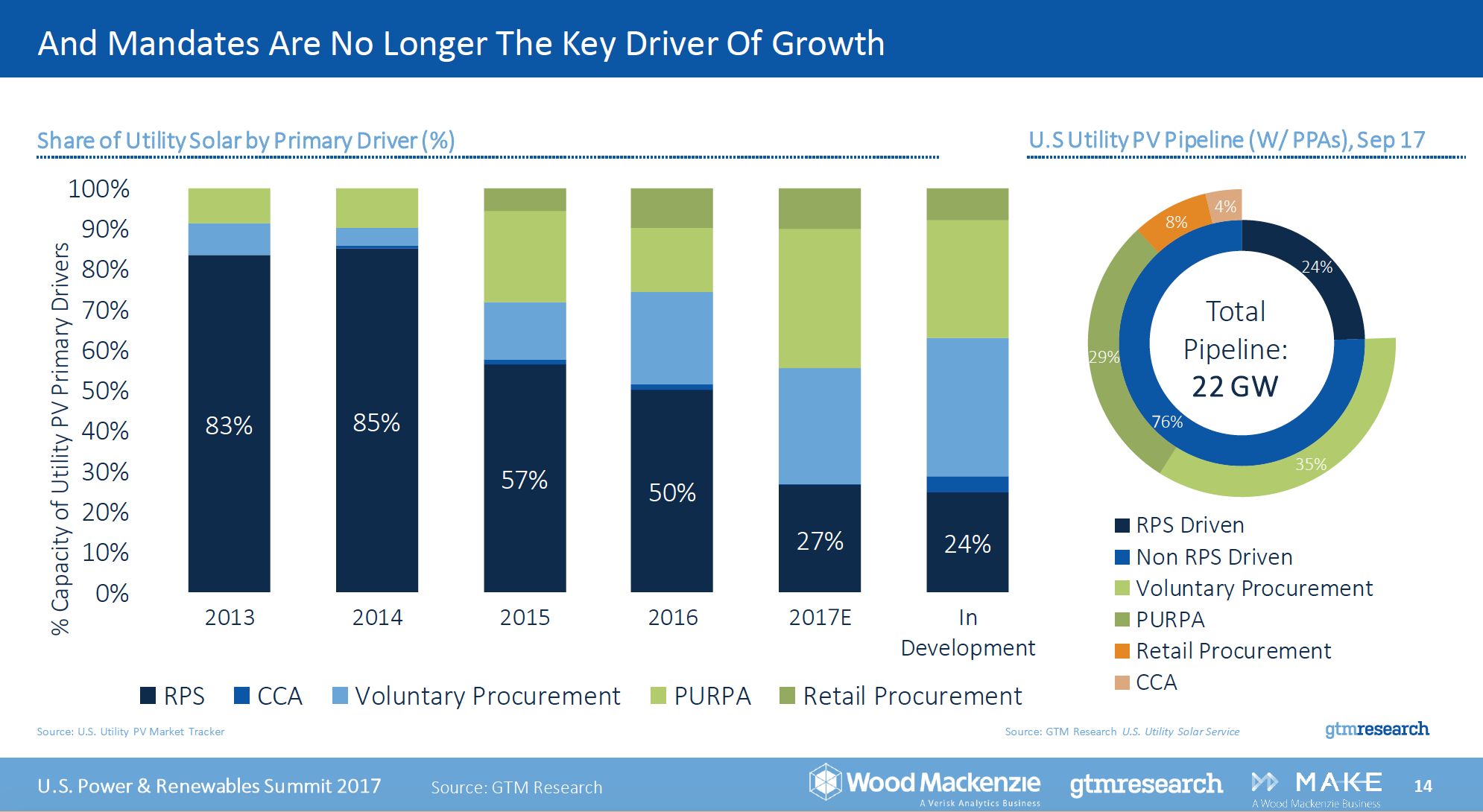

While wind and solar still rely on federal tax credits, they've shifted away from government mandates.

In 2013 and 2014, more than 80 percent of utility-scale solar demand came from state renewable portfolio standards. Of the current pipeline, state mandates drive only 24 percent.

Voluntary procurement by utilities, PURPA contracts, corporate renewables procurement and community-choice aggregation have risen as drivers for procurement. Those trends will accelerate.

"You end up building this stuff out over a much wider array of markets," said Shayle Kann, head of GTM Research. "It's not just state actors anymore."

At least 46 cities and 112 major corporations have committed to 100 percent renewables procurement. That's just the beginning.

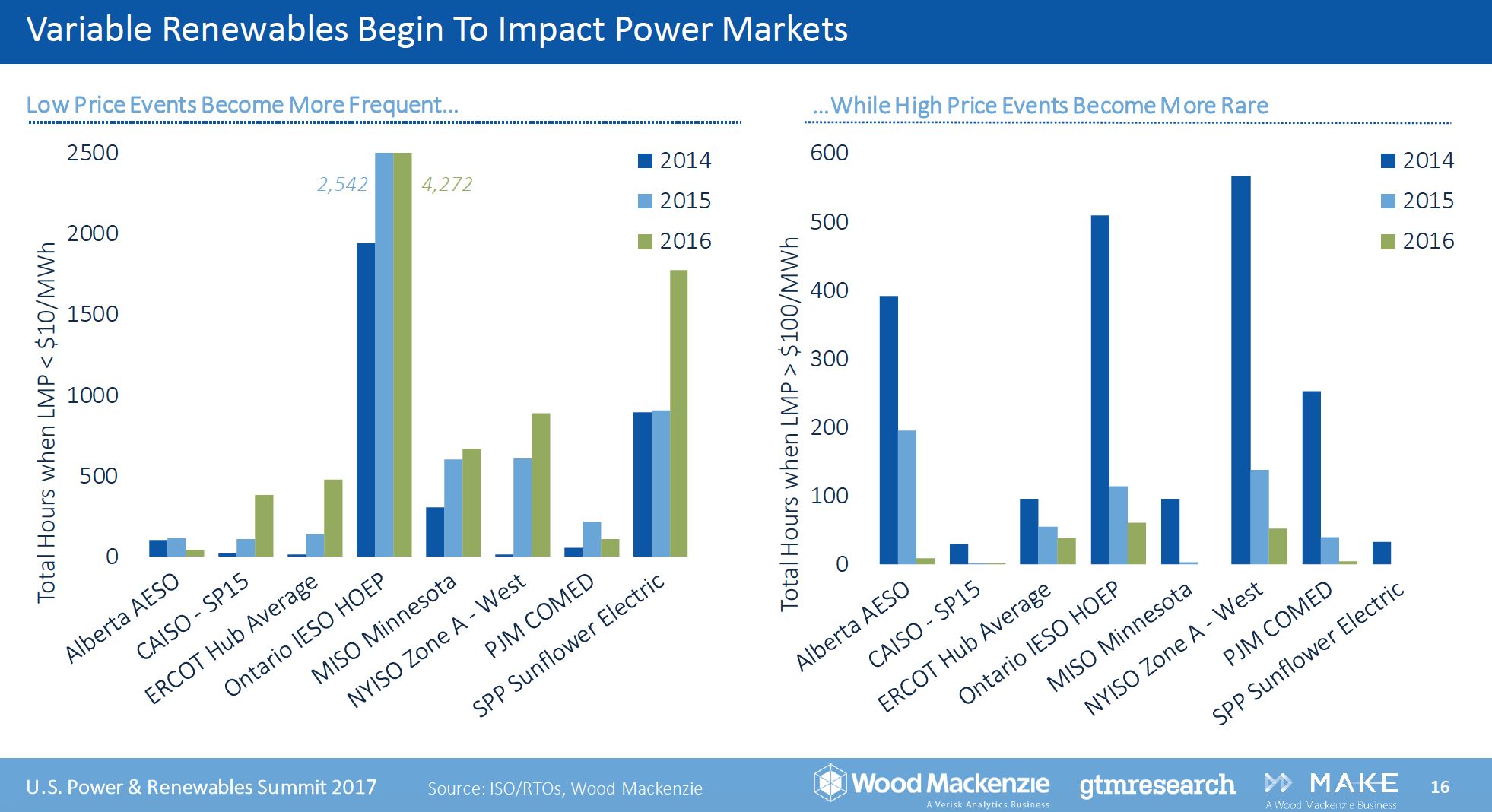

It's starting to affect power markets

The implications of this growth spurt are starting to ripple out through the power markets. One early manifestation: a spike in periods of low prices over the last three years, as well as a drop in periods of high prices. The researchers here defined low pricing as a locational marginal price less than $10 per megawatt-hour and high pricing as LMP greater than $100 per megawatt-hour.

This trend is playing out to varying degrees across North America as renewables, with zero fuel costs to operate, bring more power onto the grid.

"As we see price trends going downward, it obviously puts stress on fossil fuel assets," said Prajit Ghosh, head of Americas research at Wood Mackenzie Power and Renewables.

The stress isn't limited to coal and gas, however. Steep declines in power prices are already putting pressure on profit margins for new wind and solar developments.

"Power prices are running away from you; there's a value deflation effect of renewables at higher penetration," Kann said. "Can you actually make money with power-purchase agreement prices as low as they are, and if not, is it a sustainable market?"

Even as wholesale prices fall, retail prices are rising in many markets, Ghosh added. When customers have to pay more for electricity, it generates pressure to slow down a jurisdiction's renewables targets, he said.

The changing energy mix drives different kinds of investments as well. California's ample solar production effectively shifts the system peak from late afternoon into the evening, when solar production drops off. That creates demand for flexible capacity that can ramp up quickly to address the "duck curve" problem.

Today, the default resource for flexible capacity is natural gas plants, the same asset class that is getting squeezed by lower power prices. Many of the biggest merchant gas producers have become saddled with debt and forced to re-evaluate their business strategy.

Raising the level of renewable penetration to higher levels, like California's 50 percent goal, requires even greater flexibility, Ghosh said. But having a healthy mix of wind and solar lowers the flexibility requirement compared to having just solar meet the target.

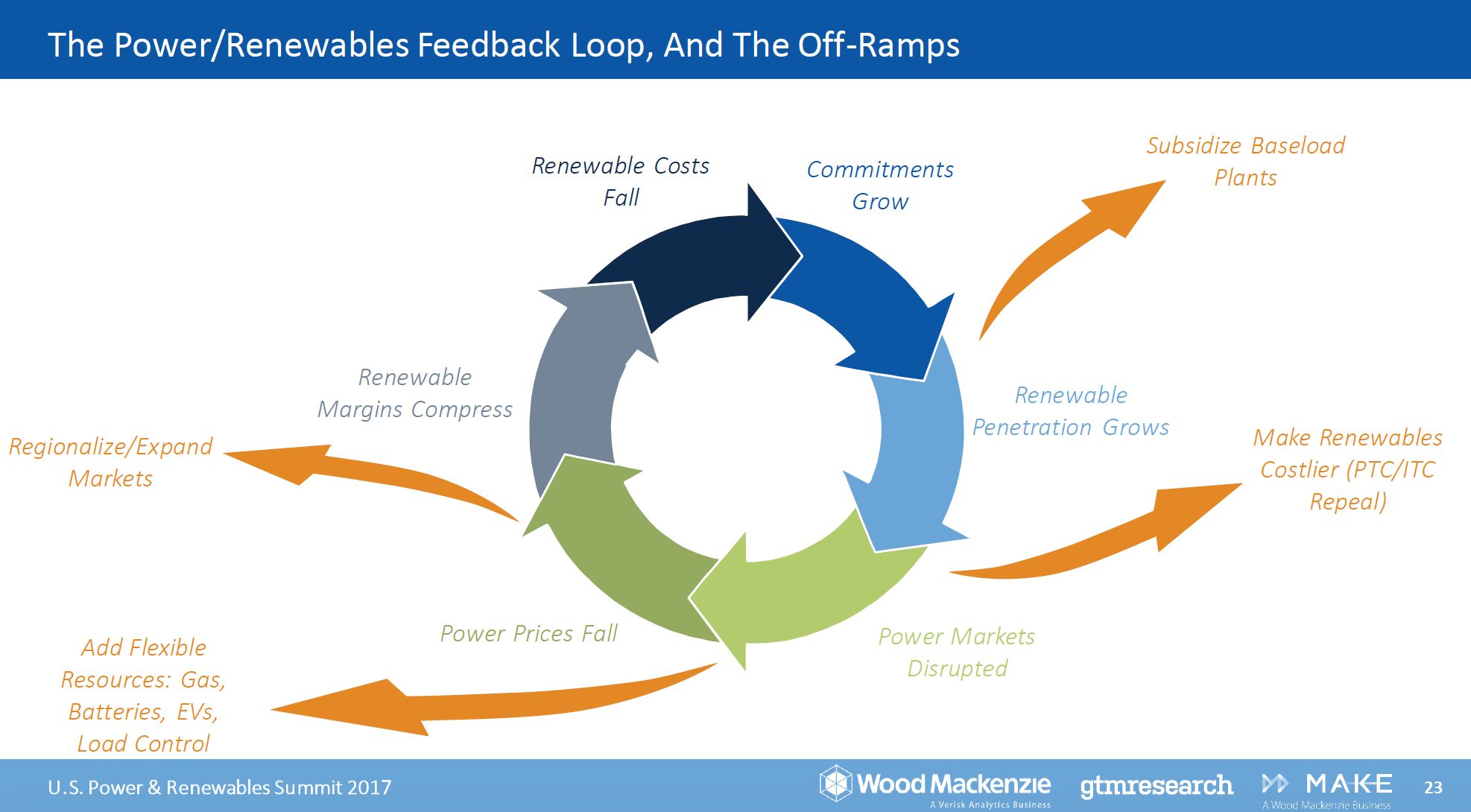

This creates a feedback loop that complicates future renewables development

For years, driving down the cost of renewables has been a top goal of the industry. It needed to prove it could compete without mandates.

That effort has exceeded expectations -- and it appears to be driving a feedback loop with uncertain ramifications.

Low costs for wind and solar spur additional interest in the resource, which leads to growth in renewable penetration. That changes the fabric of the power markets, as described above, leading to a decline in power prices.

Tougher competition on price pushes renewable developers to cut costs further, and the cycle continues.

"It's staggering on the supply chain how fast the costs are falling," Ghosh said. "This is a race to the bottom here, ultimately."

The researchers noted several "off-ramps" that could mitigate the disruption through policy means. They will appeal to certain constituencies more than others, however.

For instance, subsidizing baseload plants would slow down the pace of grid change. Energy Secretary Rick Perry has proposed doing just that in the form of rewarding plants for stockpiling 90 days of fuel.

Such a policy would upend competitive wholesale markets as we know them, and it lacks a coherent theory of why the policy is necessary.

Similarly, making renewables costlier by repealing or reducing the tax credits for wind and solar would slow the disruption of power markets.

These tax credits are already set to ramp down according to a bipartisan act of Congress from 2015, but recently proposed tax reform legislation would alter the compact. That uncertainty is already jeopardizing investments.

The other off-ramps would accelerate the grid transition rather than slowing it. Adding more flexible resources, perhaps through competitive market processes, would create revenue opportunities while addressing the need for quick ramping to meet demand on a highly renewable grid.

Regionalizing electricity markets eases the downward pricing pressure on renewables, by selling power across more geographically varied markets that produce wind and solar at different times.

Fighting the trend toward renewables would be a losing battle. The optimal configuration for renewables-heavy power markets, though, is harder to discern.