Republicans in the U.S. House of Representatives presented their proposed tax reform bill last week -- the opening volley in legislative and executive efforts to pass a comprehensive tax reform package.

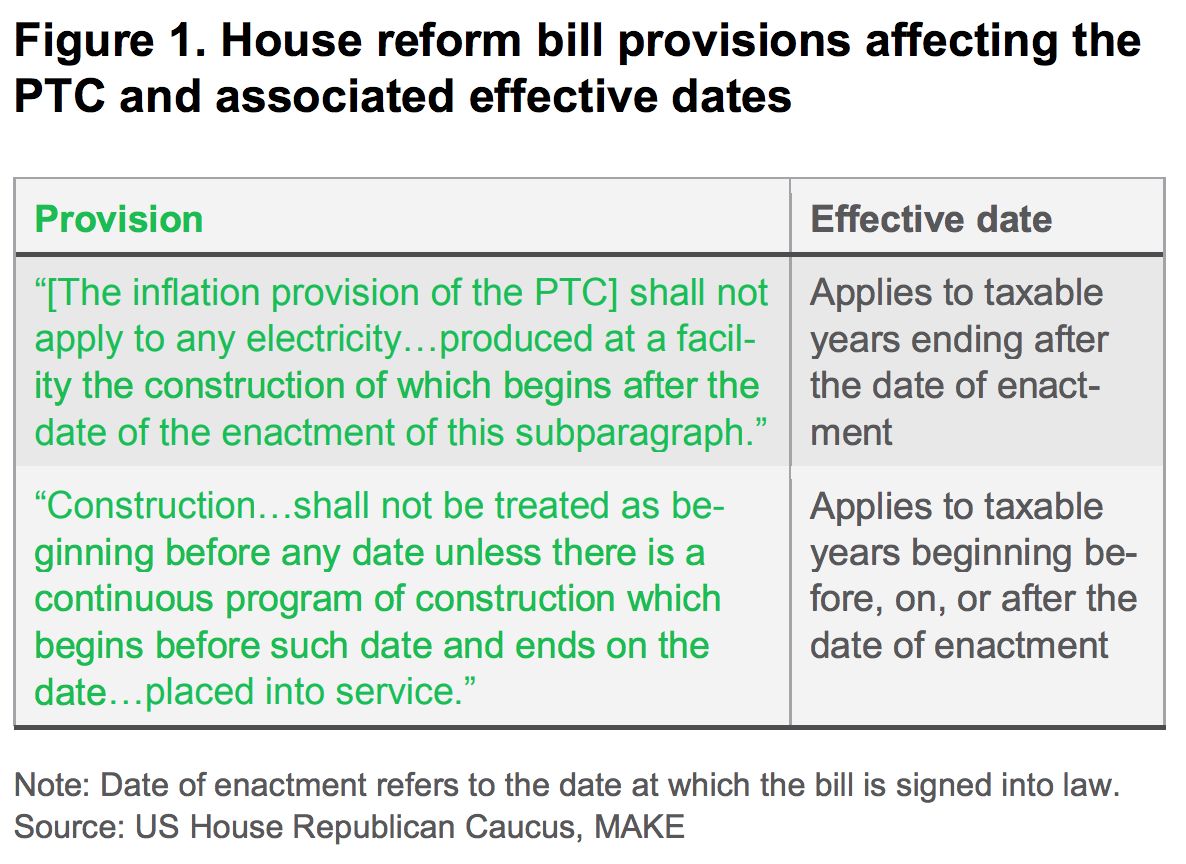

While the reform package that ultimately passes into law will require Senate approval, the House bill proposes worrying changes to the Production Tax Credit (PTC) for wind power that immediately destabilizes tax equity, 80-20 repowering efforts and 80 percent PTC value safe-harboring of turbines, and threatens to severely curtail the upcoming four-year installation forecast if the bill becomes law.

Senate unlikely to agree on PTC measures

The odds for the passage of this draft bill and its wind provisions into law are long, as the Senate is highly unlikely to allow any reform bill to impose such Draconian reforms on the wind power market. Senator Chuck Grassley (R-Iowa), author of the PTC, holds a position on the key Senate Finance Committee, which amplifies his influence and provides an additional barrier to similar PTC-weakening measures finding their way into the Senate tax reform bill. But with such sweeping tax reform at stake, few if any other senators in the slight Republican majority will regard the PTC as anything more than a bargaining chip.

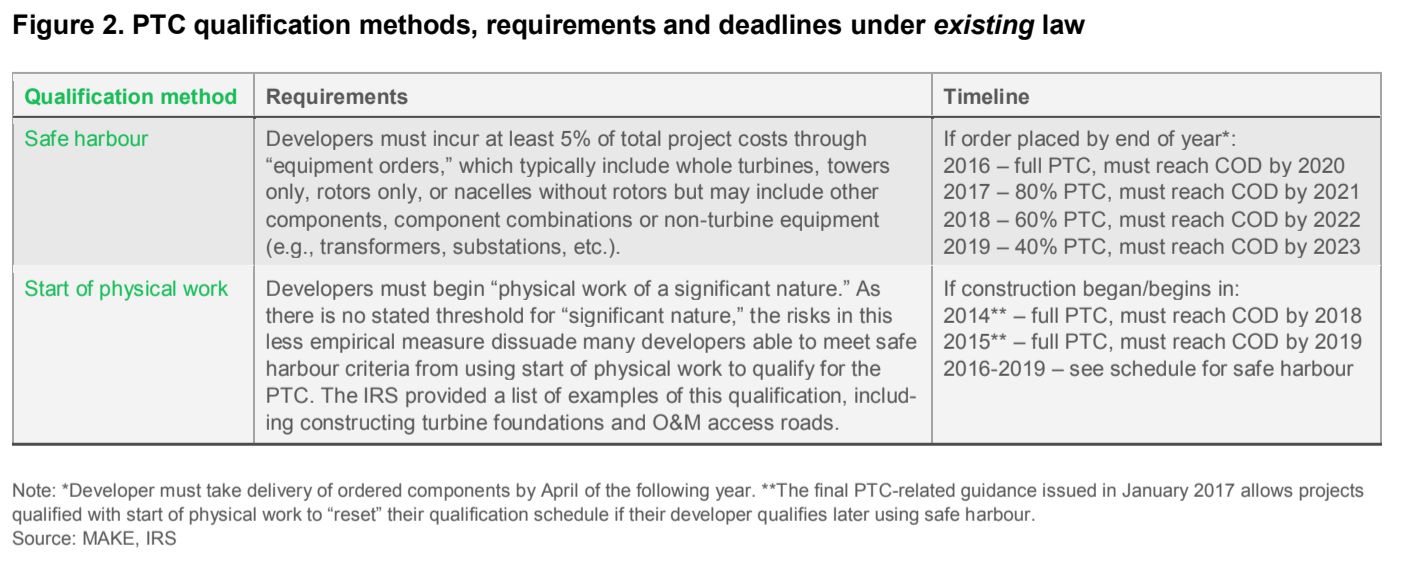

If the Senate must reform the PTC, it would most likely result in the evolution of the credit’s qualification mechanism from a “start of construction” based standard (either through physical work or safe harbor, as shown in Figure 2) to a “date of commercial operation” approach. If qualification standards are reduced to meeting a 2020 operation date, it would be a nominal boon to the industry. But, ultimately, leaving the qualification mechanisms alone and avoiding any policy uncertainty or industry recalibration is preferable.

Bill’s introduction has immediate repercussions

Regardless of the House bill’s viability, it has introduced a sudden jolt of uncertainty into the U.S. wind power market, with tangible results. The critical tax equity space, which had only recently started to function smoothly after disruption from the 2016 presidential election, will again seize up as investors recalibrate expectations and wait for further policy signals.

The threat to safe harbor and timelines have effectively frozen additional turbine procurement for the 80 percent PTC value, which has significant implications for the 80-20 repowering market, where several turbine OEMs and developers that were late to the repowering game had hoped to leverage the 80 percent PTC.

If the bill is passed into law as-is

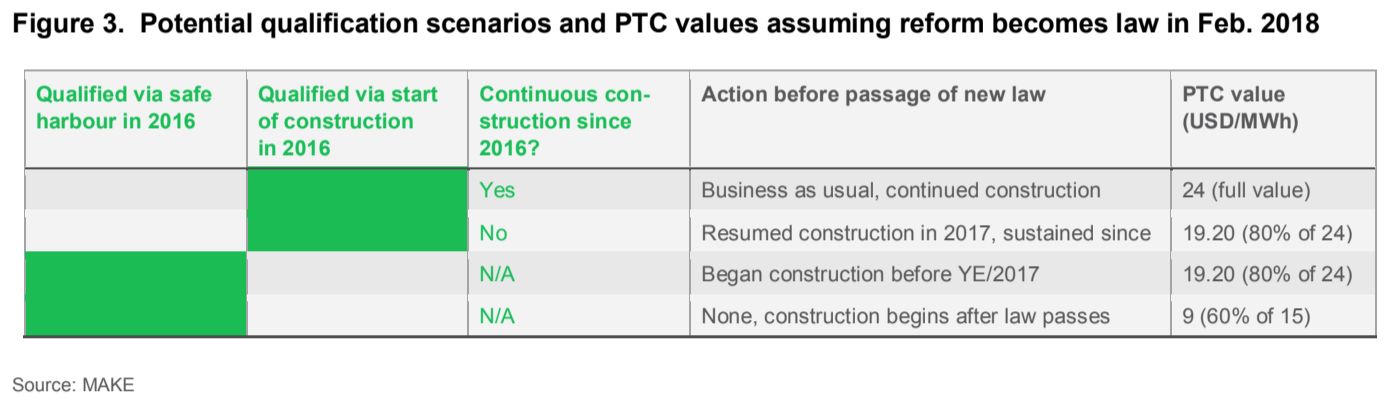

If the bill is to pass in the near term as proposed, it would pack a mighty one-two punch. Projects previously qualified for the PTC in 2016 via safe harbor would be disqualified and forced to immediately requalify via the “physical work” provision of the PTC, leaving almost no time to secure financing and EPC contracts required for sustained construction. This would then leave the developer vulnerable to the inflation provision, which effectively reduces the PTC value from its current $24 per megawatt-hour to its original, decades-old $15 per megawatt-hour.

If the developer failed to requalify before the bill is signed into law, it would be able to, at best, secure a PTC at a fractional “phase-out” value of the $15 per megawatt-hour PTC.

Figure 3 considers project outcomes in a scenario in which tax reform is enacted in February 2018. The scenario assumes the bill would not apply retroactively to projects that reach commercial operation before the law passes, though it assumes the second provision, regarding construction, does apply retroactively for projects that have not reached commercial operations before the law passes.

The bill does have positive provisions. Notably, it reduces the corporate tax rate to 20 percent and allows full asset depreciation in year one of operation, but these would not offset the inflation adjustment. Consequently, PPA pricing would need to adjust to lower incentive levels, as near-term technology and capital cost improvements are not sufficient to cushion the bill’s blow.

Disruptions would cascade; for example, utilities would require time-consuming revamps of resource plans and PPA pricing adjustments, in turn forcing independent power producers to revisit their pro formas with their entire supply chains.

Under these circumstances, financiers and other counterparties will not be keen to commit to a project that could easily collapse if its developer fails to foster it into the construction phase in a dramatically narrow window. The same issue applies to repowering efforts, also likely to suffer due to the current political environment.

***

Anthony Logan is the North American market analyst at MAKE Consulting, a Wood Mackenzie company, where he focuses on market developments, future scenarios, supply chain dynamics and competitive strategies across the wind power value chain.