In previous articles I’ve argued that in order to achieve the true potential of energy efficiency, we need to move beyond the current model of top-down programs and toward markets that measure and value energy efficiency as a tradable resource rather than as a rebate coupon.

In this article, I will go into more detail about how close we are to achieving this paradigm shift, the changes necessary to make it happen, and the many advantages it will create for building owners, industry, investors, and for the future of the utility sector.

Today’s energy-efficiency programs are typically designed around rebates and incentives that are paid upfront and are based on a predicted result. Because energy efficiency is paid in advance, without transparency and with little accountability as to results, there is a misalignment of incentives that rewards a race to the bottom and results in the need for complex and costly regulations that make innovation nearly impossible -- rarely yielding the intended outcomes.

Think of it this way: if farmers were paid based on predictions and got the same income no matter what they actually harvested, they would have no incentive to water or fertilize their crops. In order for such a system to work, investors would have to regulate and monitor every step in the farming process.

Energy-efficiency programs are in the same boat. Not only does our system often reward the wrong behavior, but when we finally do get around to measuring results, we introduce even more uncertainty. We currently spend over $200 million every year to evaluate, measure and verify savings, resulting in complex and often subjective reports that often retroactively reduce savings and create substantial uncertainty.

In one example, NRDC estimated that an evaluation incorrectly and retroactively lowered the value of PG&E’s upstream lighting incentives by $1 billion. In describing the fundamental challenge of the current system of evaluation, measurement and verification (EM&V), the DOE State Energy Efficiency Action Network put it succinctly: “EM&V is sometimes seen as expensive, not credible, not timely, not transparent, and as a burden, not a benefit.”

In order to achieve the potential of energy efficiency, we must transition from the limitations of today’s top-down programs to a system that can animate markets, encourage innovation, and attract private capital.

By definition, a market is where buyers and sellers interact to trade goods or contracts and determine a price. Rather than “market transformation” through program design, we now have the tools to calculate and track savings in near-real time and pay for performance as a resource, allowing market forces to develop solutions that drive consumer demand, and that can be delivered profitably based on the value of energy savings at the meter.

What exactly is energy efficiency?

The first step toward energy efficiency as a market is agreement on how to measure a standard unit of savings. While it can be complex to measure efficiency gains on individual buildings, by metering portfolios of similar project assets, it’s possible to calculate aggregated savings with a very high degree of confidence.

Investing in efficiency as a portfolio of assets rather than as individual projects results in consistent returns, washing out outliers and managing the uncertainty of the individual-building counterfactuals through the law of large numbers. For example, for a portfolio of car loans, an investor can expect a known percentage of defaults, even if there is no way of knowing how any individual loan might perform.

Markets abhor uncertainty, which is when you know neither what will happen next, nor what the possible distribution of outcomes looks like. However, risk is the cornerstone of markets and differs from uncertainty only in that the distribution of outcomes is known.

The solution for energy efficiency is not the pursuit of perfection on individual projects but manageable risk at the portfolio level to enable investment-grade energy efficiency.

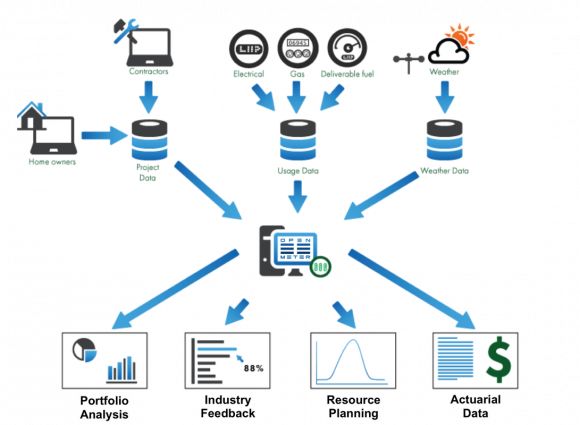

In the last few years, a host of standards and technologies have come on-line that allow the accurate, reliable, and near-real-time measurement of energy savings and load shapes. Some of these innovations include the Green Button standard for energy data transfer, standard XML dictionaries for project data, the open-source DOE SEED Platform that provides a distributed system to track project and building data, and a smart metering infrastructure that provides granular access to energy usage data.

Just as with kilowatt-hours and pounds, nobody should own the standard for measuring energy efficiency. Efforts such as the CalTRACK system, developed jointly by California utilities and regulators, can truly change the game by aligning industry, utilities and regulators around a standard measurement of savings. The process of reaching consensus on this unit of measurement continues through a joint Building Performance Institute and Air Conditioning Contractors of America standard that is now in development for the American National Standards Institute.

Building on our newly available data infrastructure and standards, it is now possible to meter energy efficiency with a high degree of confidence and repeatability. The Open EE Meter is an example of how the energy-efficiency industry can leverage data and an open-source platform to standardize and democratize energy savings and provide a standard EE meter as the basis for future markets based on energy efficiency as a resource.

EE metering differs from current EM&V approaches in the fact that results are replicable and available to all market participants based on available data. In simple terms, this means that private companies, utilities and regulators will all calculate the same level of savings for a given set of building efficiency projects.

What’s energy efficiency worth?

With agreement on the EE meter that defines a standard unit of savings (OK, I’m being optimistic), we can turn our attention to establishing a price.

While it is likely that early markets will price energy efficiency based on what we are spending for savings in current programs, in the future and with more data, markets can be employed to allow supply and demand to arrive at a price for efficiency as another capacity resource that utilities can procure to keep the lights on.

One example of a market-driven approach is the use of a reverse auction, where a utility or other load-serving entity requests offerings from providers for efficiency and providers compete to establish the price. The lowest-cost solutions receive power-purchase agreements based on a clearing price and are paid based on savings calculated using actual performance at the meter. This is already how California procures utility-scale solar, and this approach could be applied to allow the market to establish a price for saved energy.

In the future, more complex pricing signals could also emerge, incorporating energy efficiency’s many dimensions including carbon, load shape and location of savings.

When one combines the consistent savings found in portfolios of energy-efficiency projects with a market and a price, it results in stable long-term cash flows. These cash flows allow efficiency projects to be financed the same way one would finance a power plant, through project finance, rather than just the balance sheet or credit of the building owner. Power plants are financed based on the value of the energy they will produce and sell, not merely on the credit of the borrower or the value of the asset.

It makes sense that if we want efficiency to compete with power plants as part of the utility of the future we need to start financing it in the same way.

Aligning interests through markets will grow the pie

Moving to energy-efficiency procurement that pays for efficiency at the meter will unshackle contractors and the broader energy-efficiency industry from the trap of current incentive programs and the stifling regulation that inevitably goes with them.

Turning energy efficiency into a cash flow, rather than relying on upfront rebates, will enable innovative efficiency product offerings that incorporate the long-term value of savings into innovative solutions for building owners and profitable business models for contractors. There is no perfect one-size-fits-all energy assessment, software tool or consumer value proposition; a market that rewards results will allow for diverse ideas to flourish and those that deliver to get ahead.

As this new market-based approach takes hold, utilities will finally be able to get out of the business of trying to figure out how to deliver energy-efficiency services through programs, and instead can focus on procuring demand-side resources in much the same way they already procure capacity.

With the marketplace being paid based on actual performance and taking on performance risk, regulators will be able to focus on protecting consumers, establishing the “weights and measures” for integrated demand-side resources, and creating well-regulated market structures that send the right price signals. Rather than attempting to directly design the delivery of energy efficiency services through programs, regulators will be able to influence outcomes through market design, while leaving execution up to the market.

Today’s program implementers are also well positioned in this new market, since they are already performing many of same functions one would typically find in an efficiency business, including marketing, contractor management and quality control.

Most importantly, building owners will benefit from a competitive industry incentivized to develop innovative business models and products that drive demand for the broad range of homeowners and buildings in the market.

A good analogy can be seen in the solar market today, where multiple solar companies offer a range of business models from PPAs and leases to franchisees and solar loans, all of which are competing for contractors and customers. We will see the same in energy efficiency as we create the space for innovation by rewarding results.

Imagine a day when homeowners are offered a choice: a business-as-usual contractor selling a mid-range furnace and offering something akin to a credit card as financing, competing with a contractor who is offering efficient equipment and a more comprehensive upgrade with a performance guarantee at a lower price by fully monetizing the value of the savings generated.

The homeowner would have every reason to choose the second contractor, saving on both upfront costs and long-term energy bills.

We can learn from experience

The concept of treating energy efficiency as a resource that can be procured through a market is not new. In the early 1990s, there were a number of “standard offer” and demand-side bidding programs where auctions were used to acquire energy efficiency. These case studies provide important insights and lessons to draw from. While these 22-year-old pilots were successful in generating “a high level of interest and support among various types of energy service providers” and “host customers were very satisfied,” they were far from perfect.

These early energy-efficiency markets have been criticized for costing more than program-based alternatives. However, these outcomes should be expected in the early days of a market, especially given the uncertainties associated with traditional evaluation methods, early markets with little competition, and fixed pricing for savings.

Learning from these early prototypes, we can move forward with new market designs. These designs promise game-changing advances that will allow functional and transparent energy efficiency markets to emerge. The availability of meter data and open methods for calculating savings, when combined with a substantially more mature and competitive marketplace, will serve as a foundation for a transparent, data-driven approach to energy efficiency that can overcome previous barriers.

This transition is underway

The good news is that the transition to markets based on metered energy efficiency and pay-for-performance is already underway.

On April 13, NRDC and The Utility Reform Network submitted a response to a CPUC ruling arguing for "a residential sector pilot based on the existing Home Upgrade program, but with savings paid to an aggregator of projects only when savings show up at the meter using the open-source CalTRACK / Open EE Meter system."

This proposed pilot was also supported by Pacific Gas and Electric, which wrote in its filing that “[t]his pilot design has the potential to facilitate comprehensive upgrades while simultaneously minimizing implementation costs through leveraging private capital.”

The fact that diverse interests including utilities, industry, and environmental and consumer advocates can agree on the promise of this approach suggests we are approaching a tipping point.

The great innovation in this new paradigm for energy efficiency is not the technology that enables it. The real innovation is how the combination of data, technology and standards will finally allow energy efficiency to function like every other energy market.

By aligning industry with policy goals through metered savings and pay-for-performance, we will encourage innovation through competition, allowing the best solutions to rise to the top -- and a true energy efficiency market to emerge.

***

Matt Golden is a principal with Efficiency.org, an organization that works with government and industry to close the gap between public policy, private investment and the delivery of energy efficiency to market.