In my last Greentech Media article, I looked at the limitations of top-down energy efficiency programs and began to lay out a pathway toward a market where energy efficiency is treated as a tradable resource, spurring business model innovation and private investment.

Such a model will free states, utilities and regulators from the thankless job of providing top-down management of every step in the efficiency process, and instead let them do what they do best: regulate markets, manage energy procurement and protect consumers.

The frequently used analogy of energy efficiency being “low-hanging fruit” is misleading. If energy efficiency were in fact easy to pick like a ripe apple on a low branch, after 40 years of programs, more of it would have been picked. Instead, it is much more like wild strawberries -- it takes lots of people on their hands and knees a long time to fill a basket.

With well over 100 million existing buildings in the United States to retrofit, energy efficiency needs all hands on deck, rather than a top-down approach. There is no single right answer to driving consumer demand, nor one perfect retrofit model, business model or financial product that can be applied to every building or owner. Scale in energy efficiency will come from aligned interests and a marketplace competing to fill many baskets with valuable savings.

Under even the most optimistic assessments, the current trajectory of public spending on energy efficiency is only a small fraction of the trillions of dollars needed to achieve its potential. A new path forward is necessary to increase consumer demand, reward innovation and drive private capital investment.

Transitioning toward regulated markets does not mean that utility billpayer or taxpayer funds should stay out of energy efficiency -- nor that the private sector and markets will work magic without consequences. On the contrary, we need a massive expansion in energy-efficiency investment into a well regulated market that leverages billpayer and taxpayer funding as a way to animate markets.

This article explores a path forward that leverages the power of the market and advances in technology and business models to increase demand for, and investment in, energy efficiency.

Energy efficiency as a resource

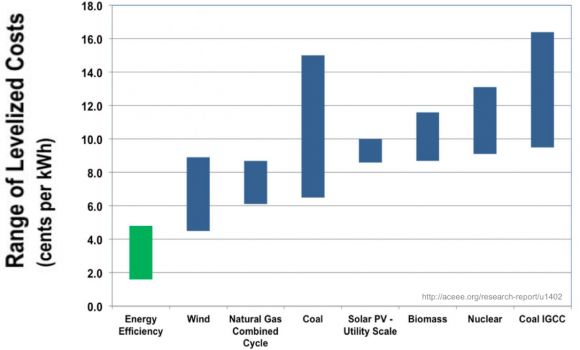

When it comes to keeping the lights on and reducing emissions, "negawatts" of energy efficiency are every bit as valuable and significantly cheaper than generating energy. However, unlike power generation, energy efficiency lacks markets that value energy savings as a resource -- equivalent to power plants being paid for the energy they produce.

Power generators finance their investments based on future cash flows from selling energy, also known as project finance. If energy efficiency is going to play its part in the new utility paradigm, it’s time we start financing it like an energy infrastructure investment.

It’s about putting everyone into the right roles. Utility programs and regulators can focus on consumer protection, ensuring fair trade, as well as focusing on the design and regulation of market systems that align incentives with the public good and grid reliability. This will leave the private sector to do what it does best: drive innovation through competitive markets.

Solar is an example we can follow

The solar industry's explosive growth is a great example of how markets can drive rapid innovation and consumer demand.

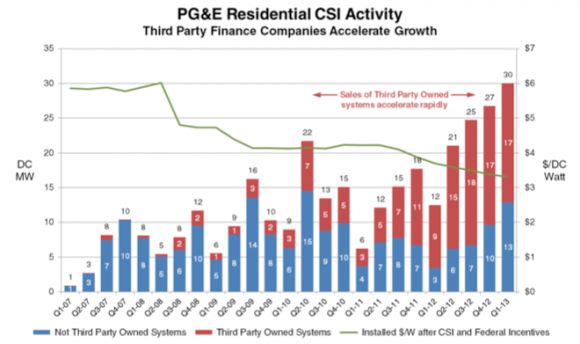

While it is easy to give all the credit to the falling price of panels and the widespread adoption of subsidies, this only tells part of the story. Solar firms have been successful in driving down soft costs even as module prices stay flat. The acceleration in the solar market can in large part be attributed to business-model innovation that has come in the form of solar leasing and power-purchase agreements offering zero upfront costs and guaranteed results.

Source: SunCentric

If one were to look back at the solar market just 10 years ago, it was a sleepy industry with a handful of small companies and very little financing outside of home equity loans. The advent of California net energy metering was the turning point for solar in 2006, which, when coupled with direct incentives, paved the way for the industry as it exists today. With the California Solar Initiative (CSI) now in the past, and the end of the federal Investment Tax Credit (25D) looming, a vibrant market has emerged to take the place of programs, with a massive increase in private investment of 175 percent in 2014, boosting the total to $26.5 billion.

What would it take for energy efficiency to scale like solar?

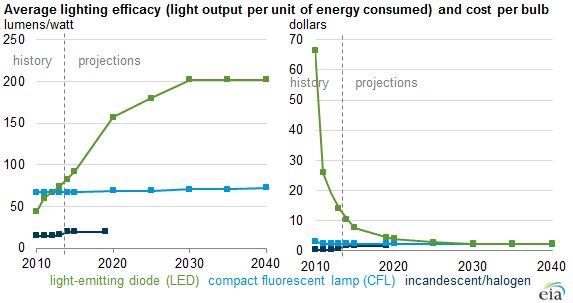

Some argue that energy efficiency is different from solar, because unlike solar, with efficiency, marginal costs increase as savings get deeper. However, energy efficiency’s version of the solar cost curve is already happening in lighting, smart thermostats, and a host of innovative business models, including property-assessed clean energy (PACE), which delivered energy efficiency and solar to 25,000 homeowners in California in 2014, totaling $500 million -- more than double the volume of the statewide Energy Upgrade California Home Upgrade program during the same period.

Energy efficiency costs less than supply-side alternatives

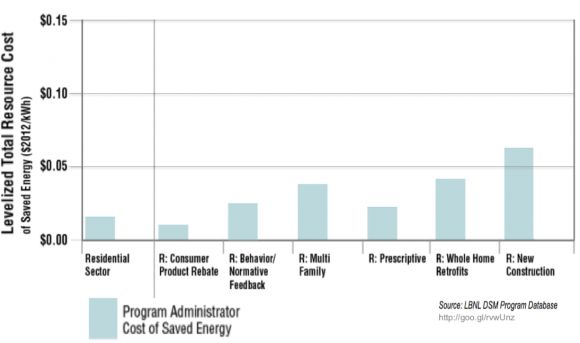

Inexpensive lighting efficiency has set unsustainable expectations as to the “cheapness” of all energy efficiency, but even the most expensive energy-efficiency measures often cost less than the cheapest supply-side alternatives.

Energy efficiency from lighting currently averages 60 percent of utility savings nationwide and sets an expectation that energy efficiency should be dirt-cheap. By way of example, Eversource (formerly NSTAR), which services over 20 percent of Massachusetts homes, projects (click here for Excel spreadsheet) it will spend 20 percent of its budget on lighting to achieve 58 percent of its savings in 2015. Technology that achieves scale in a functional market becomes the fuel for growth, but in a regulatory system designed specifically to drive the lowest possible price, this potential is lost.

Rather than basing the value on an artificially low number created by regulators, the value should be based on the utility’s avoided costs, also known as the program administrators cost (file is in PDF format), and at the price the market will bear. Utilities should be buying all energy efficiency that costs less to procure than the marginal cost of the next alternative.

If markets were allowed to properly value energy efficiency, investment could increase to levels that would drive growth, and the cost of savings to public programs would still be cheaper than the levelized avoided cost (PDF) of generating energy. With money to be made selling efficiency, market forces and competition would drive increasingly efficient business models and reward solutions that deliver cost-effective results.

In a market such as solar, technology that reaches the mass market results in increased profits and competition, creating a virtuous cycle wherein customer costs drop and demand increases. However, when energy efficiency begins to achieve scale and prices drop, the “solar moment” is lost to the efficiency industry and customers, with regulators deciding the savings could be had for free so they don’t have to pay for them. Instead of fueling the growth of efficiency, when the market moves forward, the baseline is adjusted, and it’s back to square one.

In the solar market, on the other hand, the CSI rebates which gave rooftop solar an initial boost were phased out as the market gained traction. However, the solar industry and its customers were able to continue monetizing the value of solar production through net energy metering, and now through the ongoing discussion around the “value for solar.”

Like solar, energy efficiency needs a similar mechanism to capture the value of negawatts to the utility, its customers and society. Simply relying on the inherent cost-effectiveness of energy efficiency in the form of lower bills as a means to drive demand clearly is not sufficient, as evidenced by the weak demand for efficiency. Instead, the full value of the energy-efficiency resource must be recognized and monetized to create a strong enough value proposition to change consumer behavior.

The goal should not be to press for the least possible cost, but instead to make delivering real results profitable and allow competitive forces and innovation in a well-regulated energy efficiency market to push prices lower, increase efficacy and drive demand. In a market in which supply and demand set the price, inexpensive savings will serve to increase supply, resulting in lower prices.

If home energy management systems or smart thermostats save enough energy to justify the cost, then great, they will be installed. Similarly, if better training of insulation crews delivers more savings than the standard “blow-and-go” approach, companies will invest in doing it right, because they will make more money.

Energy efficiency needs a version of the net energy meter, where savings can be calculated, tracked and valued, and programs can give way to competitive scalable markets. The lack of such a meter is the Achilles heel of energy efficiency. However, with recent investments in smart meters and data standards, it is now possible to reliably track savings at a portfolio level in near-real time.

Utilities, regulators and the energy-efficiency industry can learn lessons from previous procurement programs -- and from the problems facing current programs. However, incremental changes to our current trajectory are unlikely to jump-start the levels of growth necessary to bring efficiency to scale.

The next article in this series will delve more concretely into energy efficiency metering and how a competitive, data-driven market can work to increase competition and innovation, leading to increased consumer demand and private investment in energy efficiency.

***

Matt Golden is a principal with Efficiency.org, an organization that works with government and industry to close the gap between public policy, private investment and the delivery of energy efficiency to market.