Before Sandy smacked into the East Coast, a summer thunderstorm known as a derecho had moved quickly through the Mid-Atlantic region in 2012. More than a million customers lost power, some for a week. The storm cost Maryland electric customers nearly $600 million.

Later that year, before Sandy made landfall, the state’s Grid Resiliency Task Force found that “microgrids are a welcome and appropriate solution for customers whose need for consistent and reliable electricity is paramount.”

To move microgrids forward in the state, Governor Martin O’Malley called for a microgrid task force earlier this year that has now released its findings, defining a path forward for the technology.

The Resiliency Through Microgrids Task Force found that in the short term, distribution utilities should be able to own and operate “public-purpose” microgrids that have stackable benefits.

Unlike campus microgrids, which might serve a corporation or a university, public-purpose microgrids in Maryland would have to include various critical community assets, such as commercial hubs and emergency service complexes. They would also have to be able to island and communicate with grid operators, both the utility and PJM, to react to signals from the marketplace.

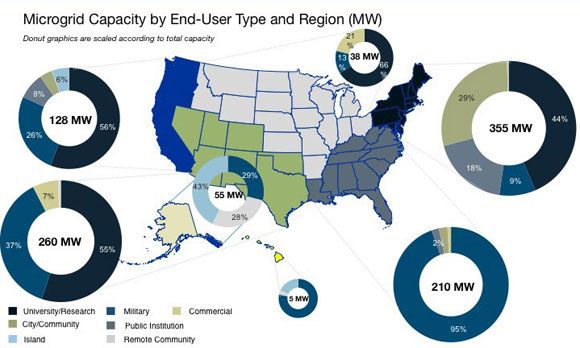

To date, the uses of microgrids have varied greatly between regions in the U.S., according to a new report from GTM Research, North American Microgrids 2014: The Evolution of Localized Energy Optimization. In the Southeast, military installations account for the overwhelming majority of microgrids, but cities are one of the primary adopters in the Northeast, while universities make up the bulk of microgrids in the Southwest and California.

The Maryland microgrids would have to be able to island in the case of a storm or other critical event, and also be able to provide load balancing, voltage controls and other ancillary benefits to the utility or to the regional energy market. The early installations will likely be sited in cities, but Maryland is also home to a large number of federal facilities that may be interested in being part of community microgrids. In the short term, the focus is on having distribution utilities own and operate the microgrids, and then eventually allowing third parties to build and operate public-purpose microgrids.

“Promoting utility-owned, public-purpose microgrids in the near term, while gradually opening the market for third-party operators in the long run, is a progressive and promising strategy,” said Magdalena Klemun, grid analyst with GTM Research and author of the North American Microgrids 2014 report. “However, timelines for necessary legal changes, the implementation of next-gen interconnection standards, and likely microgrid grant sizes will have to materialize before the impact of this initiative can be properly assessed.”

Who pays for the public microgrid?

Maryland’s next steps are to bring costs down and come up with a tariff structure for microgrids.

“This review should investigate islanding standards and mandatory procedures related to interconnection of high-penetration renewables and energy storage systems on the distribution network, with a focus on smart inverters, advanced communications technologies and islanding capabilities,” the task force report states. Establishing connection standards between the micro- and macro-grid will be one of the key pieces of bringing down system costs.

It is unclear just how much money Maryland will set aside for microgrid projects, but it looked to Connecticut’s program for guidance. Like Connecticut, the incentives would go toward the costs of design, engineering and interconnection and not generation assets. Unlike Connecticut, which has authorized municipal microgrids, Maryland has a narrower focus for which community microgrids will be approved, with resiliency being a chief goal of the microgrid.

According to the task force, distribution utilities have the authority now to own distributed assets that could comprise a microgrid. They will be expected to take advantage of emPOWER Maryland energy efficiency incentives.

Maryland’s emPOWER act calls for a statewide goal of a 15 percent reduction in per-capita electricity consumption by 2015 compared to 2007 levels. The state’s public service commission has already acknowledged that the energy efficiency programs will go beyond 2015, and the task force found that there is a place for microgrids to receive incentives through those programs. Buildings that will be a part of the microgrid could also receive money for efficiency upgrades. “If you’re going to provide power during outages, you want the most efficient load possible,” said Abigail Hopper, director of the Maryland Energy Administration.

Beyond efficiency incentives, the microgrids could bid into PJM markets, which will further offset the costs. The utilities would also be allowed to charge customers that wanted to be connected to the microgrid more for the additional grid resiliency.

However, the task force also found that some portion of the public-purpose microgrids could be socialized through an entire rate base. After all, if the hospital, grocery store and community center are all open in the wake of a storm, far more people will benefit than just those who are directly connected to a microgrid. However, a public service commission proceeding would have to be convened to determine how much of the microgrid costs can be rate-based.

The length of time that constitutes the “short term” is not specifically defined by the task force, but Hopper suggested the first utility-owned microgrids could come in three to four years, with third-party microgrids making an appearance just after that.

The Maryland Energy Administration is already embarking on a study that looks at the value of distributed generation and the value of the grid. The findings could help inform a larger proceeding down the road about a modern and distributed energy landscape.

A role for third parties

There is plenty for Maryland to contend with as it tries to encourage its distribution utilities to build out microgrids, but ultimately, the state does not want to enable only the regulated utilities to play a role in disseminating the technology.

In the longer term, Maryland sees a world where third-party owned and operated microgrids could also qualify as public-purpose microgrids. In one instance, developers could build out new communities connected to microgrids and then just connect them to the already existing grid.

The far more likely scenario, however, would be for third parties to be local microgrid operators that use existing distribution assets along with distributed energy resources for public-purpose microgrids.

In that case, the distribution utilities would still be able to rate-base the distribution assets and charge a distribution rate. Meanwhile, the microgrid operator would own or contract for the generation, storage and control systems. The microgrid operator would then function as the electric supplier for the microgrid customers. The state would likely license microgrid operators the same way it does competitive electric suppliers. The microgrid operator could also earn payments from the distribution utility for any grid-related benefits the microgrid offers, such as deferred upgrades.

One sticking point for utilities could be in providing data at the distribution level that would identify where best to site microgrids. The task force acknowledges that some of that data is proprietary, and the public services commission will have to find a way to share the information without hampering the utility.

According to Klemun, it is a slippery slope from allowing third parties to provide power to customers through microgrids to creating a risk that the microgrid operators will erode the utilities’ revenue. “You go from ensuring backup power to someday just providing power,” she added.

The task force also acknowledged that far more substantial changes would have to come to the regulated utility market before third-party, public-purpose microgrids could become a reality. The task force would likely have to undertake a proceeding that redefines the role of distribution utilities, similar to what New York’s REV proposal is doing, something that Maryland seems to be laying the groundwork for. “How can we create new business opportunities for many different folks, including utilities?” asked Hopper.

An open timeline

One key reason why it might be best to start with utility-run public-purpose microgrids, instead of immediately opening up the market to third parties, is that there would be no sweeping regulatory changes that would need to be made to allow the utilities to get started.

Maryland Energy Administration's Hopper noted that Pepco is one of the utilities that has publicly expressed a “great deal of interest” and has done some preliminary vetting and siting. Baltimore Gas & Electric serves as one of the members of the microgrid task force.

Klemun noted that Connecticut’s microgrid program had been called conservative in scope by some, but since it came with funding already in place, in some ways it’s a surer bet, since it is actually already enabling microgrids, whereas Maryland’s road map so far is not bolstered by specific goals or dollars.

“In a way, this is more progressive,” Klemun said of Maryland, “but there is no immediate monetary or legal action attached it.”

Hopper noted that the next steps weren’t dependent on just one stakeholder, such as a single utility, the PSC, the governor, her own agency or the legislature. That is a good thing, especially since it is a gubernatorial election year in the state. “There are numerous levers that could move this train,” said Hopper.