The coronavirus crisis will create a $400 billion hole in energy investment in 2020, but the power sector is faring relatively well compared to oil and gas, according to the International Energy Agency.

Going into 2020, the IEA had expected a 2 percent increase in global energy investments this year. It now expects a 20 percent drop. The devastating effect of a global economy in stasis means oil and gas investments will fall by a third this year, compared to a 10 percent decline in the power sector, the agency says.

A combination of lower energy prices, falling demand and unpaid residential bills will drag the global energy industry's total revenue down by an estimated $1 trillion this year. The IEA called the energy industry's change in fortune “staggering in both its scale and swiftness.”

“The historic plunge in global energy investment is deeply troubling for many reasons,” Fatih Birol, the IEA’s executive director, said in a statement on Wednesday. “It means lost jobs and economic opportunities today, as well as lost energy supply that we might well need tomorrow once the economy recovers. The slowdown in spending on key clean energy technologies also risks undermining the much-needed transition to more resilient and sustainable energy systems.”

Oil and gas investments crushed

Given the halving of oil prices coinciding with the outbreak of COVID-19, it's not surprising that the oil and gas sector has been hit especially hard.

Investment in the sector is expected to fall by one-third, but the figure rises to 50 percent for shale oil and gas. All the oil majors have announced spending cuts since the pandemic and price collapse took hold. Despite the ferocious headwinds — or perhaps because of them — BP, Shell and Total have committed to continuing their efforts to reduce emissions across their business and diversify into the power and renewables sector.

The power sector is on track for a 10 percent drop in investment, substantially less than oil and gas but painful nonetheless, particularly at a time of rapid change. While renewable energy investments have generally been resilient, the IEA picked out rooftop solar as one hard-hit market because of curbs on consumer spending. (There are signs, however, of a turnaround in the U.S. rooftop market.) The number of closed deals for utility-scale wind and solar projects has regressed to its level three years ago.

Electricity network investment is down 9 percent, with backing for flexible assets, like battery storage, tailing off. Birol highlighted the role that continuity of grids had played in keeping other parts of the economy open during the global health crisis.

“These networks have to be resilient and smart to ward against future shocks but also to accommodate rising shares of wind and solar power. Today’s investment trends are clear warning signs for future electricity security,” he said.

The drop in energy demand during the crisis has accelerated changes — and given insight into challenges — grids may see down the road. In the U.K., coal has all but fallen off the grid and natural gas is often dialed down as much as requirements for inertia will allow. Research by Imperial College London examining the impact of the high percentage of renewables on the grid uncovered a potential problem for developers: Projects will likely get more expensive to finance as power price forecasts fall unless changes are made to the market design.

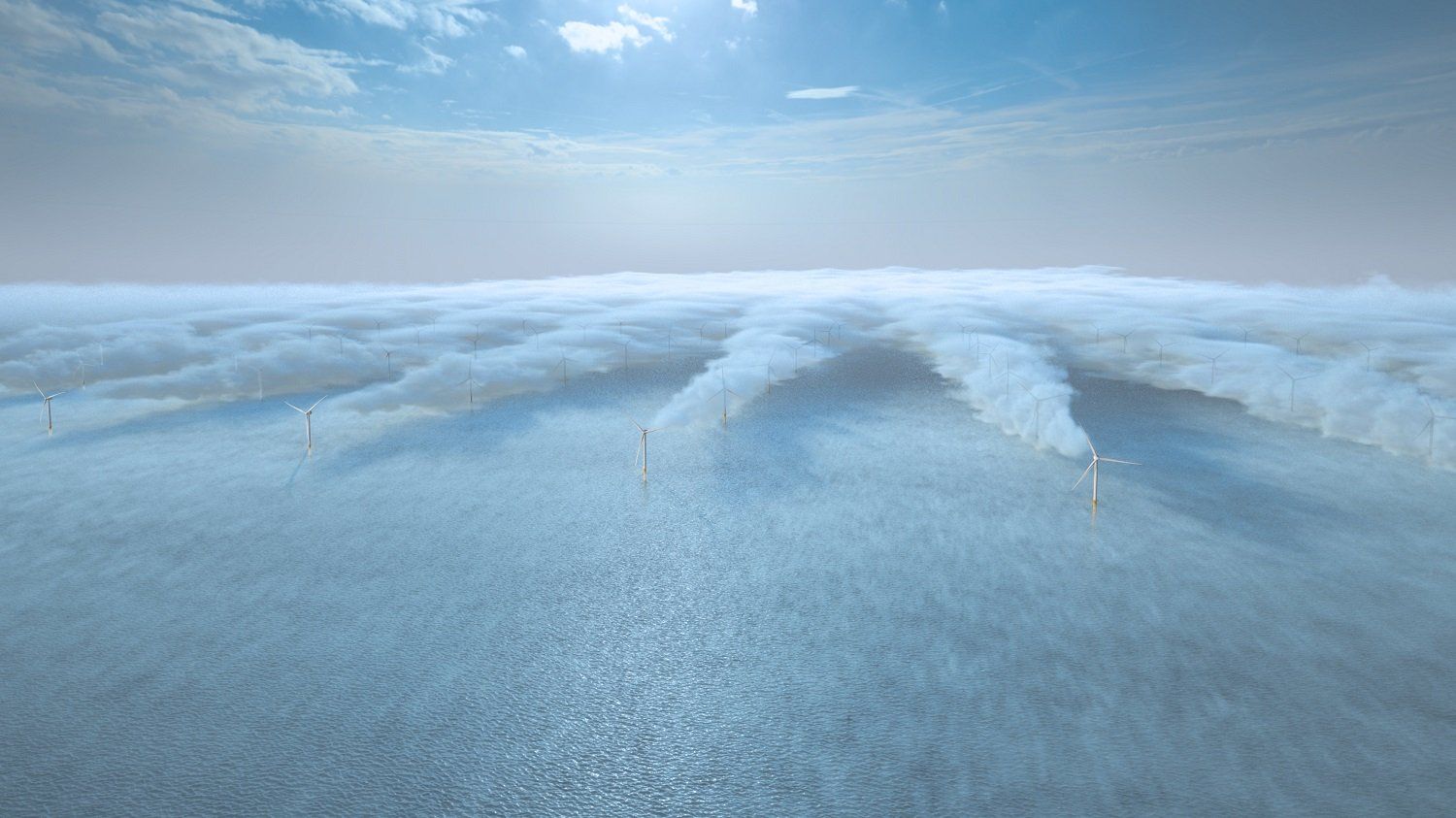

Offshore wind tenders have experienced some turbulence, but long-term political backing remains. (Credit: Siemens Gamesa)

Offshore wind tenders have experienced some turbulence, but long-term political backing remains. (Credit: Siemens Gamesa)

The coronavirus pandemic has impacted the power and renewables sector in ways both direct and indirect.

Some renewables tenders have been postponed or saw reduced interest during the pandemic, although much of this capacity will be made available to the market at a later date. German tenders are being conducted anonymously with winners’ not required to start work until the pandemic’s worst impacts are over. The European Commission has proposed holding its own tenders for the next two years in order to plug the gap left by member states’ own plans.

Financing remains a concern for many smaller developers, and permitting is more of a challenge than usual. Construction slowdowns and the squeeze on the supply chain have taken a toll, with major renewables manufacturers like Vestas and Siemens Gamesa dragged to losses in the first quarter of the year.

Investors hang their hopes on the drive for climate action

Still, throughout the pandemic, the renewables industry has maintained that its underlying fundamentals remain unchanged. Volatile oil prices have made renewables look like an attractive hedging strategy for some investors. The EU is expected this week to unveil its "Green Deal Recovery" package, putting clean energy investments at the heart of the bloc's economic recovery plans.

By and large, the investment community appears to share that underlying optimism about renewables.

“We believe that the long-term opportunities presented by the switch to renewable energy generation remain steadfast,” said Joost Bergsma, CEO of investment firm Glennmont Partners, in a statement responding to the IEA report. “The climate crisis has not gone away and will remain a long-term chronic problem, rather than a short-term acute one."

“In the medium to long term, we expect the deployment of renewable technologies to sustain its strong upward trajectory for growth on a global level,” Bergsma said.

EY, the global accountancy giant, expects a rebound in renewables investments in 2021.

“While new renewable installations may well be down as much as 10 percent in 2020 compared to 2019 levels, there is an expectation that the industry will be more resilient than others," said Ben Warren, EY global power and utilities corporate finance leader, in a press statement.