Now that Tesla is finally lifting the curtain on its energy storage ambitions, let’s take a look at the challenges that the electric-vehicle upstart will face as it seeks to make itself into a behind-the-meter and grid battery kingpin.

First, it’s important to remember that Tesla and its long-time partner in its energy storage ambitions, SolarCity, are hardly starting from scratch. The two are among the biggest applicants for California’s incentive program for behind-the-meter energy storage systems, and have spent the past few years quietly testing the ways that aggregated battery-solar systems can help meet utility and grid operator needs.

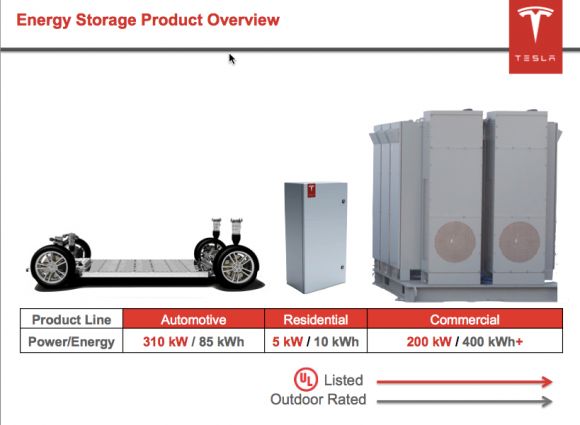

Tesla’s Giga factory, the gigantic plant it’s building in Nevada to assemble lithium-ion battery cells from partner Panasonic into finished products, certainly should give it plenty of supply. And part of that is already earmarked for homes and buildings -- of the 50 gigawatt-hours in annual production it’s aiming at by decade’s end, some 15 gigawatt-hours per year will be aimed at the stationary energy storage market.

But how to make money at it? This is where Tesla will be striving alongside a long list of contenders, including pretty much every big third-party solar company and their chosen battery partners on the residential front, startups like Stem and Green Charge Networks on the commercial building front, and contenders like AES Energy Storage, NEC/A123 and most of the world’s big battery manufacturers on the utility-scale storage front -- and that’s just mentioning the U.S. competition.

For simplicity’s sake, let’s go through the list of potential revenue-generating opportunities -- and potential pitfalls in realizing them -- in what’s likely Tesla’s biggest market for energy storage: California. In one sense, the state is almost a guaranteed market for behind-the-meter batteries due to state law and regulations that demand the state’s big three investor-owned utilities -- Pacific Gas & Electric, Southern California Edison, and San Diego Gas & Electric -- procure 1.3 gigawatts of energy storage capacity by the end of the decade.

At least half of that amount has to be owned by third parties, not utilities, and a significant portion has been set aside for customer-sited storage systems -- a natural fit for what Tesla is proposing. But California’s energy storage mandate also requires that storage projects be cost-effective, as well as serve the purpose of helping the state increase renewable energy, reduce greenhouse gas emissions, and create a more resilient and secure grid.

First, hitting the right price point

Driving down the cost of installed systems is just a starting point. According to a report from The Guardian newspaper, which cited an industry analyst relating a conversation he had with one of Tesla and SolarCity’s pilot homeowners, the companies have been pricing their pilot project home battery systems at about $13,000 for 10 to 15 kilowatt-hour systems. But that figure must be taken as what it is -- an imprecise, second-hand reference that will probably change over time.

UPDATE: Turns out that Tesla is pricing its Powerwall batteries much cheaper than anyone predicted -- $3,500 for a 10-kilowatt-hour unit, and $3,000 for a 7-kilowatt-hour unit. That's the price to the installer, which means a markup before it gets to the customer, and it doesn't include the inverter. Still, it certainly beats the price point pegged by most analysts as competitive -- under $1,000 per kilowatt-hour to get their foot in the door, and about $500 per kilowatt-hour to become widely cost-competitive.

Economies of scale from the Giga factory can be expected to drive down those costs, as could making use of partly depleted EV batteries that can’t deliver the power density to push cars down the road, but still have some energy-storage punch left in them. These trends are part of analyses by GTM Research and the Rocky Mountain Institute that predict a growing surge of battery-based storage.

And of course, the fact that Tesla and SolarCity will likely be financing their systems helps reduce the upfront price shock -- although it also places the burden of ensuring the system’s long-term economic value back on the companies’ shoulders. Indeed, if Tesla’s products are to be anything more than glorified backup generators, they’ll have to be carefully managed by the company to achieve that lifetime value -- a task that’s complicated by the uncertainties surrounding the future for distributed energy storage as a money-making resource.

The challenge of emergency backup power as a core business proposition

That leads us to a fundamental premise that belies much of the coverage we’ve seen of Tesla’s battery plans so far: the idea that they’re mainly emergency backup power units. Not only does that concept fail to do justice to the full range of capabilities that batteries can provide, but it also doesn’t make economic sense, compared to what homeowners can get from the backup-generator competition.

Even if one presumes Tesla’s system costs roughly $1,000 per kilowatt-hour, that’s still a lot more than what it costs to buy a state-of-the-art backup generator from a company like Generac, Cummins or Briggs & Stratton. For a price of about $5,000, homeowners can get enough backup power to keep their lights on and appliances running. Generator companies also offer financing, which obviates whatever advantage Tesla and SolarCity might claim from that tactic. And most of the new generators use natural gas instead of diesel, which means that, unless a power outage was caused by an earthquake or other natural disaster that also ruptured the home’s gas line, they can run indefinitely.

There are plenty of reasons that batteries are attractive where generators might not be, however -- particularly if they come as part of a prepackaged, financed rooftop solar deal. Rick Fioravanti, head of section for distributed energy resources at energy consultancy DNV GL, noted that a properly sized, solar-charged backup battery could “allow you to maintain critical loads indefinitely, absent gas infrastructure [and] electricity infrastructure.”

The key term here is "critical loads" -- batteries big enough to run an entire house won’t make economic sense, he said. But with the right-sized battery-solar combo, “if I can roll that into a 10- to 15-year lease, that cost becomes much less, compared to the benefits you get out of it in terms of resiliency.”

Why going off-grid doesn’t make mass-market sense

Even so, let’s presume that Tesla is looking for other ways for these systems to earn their keep -- which is where payback discussions start to get tied up in issues of utility programs, government rebates, regulatory structures and energy markets that make things quite complicated.

This is more so the case for residential customers, by the way. Commercial buildings in markets like California and New York that have big demand charges, or fees associated with how much electricity they use at any one time, can use stored battery power to reduce those peaks and mitigate those costs, which makes for a simpler economic proposition.

But on the home front, let’s start by looking at batteries to augment residential solar systems in states where customers already get paid retail rates for the power they generate under net metering rules. How does being able to store that power add value?

One thing’s for sure: it’s hard to deliver it by storing enough solar power to keep the home running overnight, or otherwise allowing customers to go completely off-grid. That would require the lithium-ion batteries to cycle far too often and too deeply to maintain their capabilities for long enough to pay off their costs. Buying a battery big enough to carry that off may be within the reach of the super-rich and highly environmentally motivated, perhaps. But it’s not a mass-market proposition -- although we should note that there may be exceptions, such as super-expensive electricity markets like Hawaii, or places like Germany that combine highly volatile energy prices with much lower average household energy use.

How energy arbitrage can conflict with solar values

So if charging by day and discharging at night doesn’t work, what about doing the opposite? Kimbal Musk, Tesla CEO Elon Musk’s brother and a company board member, told CNN Money that Tesla’s new battery could save homeowners 25 percent on electricity bills, simply by charging with low-price nighttime power, then discharging it during peak-price afternoons. That calculation is based on California residential electricity price differences that range from 8 cents per kilowatt-hour at night to as high as 35 cents per kilowatt-hour in the afternoon.

There are two problems with this premise, however. First, it doesn’t actually make use of the solar power being generated at the home -- and batteries that don’t do that are going to have trouble gaining access to incentives and programs aimed at encouraging batteries to boost green energy.

Take the California Self-Generation Incentive Program (SGIP), which offers lucrative rebates for energy storage systems up to 30 kilowatts in size. Tesla has submitted more than 100 applications to the SGIP, ranging from 5 to 15-kilowatt units in its 300-home pilot deployments, to 30-kilowatt systems backing up commercial businesses including Wal-Mart. Bloomberg reports that Tesla is set to collect as much as $65 million in SGIP incentives for 2014, nearly half of the program’s entire funding for last year.

But the CPUC is in the process of revising the SGIP to ensure that it only backs projects that help reduce the state’s greenhouse gas emissions profile -- and whether or not batteries fit into that category is a very complicated question to answer. Does charging from the grid at night, then discharging during the day, make the state less CO2-intensive? Depends on whether that nighttime power was mostly from in-state wind farms or out-of-state coal plants -- and whether the grid power consumption it’s deferring is being generated mostly by rooftop solar or by gas-fired peaker plants.

Adding batteries to solar systems opens up another related can of worms when they seek to earn green credit for their power output. Last year, the California Public Utilities Commission told the state’s utilities to stop refusing to connect battery-backed solar systems, after more than a year of utilities claiming that those systems might be charging up with grid power, then discharging that power for the purposes of spinning back their power bills under the state’s net metering rules.

The CPUC found that this was a highly unlikely and unprofitable way for battery-plus-solar systems to operate. But its decision also put constraints on net-metered systems, specifically by limiting how big the batteries could be in proportion to the solar system they’re supporting. That means that these systems could lack extra capacity to perform future grid-facing tasks like long-duration load shifting -- if, that is, they choose to be combined with a solar system for net metering purposes and tax credits.

Changing rate structures make payoffs hard to predict

The second problem with the energy arbitrage business case for batteries is that it relies on price differentials that can go away. California’s super-high afternoon price quoted by Kimbal Musk, for example, is currently charged only to residential customers who are using enough electricity through the course of a month to be pushed into the highest possible tiered rates for customers of California’s big three investor-owned utilities. In other words, it’s the price being paid only at the end of a very high-consuming month -- and average afternoon prices are likely to end up being quite a bit lower.

Beyond that, under a new CPUC proposed ruling, those four-tiered monthly rates will soon be replaced by simpler two-tiered rate structures, with far less price difference between the bottom and top rates. That’s actually a good thing, in terms of aligning prices with energy costs, because the cost of electricity doesn't get more expensive at the end of a 30-day period. Instead, it cycles over a 24-hour span, from nighttime troughs to afternoon or evening peaks, depending on the season.

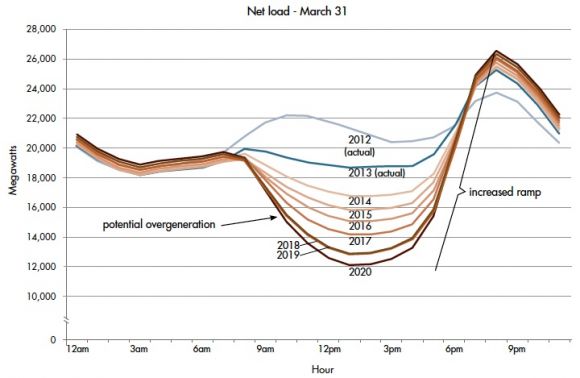

That’s why the CPUC is also pushing the state’s big utilities to create time-of-use pricing that will charge more for power when it’s in highest demand, and thus more expensive to generate with peak generation resources. But to be most effective, TOU rates shouldn’t just peak in the afternoon to get people to use less energy on hot summer days, as they’ve traditionally done. They might have to shift to get people to stop using power when they get home from work, to help deal with the big ramp-up in evening demand that will come as a byproduct of the state’s success in growing its share of distributed solar -- or, in other words, to mitigate the effects of the dreaded “duck curve.”

New distributed energy regimes will bring new energy storage opportunities

That brings us to the real long-term value of behind-the-meter batteries -- to help solve the challenges of a grid seeking to incorporate an unprecedented amount of distributed, intermittent and clean energy into its mix. On that front, companies like Tesla and SolarCity have been working alongside utilities, state regulators and research organizations to figure out what combination of technology and policy can lead to the best outcomes.

Take California’s duck curve as a template for how those values may be realized. One simple idea is to charge batteries with midday solar power, which would lessen the big drop in consumption seen in the “belly” of the duck curve, and then discharge them in the late afternoon and early evening, to flatten out the “neck” of the curve.

California’s energy regulators and grid operator CAISO call this kind of service “flexible capacity,” and they are in the midst of revamping the state’s resource adequacy mechanisms to reward energy resources that can reliably provide relief to these steep ramps in demand. We’ve already seen Southern California Edison contract with parties including behind-the-meter battery startup Stem and solar provider SunPower for this kind of distributed, aggregated grid resource, although those contracts were for long-term capacity, not for bidding into day-to-day markets.

Aggregated, networked and controlled solar-battery fleets could conceivably perform this task -- and SolarCity has built this functionality into its solar systems from the get-go. Its “Demand Logic” software platform, launched in late 2013, has the ability to “automate the discharge of stored energy to optimize utility charge savings for customers,” whether that’s demand-charge management for commercial customers or optimizing backup power -- or some as-yet-undefined business case -- for residential systems.

These business cases could be triggered by time-of-use rates designed for solar-plus-storage-equipped customers to react to price signals. Alternatively, programs could be created to allow third-party aggregators to provide this capability to grid operators in a way not directly tied to the rates that their customers pay.

Demand response -- curtailing power consumption in response to utility commands -- is another use case that can earn money above and beyond whatever savings can be gained from reducing consumption. Fast-responding assets could also play into markets or programs for ancillary services, such as spinning reserve or frequency regulation. California is in the midst of revamping its demand response regulations to allow distributed resources to play a role in these programs, although real-world markets are still a few years out -- and will require significant bundling of resources to meet the minimum load requirements they’re likely to implement.

Beyond these traditional cases, however, lies the potential value of distributed solar-storage systems as a grid asset. California, New York, Hawaii and a handful of other states are reworking their grid regulations to try to assign values to customer-owned, third-party-operated distributed energy resources that can either mitigate the extra cost and operational challenges they bring to utilities, or perform utility tasks better than traditional grid equipment and investments.

All of these alternative structures for capturing the value of battery-backed solar overlap one another in some cases, and present potential conflicts down the road in others. Tesla and SolarCity have been active participants in regulatory proceedings in the states on the leading edge of making these changes. No doubt Tesla’s big marketing and media splash is being accompanied by behind-the-scenes work to guide the development of regulations to open up new ways for its batteries to succeed on economic terms.