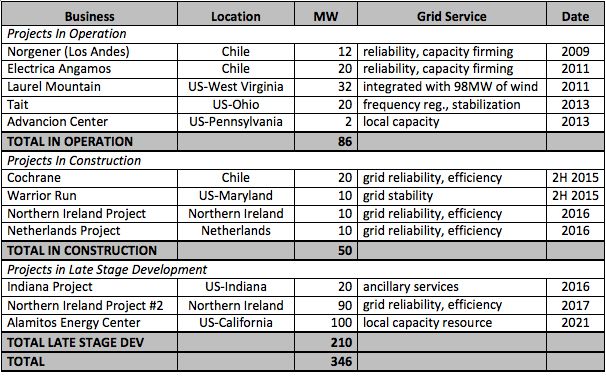

AES subsidiary AES Energy Storage manages the largest fleet of grid batteries in commercial service, with 86 megawatts of storage capacity in operation, 50 megawatts in construction, and 210 megawatts in late-stage development.

Looking at the portfolio of the largest utility storage provider reveals the multiple personalities of energy storage.

Solar is simple -- it neatly divides into residential, commercial and utility markets, has known performance, and decades of field data. (And still, despite tens of gigawatts deployed, solar's cost and value remain hotly contested.)

Storage, on the other hand, is complicated. It can perform a variety of different grid services (some with markets, some not) and it addresses geographically specific grid problems. Behind the meter, storage can lower demand charges and mesh with demand response as an aggregated fleet (see Stem's award from SCE).

Or storage can provide utility-size grid support, firming capacity and making fossil fuel generation more efficient and reliable. Storage might support the grid in the face of decommissioned nuclear plants and fossil fuel plants shuttered by cooling water rules and EPA requirements.

Note that none of these use cases are directly linked to renewables.

John Zahurancik, president of AES Energy Storage, told GTM in a previous interview, "The storage we're delivering can do a lot more than balancing intermittency."

AES also just announced its move into the energy storage markets of Ireland and the Netherlands as well as its first utility-scale project within the territory of the Midcontinent Independent System Operator (MISO) in the U.S.

Here's a list of AES energy storage projects in operation, construction, and late-stage development. The duration for these projects range from 30 minutes to four hours with "a bunch at one hour," according to Zahurancik.

Ravi Manghani, senior analyst and author of GTM Research's energy storage reports, notes that the Indiana project "would be the first frequency regulation project in the Midwest ISO," which could be a possible indication that "MISO might be thawing as a frequency regulation market." AES notes that its new Chile project "integrates energy storage with a 532-megawatt thermal power plant to provide reliability services to Chile’s northern grid."

A fundamental need for reliable, fast response

Although GTM Research sees strong growth for utility-scale energy storage this year, it's still early days in the industry.

Manghani notes that the "second and third entrant, respectively, in terms of megawatts of deployments would be Younicos (most of the U.S. deployments were completed by Xtreme Power before bankruptcy) and Beacon Power. Neither of these players have significant late-stage pipeline. Greensmith, not a traditional developer, has been a partner in many projects. In terms of projects in construction or late-stage development, there are a few other names -- Invenergy and RES Americas that have about 60 megawatts to 80 megawatts, respectively."

Although many industry supporters see energy storage as the savior of renewables, AES' Zahurancik suggests, "We come from a different place -- we come from more than 30 years as a service provider to utilities and power systems. We have every type of power generation (except for nuclear), and in some cases, we are the utility."

"We are looking to perform the same services we did before, but with less emissions. That's the place where we come from," said Zahurancik, adding, "We have a fundamental need for reliable, fast response that complements renewable energy." He suggested that renewable energy "doesn't come with reliability, controllability, and dispatchability."

Manghani notes, "Most of AES' projects that are under construction or development are located in markets where the parent company is already strong and has existing energy assets. This outlines AES' strategy and provides a blueprint to IPPs, utilities and developers that have been eyeing storage market."

According to Zahurancik, when SCE, the ISO or a PUC goes about the process of grid capacity planning, ensuring that the grid will be able to weather its "peakier moments" while accounting for "retiring plants and grid mix" and looking ahead four to seven years, "the verdict is that energy storage is more cost-effective."

AES has not disclosed the cost of its battery systems.