We recently highlighted energy decentralization as one of the key drivers for the grid edge market. In addition to the growth of PV, electric vehicles, and storage, we see microgrids as a future catalyst of the market. The following analysis on the state of microgrids is an excerpt from GTM Research's free 70-page report, Grid Edge: Utility Modernization in the Age of Distributed Generation.

Framing the Topic

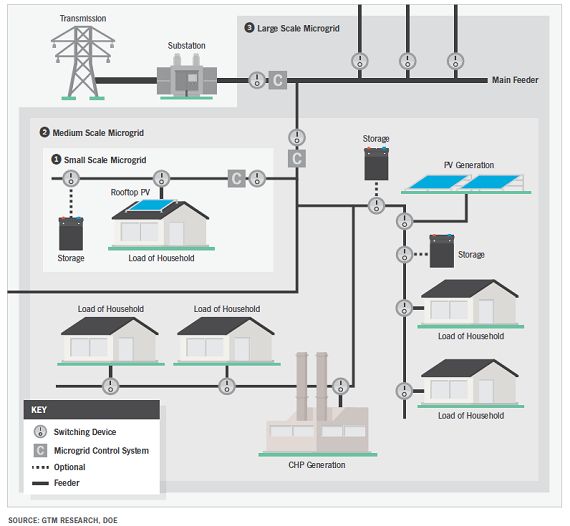

Microgrids are a mirror of the power grid’s macro-structure at micro-scale, typically ranging from between several kilowatts (residential) up to megawatt scale in size. They enlarge features such as distributed generation while compressing others, such as transmission and wide-area balancing. The defining characteristic of a microgrid is the co-location of power generation and load, which are interconnected in a clearly delimited entity that can operate in grid-connected or island mode. The microgrid may or may not include parts of the utility distribution network, but it always presents itself to the grid as controllable load or power source. The following structural diagram illustrates how GTM Research envisions a microgrid.

The precise classification of different types of microgrids remains a challenge, especially when it comes to factors such as islanding capabilities and controls, the number of grid interconnection points, and the ownership of generation and distribution assets. The World Bank’s July 2013 energy strategy paper, which omits the term “microgrid” throughout the entirety of its 39-page discussion of distributed energy and “mini-grids,” is one example of this conceptual ambiguity. But there are promising developments, as well. Further development of IEEE’s standard 1547, the major guideline for distributed resource integration, focuses specifically on microgrid issues such as unintentional islanding and will help streamline implementation strategies.

Microgrid Deployment Status and Growth Projections

2013 has seen seven announcements of new microgrid projects or add-ons in the U.S., more than ever before. This will add to an estimated 1,500 MW of microgrid capacity that is already operating. In India and other emerging economies, village-level microgrids are becoming a defining pillar of rural electrification projects. However, venture capitalists have not yet embraced the microgrid, most likely because it remains uncertain whether the technology will ever evolve from niche applications and public institutions to the larger market of apartment blocks, hospitals, homes or data centers. Further, there is a possibility that bulk power grid modernization efforts will make islanding capabilities appear unnecessarily expensive. The answer will likely be decided in a race between macro and micro grid intelligence. If more investments are made in grid hardening and cheaper DG systems, a microgrid might not be economical other than for critical loads. The advantages and disadvantages of different autonomy scenarios are highlighted in the following diagram.

Trends, Thoughts, Vendors, Ideas

Slowly but steadily, the microgrid market is progressing from the demonstration phase to the deployment phase, at least in public institutions. Among the most important milestones to date are the 50% reduction in peak load consumption achieved by the Illinois Institute of Technology microgrid project, the 25 military microgrid installations across the U.S., and the Food and Drug Administration’s cogeneration-based microgrid in Maryland being able to maintain power during Hurricane Sandy.

The U.S. military currently takes an important role as an early adopter and a provider of conceptual tools. Energy Surety Microgrids (ESM), a design methodology developed in cooperation with Sandia National Laboratories, helps provide a blueprint for microgrids that is adapted to specific local system needs. Civilian applications are underway, as well: ESM is currently being used to help develop a microgrid for New Jersey’s Northeast corridor transit system.

From a vendor’s perspective, microgrids hold the most obvious promise for energy storage companies. The term “microgrid” is not always linked with intermittent energy sources; in fact, many projects in operation use combined heat and power. However, they do almost always need some form of storage mechanism for self-maintenance or time-shifting. The use of Primus’ flow batteries at the Marine Corps Air Station in Miramar, California is one recent example of the storage market potential of microgrids. Likewise, microgrids could be helpful for analytics firms and for large incumbents like Lockheed Martin and Boeing that leverage competence from military and aircraft technology. After all, every plane already has its own small microgrid; the technology needs to make a safe landing on civilian grounds, so to speak.

Risk and Opportunity

Major opportunity: Combinations of standardization and customization to local needs, allowing the optimization of local consumption patterns based on a specific customer’s objective.

Major risk: Microgrids could remain undefined as a legal entity. Uncertainties around value streams will impede private capital investment because addressing a different regulatory environment for every installation makes project development a complicated and costly process.

***

Network with leaders from GE, SDG&E, IBM, AT&T, Intel, PG&E, and more. Learn more about our new Grid Edge Executive Council.