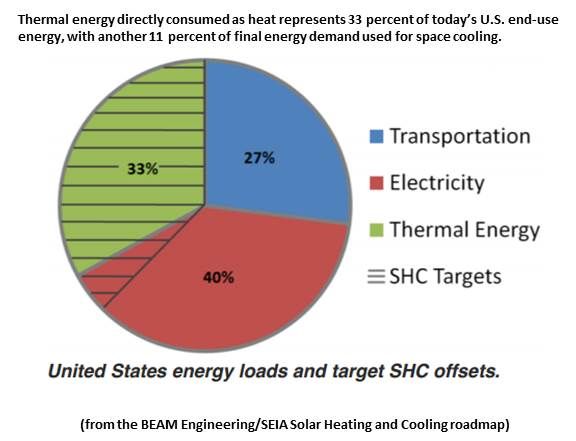

“Why even consider using electrons to heat water when there is so much more demand for them in traditional electricity generation and in electric transport?” asked Heliodyne CEO Ole Pilgaard, Chair of the U.S. Solar Heating & Cooling Alliance’s Roadmap Working Group.

“Solar thermal has lived in the shadow of more popular technologies like wind and PV,” Pilgaard said in describing Solar Heating & Cooling: Energy for a Secure Future, a roadmap for the sector prepared by BEAM Engineering for the Solar Energy Industries Association (SEIA). It describes how solar could capture much of the U.S. opportunity in domestic water heating, space heating, swimming pool heating, air conditioning, process heating, steam generation, and air heating.

Targets and policies that support solar heating and cooling (SHC) could drive the installation of 300 gigawatts-thermal of capacity by 2050. That, BEAM Engineering concluded, would require 100 million SHC panels, or 10 square feet of solar collector area per person. It would meet nearly 8 percent of the United States' 2050 heating and cooling needs, generate over 50,000 jobs, save $61 billion in annual energy costs, avoid at least $19.1 billion in expected electric and natural gas transmission and distribution upgrades, and avoid 226 million tons of CO2 emissions per year.

The business-as-usual scenario predicts 75 gigawatts-thermal in 2050.

The Carter administration enacted a 40 percent federal investment tax credit for SHC in the 1970s. But the Reagan administration revoked the tax credit in 1985. “Solar thermal went from quite a large industry to almost nothing, almost overnight,” Pilgaard said.

SHC equipment is mostly common, recyclable, nontoxic building materials like copper, aluminum, steel, and polymers. A residential solar water heating system costs $6,000 to $10,000. A commercial or industrial system can run from $20,000 to $1,000,000.

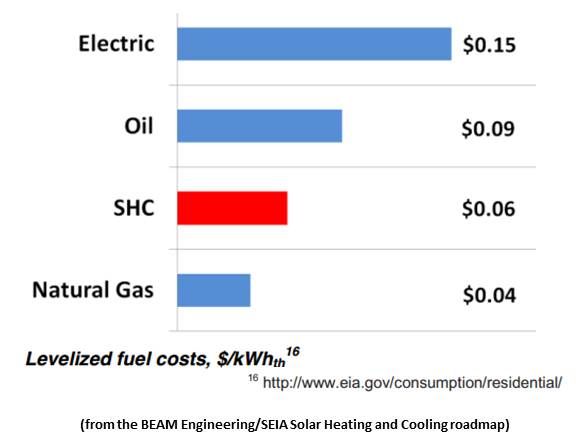

“The payback depends on the location, the type of technology, and the local incentives, but it is generally three to seven years,” Pilgaard said. “The national average cost of electricity is $0.12 per kilowatt-hour to $0.14 per kilowatt-hour. PV with incentives is at grid parity at around $0.13 per kilowatt-hour to $0.14 per kilowatt-hour. Solar thermal with incentives is around $0.06 per kilowatt-hour and cost-effective in places that use oil for heating. But it displaces natural gas in 50 percent of the U.S. water heating market, and natural gas is $0.04 per kilowatt-hour.”

There are some 30,000 SHC systems installed in the U.S. every year. These systems produce an annual estimated $435 million in revenue and provide 5,000-plus jobs, along with the additional benefit of new generation that emits 0 pounds of CO2 per megawatt-thermal in place of natural gas generation, which emits 400 pounds of CO2 per megawatt-thermal, resulting in even more carbon-intensive generation.

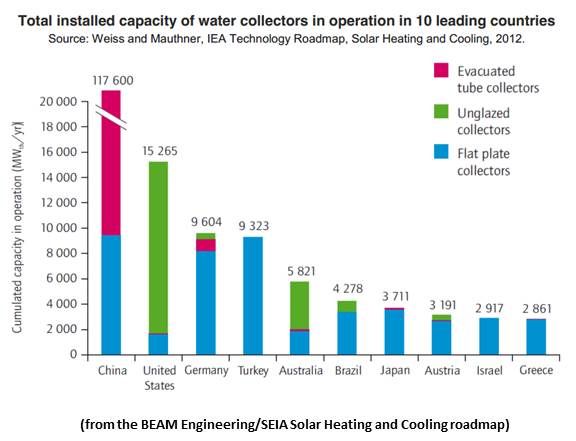

The 9 gigawatts-thermal of installed SHC capacity in the U.S. makes this country the 36th ranked per capita in world. China, with 152.2 gigawatts-thermal, is the leader.

Barriers to U.S. growth, the roadmap says, include lack of consumer awareness, high upfront costs, unclear permitting and building code guidelines, and underdeveloped distribution channels.

The release of the roadmap does not accompany any specific policy campaign, but “the biggest barrier is still the first cost issue and access to capital,” explained Skyline Innovations Market Development head and Alliance Chair Mike Healy. “We are trying to create policies that will support third-party ownership (TPO) financing and make it attractive to the tax equity market.”

The roadmap, he noted, also identifies the need for stable, long-term policies that complement existing renewables mandates, provide financial incentives, address soft costs, and drive research, demonstration projects, and workforce development.

“TPO has driven PV growth in residential, but it is best for SHC in commercial systems,” Pilgaard said. “A $2,000 legal agreement is too costly for a $6,000 SHC residential system, but not for a $30,000 residential PV system. TPO has been successful in the SHC commercial sector because systems cost anywhere from $20,000 to $1,000,000, so the $5,000 to $10,000 legal framework is affordable. TPO financing might work if multiple small residential systems could be bundled into one legal framework.”

Solar cooling and hot water storage technologies are not as advanced, efficient, or cost-effective as electricity-powered air conditioning.

“Solar hot water technology is viable, feasible and accessible. There is a great industry behind it, with plenty of products and efficient technology,” Pilgaard said. Research is still needed for solar cooling and storage.

“Solar heating and space heating make up 30 percent of U.S. energy. It is the low-hanging fruit, the readily available opportunity. And 10 percent of cooling can now be transferred to solar,” Pilgaard said. “Solar cooling and storage can become cost-competitive just as solar PV and wind have. But we can only do that if there is a market driving technology development, and we need policy help to develop that market.”