A new device from Sunnovations that measures and displays the value of solar water heating (SWH) systems could finally help installers crack the residential market.

The value proposition in SWH has been measured and validated in multi-resident and commercial buildings, because the $1,100+ cost of the device needed to do the measuring is only perhaps 4 percent of a large system cost, according to a Massachusetts Clean Energy Center study.

Because usage and production can be monitored, companies like Skyline Innovations and FLS Solar can offer third-party ownership financing of SWH systems through power purchase agreements (PPAs) that allow commercial consumers relief from upfront costs and ownership responsibilities.

But that same device increases the price of an $8,000 residential SWH system to over $9,000, not counting the cost of installing, maintaining and reading it, Sunnovations CEO Matt Carlson said. That is why monitoring is included in less than 5 percent of U.S. systems.

The Massachusetts study did note, though, that where monitoring of SWH systems is accurately done, it shows that they produce 80 percent to 110 percent of what they promise. This suggests the value proposition for residential SWH systems is clear.

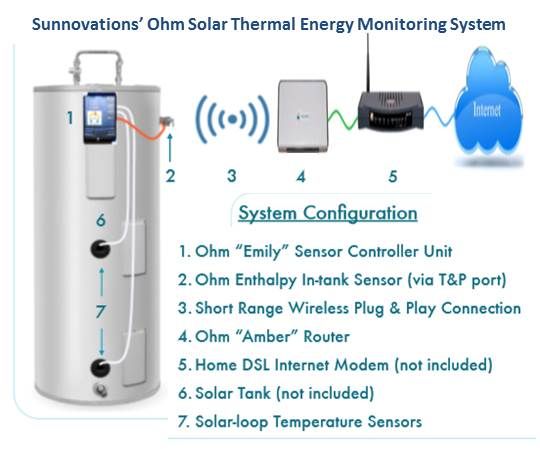

“The price tag on Sunnovations’ new and patent-pending Ohm Solar Thermal Energy Monitoring System is $499,” Carlson said. “It is an affordable way to provide visibility into the system’s function.”

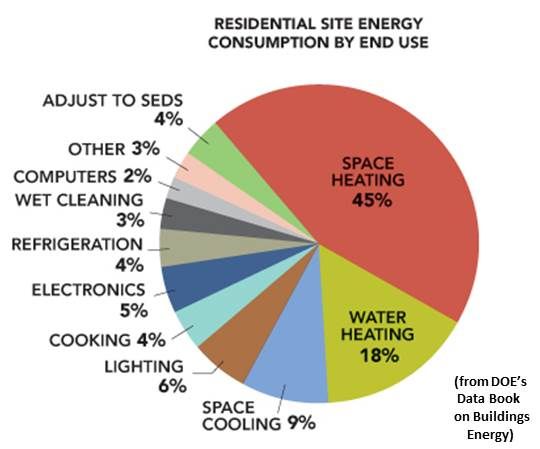

Because heating water accounts, on average, for 18 percent of a single-family home’s energy use, Carlson believes that when homeowners are able to see on the web-based dashboard exactly how much they are saving with their SWH systems, it will be a game-changer.

“Our category has been crying out for something like this,” Carlson said, “and the lack of it is one of the reasons solar thermal has lagged behind PV.”

Other marketplace disadvantages that Sunnovations and competitors like Alternative Energy Technologies, SunEarth, SHUCO and Solar Hot face is that, unlike solar PV, there is no grid to which to send excess production, and there are few incentive programs that ease the upfront cost burden.

Though SWH technology is much older than PV, with patents as far back as the 1890s, the U.S. industry is growing much more slowly. And while the U.S. is among the world leaders in most renewable technologies, its SWH industry had only 2.3 gigawatts-thermal in 2010, while China had 118 gigawatts-thermal and the world had built about 185 gigawatts-thermal. The U.S. market is five times bigger than it was in 2005 and growing at 6 percent annually, according to recent SEPA statistics.

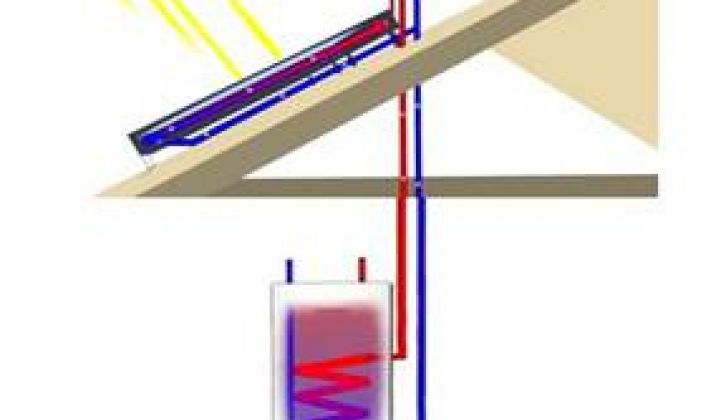

SWH is, Carlson said, “a fairly simple technology. A heat transfer fluid, glycol, runs through panels on the roof. The heated fluid runs into the tank and, voila, hot water.” The water tank functions exactly like a regular water heating tank, except that it has a solar pre-heating heat exchange element that replaces the heating that the gas or electricity would do, he explained, as well as a backup heating element, “because it is not sunny all the time.”

Carlson said the Ohm system will be more easily installed and more reliable than the 338 flow meter-based monitoring units tested and then removed by Orlando Municipal Utility because of a 31 percent fail rate. More than half of that fail rate, Carlson noted, was due to installer error.

Although Sunnovations’ Ohm system has had limited field trials, preliminary independent testing by TUV Rheinland has shown a 98 percent system accuracy, according to Carlson.

In another contrast to the flow meter systems used in Orlando and in the Massachusetts study that typically took two to three hours to install, Carlson said, the Ohm system installation, even in retrofits, takes less than 30 minutes. “It is a simple system and 100 percent plug-and-play.”

Wires run into the hot water tank connect to the Ohm sensor mounted in a valve at the tank wall. Typical computer cables connect the sensor to a modem’s USB port. The modem send’s data wirelessly for display on the web dashboard.

On the dashboard, a homeowner can see the hot water in the system heated by the solar system and from whatever auxiliary heating source (gas, electricity, oil, etc.) on which the home relies. It also shows the total hot water use, how much solar heated water is available, and how the tank is performing.

This could be especially critical in driving more investment by utilities and institutions in solar hot water systems, Carlson pointed out. “Utilities want to know what they are getting for their investment. Giving them this data could lead to mass adoption of the technology.”

There are approximately 100 million residential water heating systems in the U.S., according to Carlson, and just over half have natural gas water heating systems with which, at today’s very low natural gas prices, SWH cannot compete.

The rest use electricity, fuel oil or propane. That is an addressable market of nearly 50 million homes. “There are probably six things that need to be solved to make SWH a mass market technology in the U.S.," Carlson said. "This isn’t a panacea, but it is an important piece of the puzzle."