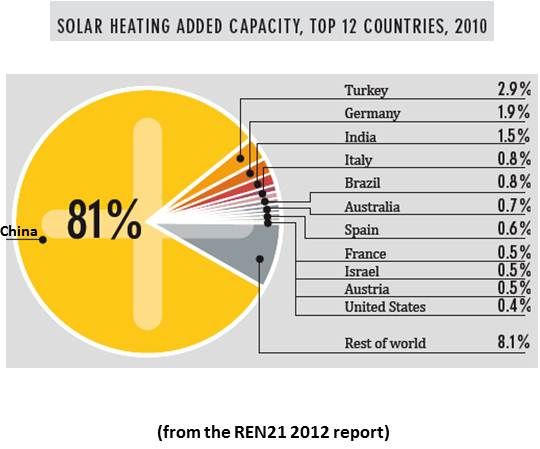

There are about 200 million solar water heating (SWH) systems in the world. There are about one million systems in the U.S. Year-on-year numbers, even during the recession, showed SWH to be an expanding domestic industry.

There are approximately 100 million residential water heating systems in the U.S., according to Sunnovations CEO Matt Carlson, and just under half use electricity, fuel oil or propane. “I’m looking at a market of 50-million-plus homes that don’t use natural gas to heat their water,” he said. “That’s a pretty sizeable market, and that’s where the opportunity is.”

In the U.S., natural gas is cheap and the infrastructure to deliver it is in place. Though many market watchers expect increased competition from liquid natural gas (LNG) exporters to soon drive the domestic price up, Carlson and other SWH proponents admit they cannot compete with natural gas at its present low rates.

Eight million water heaters are sold yearly in the U.S., Carlson said, at a cost of $1,000 to $1,500. The yearly water heating bill of a typical family of four with an electric system, he said, is $400 to $500, the second biggest energy cost to homeowners. It is more than “all of the load from the lighting and electronics of a home,” he added, and a solar system “is going to substitute for a good three-quarters of that, depending on where you are.”

The economics of SWH also depends on how much hot water is used. Commercial systems for businesses like agricultural and industrial operations, laundromats, and hotels are more economically viable. Companies like Skyline Innovations and FLS Solar offer third-party financing of SWH systems through power purchase agreements (PPAs) that allow commercial consumers access to solar water heating without bearing upfront costs or owner responsibilities.

Provided as part of an overall building retrofit and energy management project, third-party financing allows business customers to pay for hot water on the basis of what they would have spent with the previous system. Margins allow the installer to own, maintain, and profit on the SWH system over the course of a twelve-year contract.

“On the residential side, there are not many models out there yet, largely because you can't easily measure or net-meter thermal energy,” Carlson said. “The availability of third-party finance has made it easier to sell PV and in some respects has crowded out SHW.” Sunnovations and competitors like Alternative Energy Technologies, SunEarth, SHUCO and Solar Hot do not have federal incentives like those that boost residential solar PV.

A residential SWH system usually has a five-year to seven-year payback, depending on local conditions, fuel costs and incentives, but “we need the U.S. homeowner to be aware of this as an option,” Carlson explained, because “homeowners don’t always buy things for strictly economic reasons. What’s the payback on the water heater they have in their home right now? What’s the payback on the granite countertop they bought?”

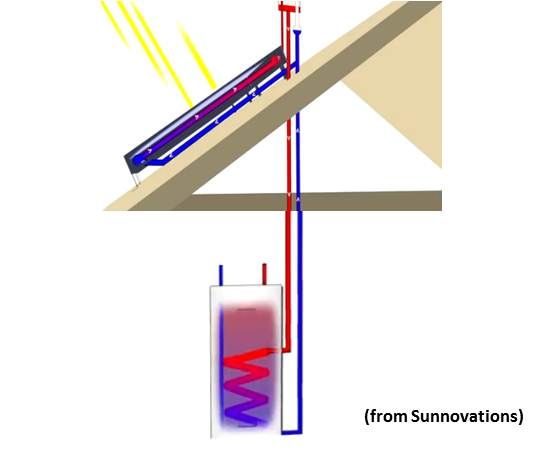

A SWH system has a water heating tank that functions, Carlson explained, “exactly like a regular water heating tank except that it has a solar pre-heating heat exchange element in it that takes away the heating that the gas or electricity would do.” It also has “a backup heating element, because it is not sunny all the time.” SWH is, he said, “a fairly simple technology. A heat transfer fluid, glycol, runs through panels on the roof. The heated fluid runs into the tank and, voila, hot water.”

Sunnovations is, Carlson said, “a startup with some resources that is trying to push the market.” It has raised $1.25 million in external capital. Its mission is to drive the costs of residential SWH down. “Solar thermal for water heating is too expensive right now,” he said. “Our technology,” he added, is “lower-cost because we are removing components that are expensive and time consuming to install.”

Engineer and entrepreneur Arnoud Van Houten, a veteran of the IT sector, invented the Sunnovations technology and founded the company about four years ago because “what was on the market wasn’t fulfilling the potential of SWH in the U.S.”

Carlson acknowledged Sunnovations only has "several dozen systems in the field” but said the company does have “a distribution network up and down the East Coast.” Installers are reporting, he said, that “our system price on an installed basis is at least a thousand dollars less than comparable systems [and] that the install time is almost always a single day.” One installer, he added, “reported they were saving ten man-hours per job.”

Sunnovations just announced three technical advances that Carlson said are industry firsts: (1) The only “self-pumped” systems given the “Good Housekeeping Seal of Approval” by SWH industry certifier Solar Rating and Certification Corporation (SRCC); (2) the only closed-loop glycol systems certified by the SRCC to use PEX for the solar loop piping; and (3) the only systems with passive overheat protection.

“Sandia National Labs did a ten-year failure rate [study] of active pump systems,” Carlson explained, “and found a 50 percent failure rate, and then identified the most common failure points. Our system simply doesn’t have two-thirds of the most common failure points, the components that are most prone to failure.”

Sunnovations is keenly aware that “costs are too high now,” Carlson said, “but we are working toward a subsidy-independent technology.”