In pursuit of its mission to bring down the cost of solar, the Department of Energy (DOE) Sunshot Business Incubator Program has awarded Clean Power Finance (CPF) two grants. With one, CPF will create a marketplace for solar system operations and maintenance (O&M) services. The other will help fund a CPF online system to find and match prospective solar buyers with installers that best meet their needs.

“CPF connects installers and financiers,” said Senior Director of Government Programs Management James Tong. Institutional investors like Google Ventures and Morgan Stanley and venture investors like Kleiner Perkins and Claremont Creek have made a half-billion dollars available for CPF to place with its 1,550-customer network of qualified solar builders because, CPF CEO Nat Kreamer has pointed out, “rooftop solar is a low-risk, high-reward investment in what is essentially a long-term asset.”

As much as 45 percent of an investor’s capital outlay, Kreamer said, can come back as a tax benefit in the loan’s first year. And the overall return on investment is “anywhere from the high single digits to the mid-teens.”

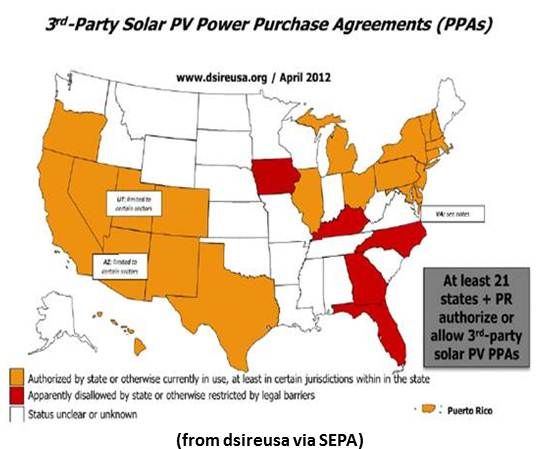

The fastest growing segment of solar system installation is financed by third-party providers such as CPF’s investors and companies like SolarCity and SunRun. The DOE-backed programs, Tong said, “will leverage our platform and network to create other marketplaces for third-party financiers.”

The programs will reduce risk and provide services that are not now efficiently met. “Software is a big component of both projects,” Tong said, “but the DOE is paying for a suite of services that includes legal contracts, business development, finding the right people and monitoring the marketplace.”

CPF has budgeted $1 million, $500,000 of which will come from Sunshot, to build an online marketplace for photovoltaic (PV) system operations and maintenance (O&M) services from which third-party financiers who own residential solar systems will able to choose providers.

“Right now, there is no institution to efficiently find O&M vendors,” Tong explained. Financiers have little choice but to rely on their original installer and “exclusivity can be a very large risk.” Funders have no way of knowing if the cost of the O&M services is competitive, if the quality of work is adequate, or if the service will be done promptly. And, Tong pointed out, the original installer could be out of business by the time O&M services are needed.

“A recent report from S&P cited three general risks to the residential solar finance market,” Tong said. “One was the lack of large-scale O&M services.”

Tong likened the situation to buying a car but having only the dealership for service. “You get no guarantee on a competitive price or that the dealer will stay open for as long as you own the car. We’re trying to create a marketplace where you can go to your local mechanic or Midas or the dealership to get different pieces and choose your price and service quality.”

CPF will create an “agnostic” O&M marketplace that includes its existing pool of installers and a full range of qualified competitors, from electricians to roofers to panel washers.

“We’ve enlisted SolarCity to help us because they have enormous installation capacity,” Tong said. “With Clean Power Finance’s expansive vendor network, this O&M marketplace will create the large-scale services the S&P report mentioned,” Tong explained, and “remove a key barrier to massive consumer adoption.”

CPF has also budgeted $2.2 million -- $1 million of which will come from Sunshot -- to create a solar customer acquisition brokerage.

“Customer acquisition is one of the biggest costs in solar,” Tong said. “The brokerage will enable solar companies to focus on their core competencies and significantly lower their customer acquisition costs.”

Installers depend on leads to customers, but the supply is inconsistent. A brokerage would allow installers to obtain and exchange customers and leads and avoid inefficiencies. “Having this brokerage,” Tong said, allows “pooling of what’s out there and choosing installations, prices and locations that work best for the installer.”

“Pricing in these exchanges will adjust to prevailing market conditions,” Tong said. CPF hopes to eliminate the term agreements now common in the solar industry “which create more certainty by committing the parties to a contractual term but which can significantly disadvantage one side if market conditions like falling panel prices favor the other side.”

The brokerage will also, Tong said, allow installers to take advantage of more successful companies’ resources. “If their crews aren’t working during slower months or they are carrying an excessive amount of inventory, they could use this brokerage to supplement their deal flow by connecting with companies that acquire customers more cost-effectively than they can.”

The goal, Tong explained, is to help installers get marketing and sales help if they need it. “People who are good at marketing and sales are often limited by installation capacity and geographical coverage; installers are often limited by their sales and marketing capacity.” The brokerage, he said, will help them connect.

“We see ourselves as facilitators to the entire industry,” Tong explained. Increased security from the O&M marketplace and increased business activity from the customer acquisition brokerage, CPF believes, could drive the price of installed solar down as much as 50 percent. “Both projects will succeed if this happens,” Tong said, and “it’s almost a virtuous loop. If this succeeds, prices go down, and if prices go down, these projects succeed.”