Smart thermostats, connected lighting and electric water heaters offer customers greater awareness and control of their energy consumption — and they're becoming a more important part of the broader connected-home landscape.

By 2023, 28 percent of U.S. households will deploy smart thermostats; 36 percent will have at least one voice assistant device and use the device as a smart home control platform. GTM Research estimates home energy management technologies will result in $24 billion in hardware sales to market players from 2016 to 2023, according to a new report, Energy Management in the Connected Home.

Similar to the transformation of connected utility distribution equipment, connected home technologies have two-way communication capabilities that enable them to collect data on electricity consumption and be more integrated with grid operations — differentiating them from energy-efficiency upgrades and one-way demand response controls that offer limited visibility and control capabilities.

Although the home energy management landscape comprises a wide variety of technologies with different capabilities, connected devices are at the center of automating and orienting the home to become an asset to the energy system.

However, increasing interactivity of the home has been driven by safety, comfort and convenience, not energy savings. “It’s recognized by both customers and utilities that customers only think about energy savings when their energy bill is a significant portion of their spending,” said Fei Wang, senior grid edge analyst and author of the report. “The savings potential is so small that it is hard to sustain customer engagement.”

This is evident in the explosion of voice assistant devices sold in 2017. These devices have been sold largely as tools to enable hands-free information and audio services to enhance customer convenience, but they are also becoming the human interface or even the brain of the smart home.

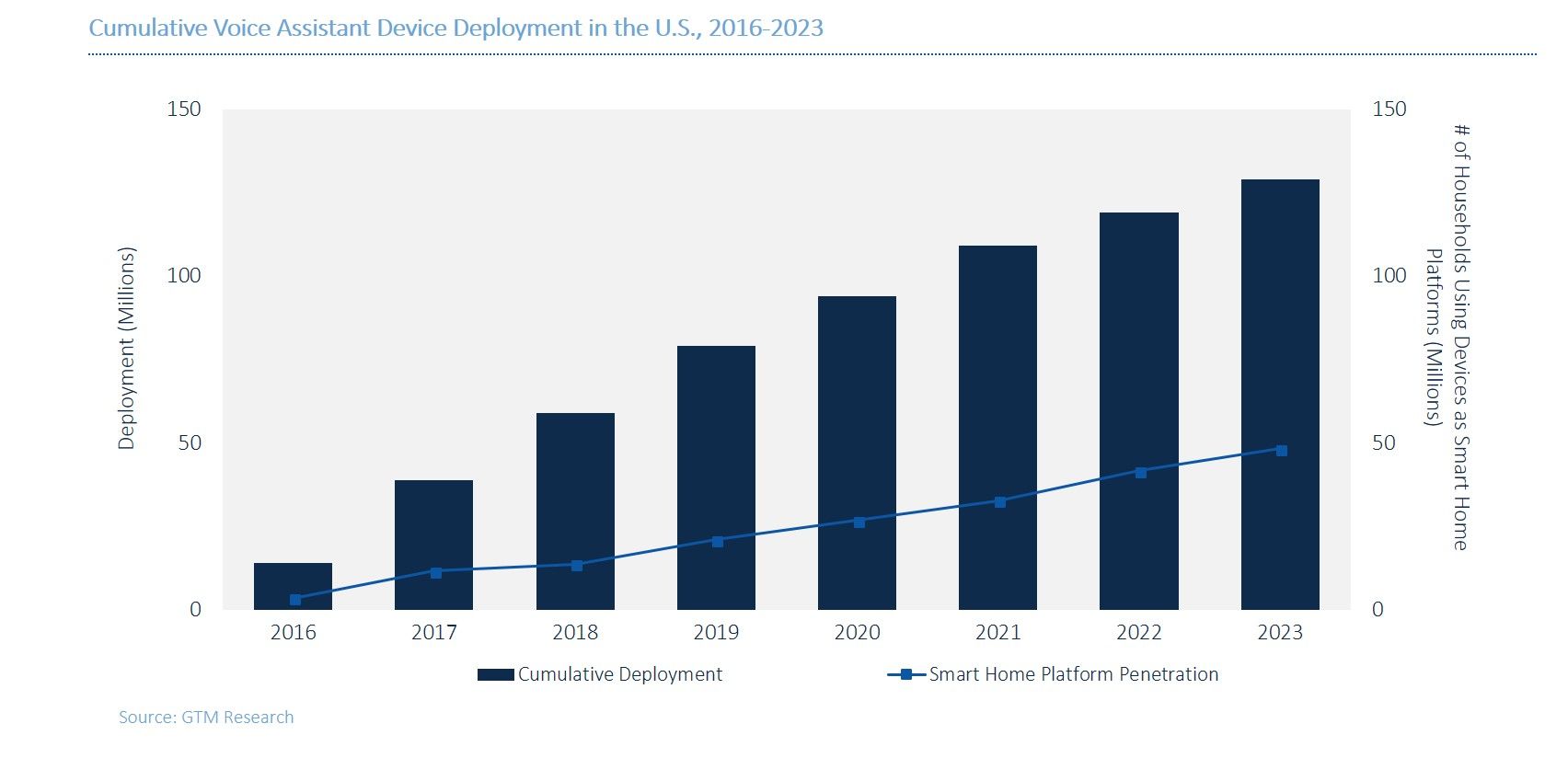

Google and Amazon are among the most well-known players in the voice assistant space, and GTM Research estimates that there will be 129 million of these devices deployed by 2023, making it a key technology for the home energy market. Technologies that are more exclusively focused on energy management, such as smart thermostats and smart lighting, are projected to experience more conservative growth.

The smart home arena attracts players from various channels, and partnerships form across channels. Internet service providers and security companies are working to expand their relationship with American consumers by expanding into energy management offerings. Many companies are forming partnerships to build out a portfolio of services that is attractive to consumers. The report includes several case studies highlighting notable projects.

A seamless customer experience will be a competitive advantage in this market, noted Wang. “Automation and reducing prompts to react to grid events are key to keeping customers engaged and preventing customer fatigue,” said Wang. Automation will allow connected devices to participate fluidly with demand flexibility programs without active customer acknowledgement while ensuring customer comfort.

The full report includes a full vendor landscape, corporate activity, market sizing and case studies. Find out more.

---

WEBINAR: Fei Wang, Senior Grid Edge Analyst, and Brett Simon, Senior Energy Storage Analyst, will be discussing The Grid-Connected Home on July 24 at 2:00 PM ET. Get more details and sign up here.