Since 2014, non-residential storage system prices have declined by more than 15 percent in the U.S.

Commercial and industrial customers with predictable, peaky loads are increasingly turning to storage to help manage demand charges. Grid services are also expected to provide a key value stream by the early 2020s.

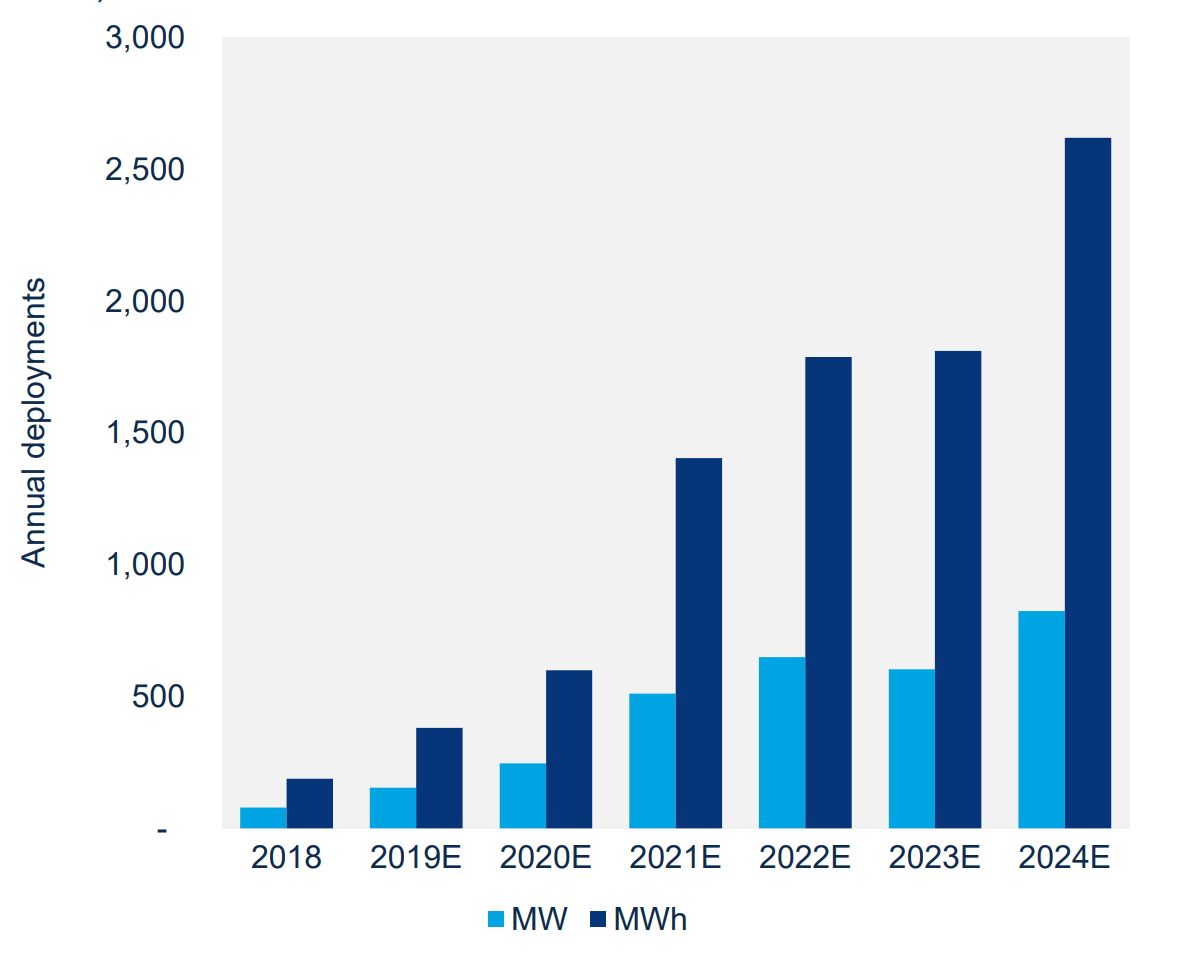

Over the next five years, system costs will decline further, with all-in costs falling by more than 27 percent by 2024, according to a new Wood Mackenzie report that looks at the pricing landscape for the U.S. non-residential storage segment. Falling costs will help drive more than 10x growth in the U.S. non-residential storage market over those five years.

WoodMac finds that battery prices for non-residential storage in the U.S. will drop 35 percent by 2024, as manufacturers achieve new economies of scale.

While battery cost declines have been the dominant factor in non-residential system cost declines for some years now, the next five years will see notable progress in balance-of-system cost declines, with BOS declines contributing more to overall savings at the systems level over the next five years than ever before. By 2024, turnkey BOS costs will decline by more than 20 percent for non-residential systems.

Annual Non-Residential Energy Storage Deployments in the U.S. (MW and MWh), 2018-2024E

Source: Wood Mackenzie Power & Renewables/ESA U.S. Energy Storage Monitor Q3 2019 full report

EPC changes

Engineering, procurement and construction for storage is still quite bespoke because of the lack of standardized solutions. EPC costs currently account for 20 percent of system costs.

The vendor ecosystem for non-residential sector is becoming more crowded, especially in the >100-kilowatt system size range, and as such competitive markets will drive down system costs over the next five years, also impacting design, engineering and commissioning costs while shrinking margins over time.

Increasing standardization around system design, efficiencies in engineering and construction, and changes in business models are being driven by a rapidly growing market that is becoming more lucrative for solar developers and EPCs. These trends will help bring down EPC costs over the next five years.

One example of system design innovation is the increasing prevalence of preloaded containers, which make it easier for EPC companies to install solutions on site.

Zeroes and ones

A trend toward consolidation in the storage software space began in 2017 and is continuing due to the key role that software plays in improving system economics by bringing down lifetime costs and assuring system revenue.

Last year saw a flurry of M&A activity related to non-residential storage, and energy storage software was central to these acquisitions. This year, companies that had software and system integration in-house have started to focus more on software. (Stem is an example of this trend.)

Market consolidation is emerging as a theme that is going to impact pricing as vendors try to bring software capability in house.

Higher-performance battery management systems can help increase the safety and lifespan of batteries and improve overall system economics. Now that utilities are looking at using non-residential storage systems for grid services, software is gaining in importance, helping to deliver revenue from storage assets, allowing batteries to pair easily solar with storage and other applications.

… Plus solar

Partnerships with solar companies are also poised to make an impact on non-residential storage system pricing. An expanding group of solar players are moving into the non-residential storage space, adding storage products to their offerings or partnering with storage companies to sell to their existing base.

Solar is also changing the role of storage system integrators. As solar-plus-storage continues to boom, vendors that can adapt to the needs of the market and offer products that are easy to pair with renewables will be optimally positioned for success.

As solar developers enter the storage space, integrators’ track records of successful projects, combined with an existing knowledge of installation and project management, will become more valuable, and the role of the system integrator will become increasingly important.

Battery trends

While BOS costs are poised to play a bigger role than they have in the past, battery costs remain key to overall system price reductions.

One battery trend to watch is rising vendor interest in lithium-iron-phosphate (LFP) batteries, which were once more expensive than nickel-manganese-cobalt oxide batteries but have now become less expensive.

Though energy density is a drawback, vendors are looking favorably at LFP as fire safety regulations become more strict. However, tariffs that may take effect as part of the the ongoing U.S.-China trade war would eliminate some of the pricing advantage for LFP technology.

Looking ahead

In the past, the primary driver of historical system price declines has been falling battery prices. Balance-of-system costs also declined but the pace was much slower; high soft costs prevented significant declines in system-level prices.

This is expected to change, as going forward both battery prices and BOS costs will drive non-residential savings at the system level.

Progress in BOS costs does not include any soft costs associated with interconnection, permitting, customer acquisition, overhead or margins. These costs still make up a significant portion of system costs today, and no major changes are expected over the next five years in the absence of dramatic policy shifts.

***

Mitalee Gupta is an analyst with Wood Mackenzie's storage team and author of the report U.S. Non-Residential Storage System Prices: Trends From 2019-2024.