The reasoning behind utilities’ increasing resistance to rooftop PV was clear in a conversation with NV Energy CEO/Edison Electric Institute Chair Michael Yackira on the sidelines of Senate Majority Leader Harry Reid’s (D-NV) National Clean Energy Summit in Las Vegas.

An SEC-imposed quiet period prevented Yackira from talking about the purchase of NV Energy (NVE), Nevada’s dominant electricity provider, by MidAmerican Energy (MDPWK), a subsidiary of Warren Buffett’s Berkshire Hathaway (BRK.A). But he was more than willing to talk about the utility take on rooftop solar.

“MidAmerican and NV Energy will support distributed generation in Nevada if that is what customers want,” Yackira said. “But we want to make sure they understand two basic elements of DG expansion.”

First, he said, rooftop solar does not work without utilities’ transmission and distribution infrastructure. “When the sun goes down, people still need their electricity.”

Second, non-solar-owning utility customers pay for that infrastructure and for solar rebates. “They are people who likely can least afford it, the customer base that is not participating.”

There has been little penetration of PV in most markets, Yackira acknowledged, but it is “a free ride” for solar owners. “They use the utilities’ systems to sell solar-generated electricity at retail rates and they buy electricity from the system when the sun goes down.” With net energy metering, their bills zero out and they do not pay infrastructure charges.

Utilities, Yackira said, want that clearly understood. “We have found in surveys that people love the concept of green power but don’t love the bill. If a residential customer finds they have to pay more than $5 per month, they don’t want to.”

Yackira used a telecom analogy. “If AT&T is competing head-to-head against Verizon for cell phone customers, there are infrastructure costs being paid for by both companies,” he said. "But if the infrastructure is paid for primarily by people who are non-participants, as with DG, that is the wrong equation.”

The question rooftop solar builders want answered is whether their product imposes costs on or benefits utility customers. “The all-in cost of natural gas production in Nevada is less than $0.06 per kilowatt-hour,” Yackira said. “If DG can produce power at six cents or less, it is a no-brainer. But it can’t.”

“There is no such thing as an 'all-in' cost of natural gas that doesn’t include the cost of getting that power from a remote plant and how that compares to having generation on the local grid,” said Karl Rabago, former Texas utility commissioner and founder of Rabago Energy.

Yackira agreed that the “all-in cost” is what energy experts call the “avoided cost.”

An avoided-cost analysis does not consider longer-term impacts, Rabago said. “It is very hard for traditional utility people to see rooftop solar as a resource because they do not control it.” As a result, he explained, “they don’t consider it a resource; they think of it as opportunity energy, so they are not willing to consider cumulative impacts.”

There is value to utilities in having a diverse portfolio with some generation closer to the load, Rabago said. It can help meet peak demand, reduce line losses and reduce the need to build new distribution.

“You can’t not build distribution. That is a fundamental flaw in the rooftop PV business model,” Yackira said. “If I build a new housing development and the only thing I put in is rooftop solar, and there is no distribution or transmission infrastructure to support that, it goes dark.”

That reasoning does consider help meeting peak demand, savings from line losses and from wear and tear that lead to repair and upgrading expenses, Yackira said. “But you are saving very little. When you say you diminish the impact with solar, I’m not sure how much you diminish it. If you need to serve the load, the savings in wear and tear is almost infinitesimal. It is not a material change.”

The wires are still being used, Yackira said. “The power flow still goes back and forth because it can only be evenly matched at a few times of the day. The rest of the time, it is either coming in from the PV system or going out from our system to the house.”

In the absence of real data, utilities assume a “simplistic binomial distribution of costs and benefits,” Rabago said. “The straw man is that solar either avoids transmission and distribution costs or it doesn’t, and the conclusion is that since it doesn’t, because PV has to be connected to the grid, therefore all the costs apply to solar and none are avoided.”

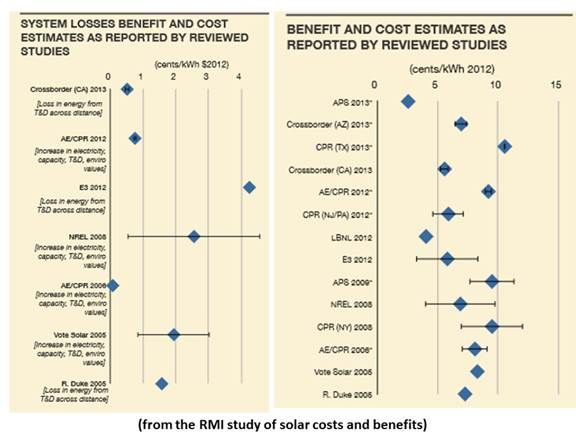

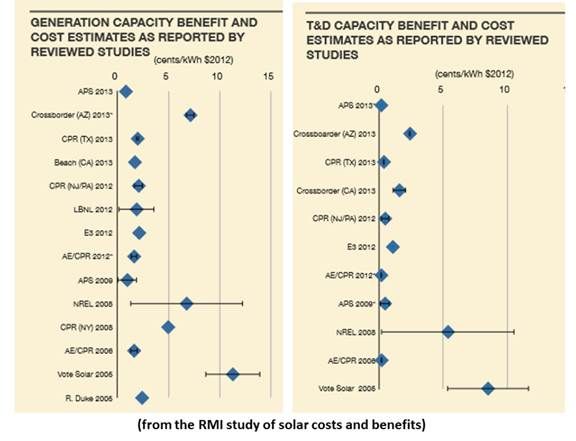

It is a more complicated question, he said, referencing a recent multi-dimensional Rocky Mountain Institute meta-study of fifteen PV cost-benefit analyses.

PV has its place, Yackira said, “We just want to be sure people understand what the true cost is. Avoided cost is important. What are you avoiding by putting PV on rooftops? I would suggest it is not a lot.”