MidAmerican Energy Holding Company, the Midwestern utility subsidiary of Warren Buffett’s Berkshire Hathaway, announced today it will form a branch dedicated exclusively to the development of renewable energy.

The renewables platform will, unlike four of MidAmerican’s five other highly regulated platforms (two utilities and two gas pipelines), offer MidAmerican the opportunity it has only had in its CalEnergy geothermal and cogeneration platform -- namely, to invest outside the strictures of regulatory obligations and with regard solely for its shareholders.

MidAmerican Renewables LLC will have four subunits. MidAmerican Solar will encompass such recent MidAmerican investments as the 550-megawatt AC Topaz solar power plant in California and the 290-megawatt AC Agua Caliente project in Arizona. MidAmerican Wind will incorporate the 3,360-plus megawatts of wind the company owns, including new investments like the nearly 600 megawatts of Midwestern wind the utility has purchased since 2010.

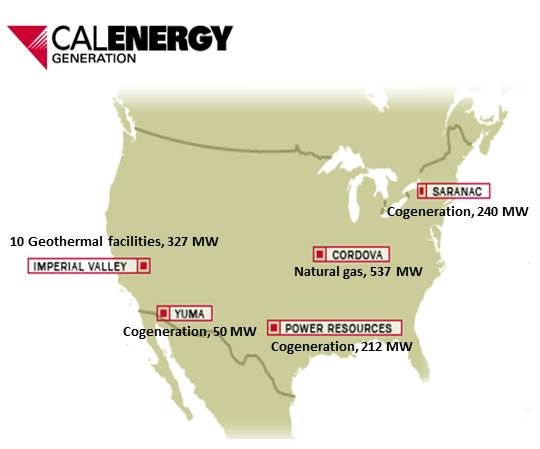

MidAmerican Geothermal will incorporate the company’s existing holdings under its CalEnergy brand. The new venture will also include MidAmerican Hydro.

The most exciting part of this, explained MidAmerican Vice President for federal policy Jonathan Weisgall, is the unregulated nature of the undertaking. A utility has to meet the dictates of federal, state and local regulators and a gas pipeline builder is governed by the Federal Energy Regulatory Commission (FERC). MidAmerican Renewables will be free to invest shareholders’ money as it sees fit.

_540_449_80.jpg)

Despite hostile publicity about renewables arising from loan guarantees and other federal support efforts, the Buffett people believe investing in the sector is a financially smart move.

“We look forward to expanding our wind, geothermal, solar and hydro portfolio,” said MidAmerican Energy chairman, president and CEO Greg Abel. “We believe the need for renewable energy will continue to grow.”

Like other well-capitalized, high-profile investors such as Google and Ted Turner, the Buffett company believes this increased emphasis on renewables in its portfolio is a solid business decision that will pay off over time.

“This is a vote for renewable energy,” Weisgall told GTM in discussing why Warren Buffett, perhaps the nation’s premier investment maven, is for this move. “It is not a bet.”

Weisgall said there is no specific budget or capitalization for the renewables entity but pointed to MidAmerican Energy’s steadily increasing renewables buys in recent years as an indication of the new branch’s financial scope. In addition to $6.1 billion invested in wind, largely since 2008, the company reportedly put some $3 billion into the two late-2011 solar power plant investments.

Federal policy and tax credits that help keep renewables on a level playing field with more mature electricity sources figure into MidAmerican’s strategy, according to Weisgall. While in an unregulated market one hundred percent of the benefits from investments that earn tax credits and tax benefits such as accelerated depreciation go directly to MidAmerican’s customers, the new unit created to operate in unregulated markets will give MidAmerican the opportunity to assume the role of developer and take advantage of the incentives. But MidAmerican is not gambling on these incentives being in place.

While wind’s vital production tax credit (PTC) expires on the last day of 2012, the solar investment tax credit (ITC) will remain in place through 2016 and geothermal’s tax credit extends to the end of 2013. The benefits these tax credits offer to MidAmerican are part of the company’s attraction to solar and geothermal.

As for wind, all of MidAmerican’s most recent wind buys, including the 81-megawatt Bishop Hill II project in Illinois, will be in the ground by the end of 2012, Weisgall pointed out, making them eligible for the current PTC. He and others in the renewables industries still hold out hope that a PTC extension and a restoration of the accelerated depreciation to 100 percent from its recent cut to 50 percent will be included in the tax extenders package due to come before Congress at the end of February.

“But we cannot count on a tax credit, and we will work with the facts as they are,” Weisgall said. Wind may remain a viable investment for MidAmerican stakeholders because of its increasingly competitive levelized cost of electricity. Or, Weisgall admitted, wind may not continue to be part of the new renewables unit’s portfolio.

In keeping with the Berkshire Hathaway commitment to frugality on behalf of its stockholders, officers at MidAmerican Energy will assume supervision of the new renewables units, Weisgall said. Only one new hire will be brought on.