Third-party-owned solar from firms like SolarCity and Sunrun continues to be an attractive investment and asset class for banks with an appetite for tax equity.

SolarCity just announced a new structured finance fund with Credit Suisse (NYSE: CS), the second of two investments to finance solar projects totaling $200 million from Credit Suisse.

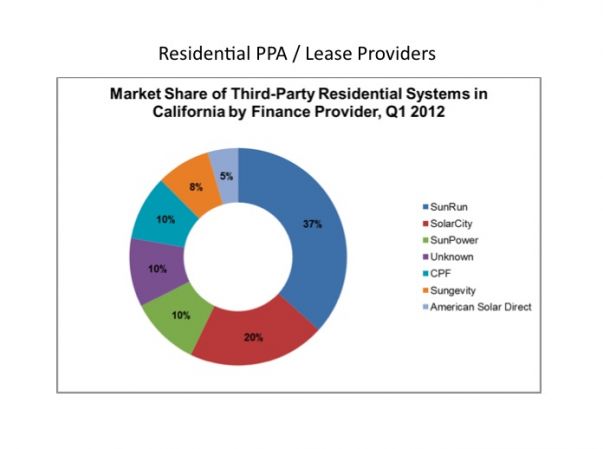

Credit Suisse kept the funds flowing to Sunrun as well, committing $200 million to Sunrun's solar power service. Sunrun led the field in California in Q1 of 2012 in third-party residential market share (see chart below).

Third-party financiers like Sunrun and SolarCity (and Clean Power Finance, SunPower, Sungevity, OneRoof Energy, etc.) eliminate the upfront cost of solar panels to customers. Customers can install solar panels for no money down and pay just for the solar electricity they produce at prices below utility rates. The third parties (or their partners) manage the process of permitting, installation and O&M.

A June 2012 report from the California Public Utilities Commission shows that the number of home solar projects in low- and middle-income markets increased by triple-digit percentages since solar power as a service has been offered to homeowners.

Third-party financing is being entertained for other energy services, as well. Solar hot water (SHW) vendors such as Skyline Innovations are exploring this. EPR2 is looking at third-party financing of solar on commercial and multi-tenant buildings. And a whole slew of startups and ESCOs are exploring ways to finance energy efficiency measures.

Barclays issued a note on the solar industry's general health today, saying, "While some progress has been made on the demand front, industry overcapacity continues to remain the prevailing issue impacting the sector providing limited visibility on when and at what level the industry will achieve sustainable profitability. We thus retain our overall cautious view on the solar sector. [...] Overall, we expect vendors to broadly reaffirm recently raised expectations for 30 to 35 gigawatts of global installations; 4Q12 should be the strongest quarter, in part due to seasonality. [...] In our view, overcapacity continues to remain the prevailing issue impacting the sector, [... and] timing on a margin recovery remains the single most important factor impacting shares across the solar sector."

Data below from GTM Research's U.S. PV Leaderboard. Contact Justin Freedman at [email protected] for more details.