For the sixth time, U.S. Bancorp has put up major funding to partner with SolarCity in the rapidly expanding third-party ownership sector of the rooftop solar PV business.

“It speaks volumes about the value of investing in solar,” noted SolarCity spokesperson Jonathan Bass about U.S. Bancorp’s re-investment. This funding, the bank’s largest in its three-year relationship with the solar provider, is enough to finance as much as $250 million in PV projects for residences, businesses and public buildings.

“Each fund has a different mix of tax equity, potentially some debt, and corporate equity from SolarCity in some cases,” Bass explained. “All the fund structures are different,” he added, and specifics “are proprietary.”

This $250 million will be “only solar,” Bass said, and will not go to SolarCity’s newer home energy efficiency retrofits. “The fund is somewhat unique,” he said, “in that it can finance residential projects, projects for small and large businesses, and municipal government projects.” Such versatility, Bass added, will allow a wide range of people to take advantage of solar’s value proposition.

Often, such funds focus on a single sector, Bass said. “Our fund with Google was just for homeowners. And we recently did a fund with Rabobank that was just for commercial projects.”

The new U.S. Bancorp fund will go to PV projects that “will mostly be deployed this year.”

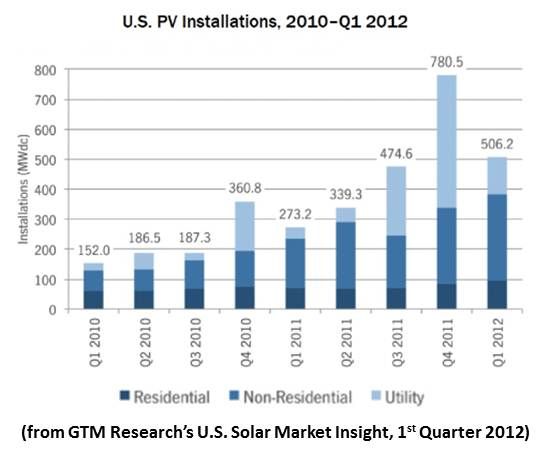

Newly released numbers from Greentech Media Research on the U.S. solar industry’s first quarter in 2012 show the industry growing at an 85 percent year-on-year clip. “They’re exciting,” Bass said of the numbers. “They show growth in every segment of the industry. And this U.S. Bancorp deal shows that private capital continues to flow into the space.”

SolarCity was one of the pioneers, along with SunEdison, SunRun, Sungevity and a handful of others, of the third-party ownership model. It obtained its first funding in spring 2008 and has raised over $1.5 billion in structured financing to date.

In third-party financing, home and business owners contract over a fifteen- or twenty-year period with a third party like SolarCity for the electricity generated by a system the third party installs, owns and maintains on the owner’s roof.

The investor gets the tax equity advantage from the 30 percent federal Investment Tax Credit (ITC) and the installer gets regular payments over the contract’s term.

The resident gets solar generated electricity at a rate significantly below the retail utility rate without bearing the burdens of upfront costs and ownership risks.

“In many cases, when they pay little to nothing in upfront costs,” Bass said, “they can see savings of 10 percent to 15 percent on their utility bills.” But, he stipulated, that can vary quite a bit depending on the system’s location and orientation, the local electricity rates, and other factors.

Because SolarCity is in an SEC-mandated pre-IPO quiet period, Bass could not discuss some of the deal’s details. He deferred to U.S. Bancorp to discuss the subject of return on investment, except to say that “from a structured finance perspective, these are stable, reliable assets that are reliably producing power over a period of time.”

Clean Power Finance (CPF) CEO Nat Kreamer, whose company has aggressively moved into the third-party space in the last year, recently told GTM “rooftop solar is a low-risk, high-reward investment in what is essentially a long-term asset.” As much as 45 percent of an investor’s capital outlay, Kreamer said, can come back as a tax benefit in the loan’s first year. And the overall return on investment is “anywhere from the high single digits to the mid-teens.”

The new U.S. Bancorp-SolarCity fund follows an announcement from CPF of a working relationship it has formed with SolarCity to develop a DOE grant-backed solar industry-wide operations and maintenance (O&M) marketplace. Such a marketplace is expected to further remove risk for investors and, by doing so, to bring yet more capital into solar third-party finance.

Asked how solar might be affected by the recent announcement by Southern California Edison (SCE) that its 2,200-megawatt San Onofre Nuclear Generating Station (SONGS) will be offline at least through the end of August, Bass noted that “solar systems provide value by producing power at peak times.” The threat Southern California faces this summer, Bass said, “illustrates the value of producing peak power.”