Things aren’t going well for the cleantech industries at the federal level. Energy Secretary Rick Perry’s attempt to boost coal and nuclear power in energy markets, the threat of tariffs disrupting the U.S. solar sector, and uncertainty over the tax reform bill emerging from Congress are just a few examples.

That leaves the states to lead in the technology integrations and economic innovations at the grid edge. No surprise there.

A few key states such as California, New York and Hawaii are starting to roll out these efforts with at least the intention of moving from beyond pilot scale -- although the progress, coming as it does through incremental changes in long-running utility commission proceedings, can sometimes be hard to track. Here’s what’s been happening lately that’s worth catching up on.

California DRAM: The search for the true market value of DERs

Take last week’s unanimous approval by the California Public Utilities Commission of an order closing the four-year old proceeding, R. 13-09-011, that’s meant to dramatically overhaul how demand response is procured in the state.

The CPUC hasn’t closed the books on reforming demand-side resources, however. The closing of this docket comes with plans to expand its efforts, including a 2018 review of everything it’s done so far. Working with the California Energy Commission and other partners, the CPUC has a long-range plan for a very different system, including a new set of terms such as “shape,” “shift” and “shimmy” to accompany the old-fashioned concept of demand response as exclusively a load-shedding resource.

As Mark Martinez, Southern California Edison’s emerging markets and technology manager, wrote on LinkedIn when the CPUC issued its draft decisions last month, “This CPUC milestone ends an exciting (at least for us DR folks!) period of dynamic regulatory changes, program innovation, and all-party collaboration for ‘supply side’ and ‘load modifying’ DR, one that changed DR from 1.0 to 3.0 very rapidly, and now tees up the effort to develop the new models of DR in California.”

But the final decision on this matter didn’t come without some last-minute wrangling between utilities and the companies like OhmConnect, eMotorWerks, Stem, CPower, EnerNOC and EnergyHub involved in California’s distributed energy market opportunities.

Specifically, the CPUC’s final decision included an important last-minute change to the Demand Response Auction Mechanism (DRAM), the four-year program that’s created a market structure for third parties to bid aggregated DERs into utility capacity and grid energy markets. In simple terms, the CPUC was faced with two choices: ending the program as-is, or adding another auction next year for delivery in 2019. It chose the latter option.

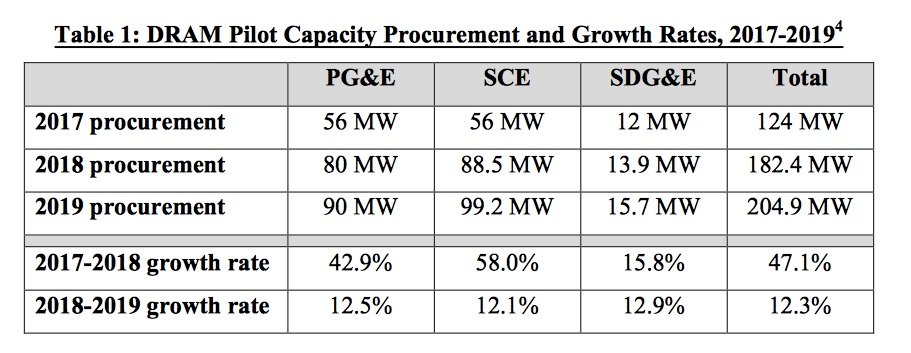

Since starting in 2015, DRAM has brought in hundreds of megawatts of DERs, ranging from commercial and industrial loads shifted from more traditional utility DR programs, to more experimental behavioral modification of home energy use and plug-in electric vehicle charging management. This year’s auctions for delivery in 2018 and 2019 brought in more than 200 megawatts of contracts, more than five times the first round’s 40 megawatts of contracts, and more than double the second round’s 82 megawatts.

This growth has come with some conflict between Pacific Gas & Electric, Southern California Edison, San Diego Gas & Electric and DRAM providers, largely over whether the utilities are spending as much on the program as the CPUC expected them to. The final decision played out this dynamic to the last, with commissioners determining to go ahead and order one final auction in 2018 for deliveries in 2019.

“Absent this decision, it was unclear what the future would hold for demand response and DRAM,” Katherine Hamilton, executive director of the Advanced Energy Management Alliance, wrote in a Friday statement. AEMA is a national organization whose members include several companies that are active demand response providers in California.

That’s not how PG&E felt, however. In its filing, the utility noted that it doesn’t have a resource adequacy need to fill next year, leaving it no reason to seek out additional capacity from DRAM or other resources. It also declared that “an additional DRAM auction is premature and not likely to offer further insights” into how the program works.

But the demand response parties disagreed. EnerNOC, CPower and EnergyHub said in comments that state grid operator CAISO believes that a 2018 DRAM pilot is needed to “ensure that the competitive market for demand response resources continues to thrive,” and that without it, “the nascent competitive demand response market could wither.”

OhmConnect, eMotorWerks and Stem filed comments pointing out that, out of all the other California experiments into aggregating DERs for grid and market needs, “most of the alternatives for 2019 are not ‘proven’ at all.”

For example, while many industry observers see important opportunities for DERs in deferring distribution grid investments, the pilot projects and solicitations under the CPUC’s Distribution Resources Plan and Integrated Distributed Energy Resources proceedings “are the first of their kind in California,” the companies wrote.

And so far at least, they’ve been accomplished through utility RFPs, not open market constructs -- although there’s another hot debate underway over how to open this process, both in terms of data and in terms of dollars.

Meanwhile, while traditional utility approaches to demand response like the Capacity Bidding Program are being shifted to the new model of competitive demand response, CBP has “never before been open to residential customers, and key program enhancements (e.g., electronic customer authorization) remain unresolved,” the group wrote.

Most importantly, however, the costs, benefits and payments for these alternatives are being created “via administrative cost-effectiveness calculations rather than competitive market forces,” the groups wrote. That’s exactly the kind of thing the CPUC was trying to move away from by creating DRAM, which was meant to push DER aggregators to compete on the price they’re willing to offer utilities and grid operators, and establish a fair market value, so to speak, for these resources.

California has underperformed in demand response compared to other parts of the country that have created market-based opportunities for participation, which is the reason the CPUC started this overhaul in the first place. But it’s also an important test market, with more rooftop solar, plug-in EVs and behind-the-meter batteries than any other state.

Big energy players are taking notice of this opportunity. Two of DRAM’s more energetic participants, EnerNOC and eMotorWerks, have both been acquired by Enel in the past year.

New York REV: Oversight ruling a win for DER providers and Green Button Connect

Last we checked in with New York’s Reforming the Energy Vision initiative, clean energy and grid edge advocates were crying foul over how the state Public Service Commission had allowed wildly varying utility DER valuation methodologies and prohibitively short revenue certainty windows to become part of the REV Phase 1 final order.

This month brought some more cheering news for DER providers, albeit on another subject, when the PSC approved an order that included some important changes to the rules guiding transactions of data and energy that REV envisions.

In this case, it’s more of what the PSC left out, rather than added, that’s helpful. Specifically, a draft version of the order released in April contained some stringent creditworthiness and performance bonding requirements, including minimum asset requirements of $10,000 per kilowatt of energy, or $500,000 for a minimum-size 50-kilowatt aggregation, for DER providers. These requirements were dropped from the final version.

“For large commercial and industrial customers, who are capable of representing their own interests with DER providers, there will be minimal oversight of transactions,” Lisa Frantzis, senior vice president for strategy at Advanced Energy Economy, wrote in a statement last week. “Rather, the focus will be on ensuring transparency and fair treatment for mass-market customers.”

The order also leaves out some deal-breaking cybersecurity requirements for how DER providers, utilities and customers can share energy data through the Green Button standard, according to Michael Murray, chief technology strategist at More Than Smart and co-founder of Mission:Data, a group of companies involved in energy data access issues across the country.

“There was also some nonsense in the April staff white paper requiring Green Button data recipients to comply with the NIST Cybersecurity Framework for critical infrastructure,” Murray wrote in an email. “In other words, people building smartphone apps would have to comply with the same cybersecurity rules as nuclear power plants. Fortunately, that was removed from yesterday's order.”

The DER oversight ruling also clears the way for New York utilities such as Con Edison to start establishing eligibility criteria to release Green Button Connect capabilities to customers and their approved and vetted third-party energy services providers, he noted. While New York’s utilities are only beginning to deploy smart meters, REV is asking them to create energy marketplaces where customers can acquire their own energy data, find third-party service providers, and engage in future opportunities.

Hawaii: A new model for RFPs and PPAs that value flexibility and storage

Hawaii’s isolated islands grids support the country’s highest penetrations of rooftop solar, and its 100-percent renewables mandate assures a future where intermittent solar and wind must be managed if they are to survive.

Last week, Hawaiian Electric Companies (HECO) launched its biggest-yet round of renewable energy procurements, including some innovative approaches to integrating these needs into what it calls a “model PPA,” or power-purchase agreement.

PPAs are the standard contract between utilities and renewable energy projects, but HECO’s new ones are meant to “achieve greater flexibility for utilities to dynamically and cost-effectively dispatch power from the new projects and to lower risks to developers and their financiers, resulting in lower costs to customers.”

HECO was given the green light to move forward on these new contracts in July, when the Hawaii Public Utilities Commission finally approved its Power Supply Improvement Plan. HECO companies Hawaiian Electric, Maui Electric and Hawaii Electric Light plan to issue RFPs in two stages over the next two years for renewable resources required through 2022, including 220 megawatts for Oahu, 50 megawatts for Hawaii Island, and 100 megawatts for Maui. The latter bid includes 40 megawatts of “firm renewable generation.”

HECO also intends to provide developers the option to include energy storage in their bids. The final RFPs are expected in the first quarter of 2018, with selection of developers and contract negotiations in the second quarter. The draft documents can be viewed here.