With President Joe Biden in the White House, ink drying on a spate of new climate-focused executive orders and an extension of the federal Investment Tax Credit on the books, the immediate future looks relatively rosy for solar.

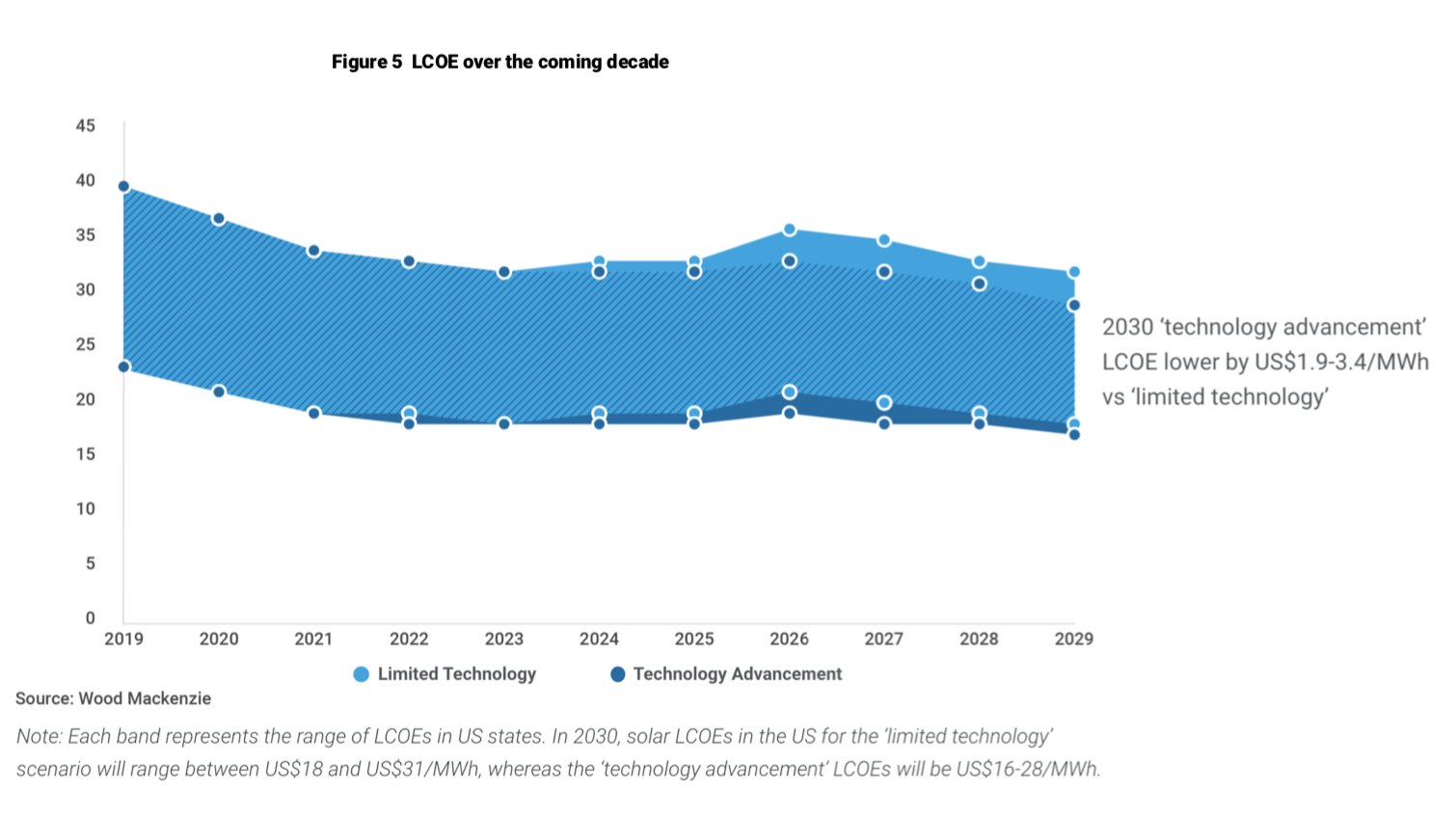

The U.S. Energy Information Administration anticipates that renewables will be the fastest-growing source of electricity through midcentury. While solar accounted for about 15 percent of renewable electricity generation in the U.S. in 2020, according to EIA, that will increase to nearly 50 percent by 2050. And solar will be the cheapest form of electricity across the United States by 2030, according to a recently released Wood Mackenzie report. The consultancy expects solar costs to decline 15 to 25 percent over the next ten years.

In a recent series for Squared, I cataloged some of the technological innovations that could define the next decade for solar. Here, I’ll dig into the macro trends Wood Mackenzie analysts expect to drive the resource's next decade.

Costs will continue falling through 2030

In 2011, the Department of Energy launched its SunShot initiative, modeled after the moonshot effort of the mid-twentieth century, to “reduce the costs of solar energy and reestablish U.S. global leadership” in solar. A decade later, the U.S. has accomplished at least one of those goals; three years before DOE had targeted, SunShot successfully lowered utility-scale solar prices to its goal of $1 per watt.

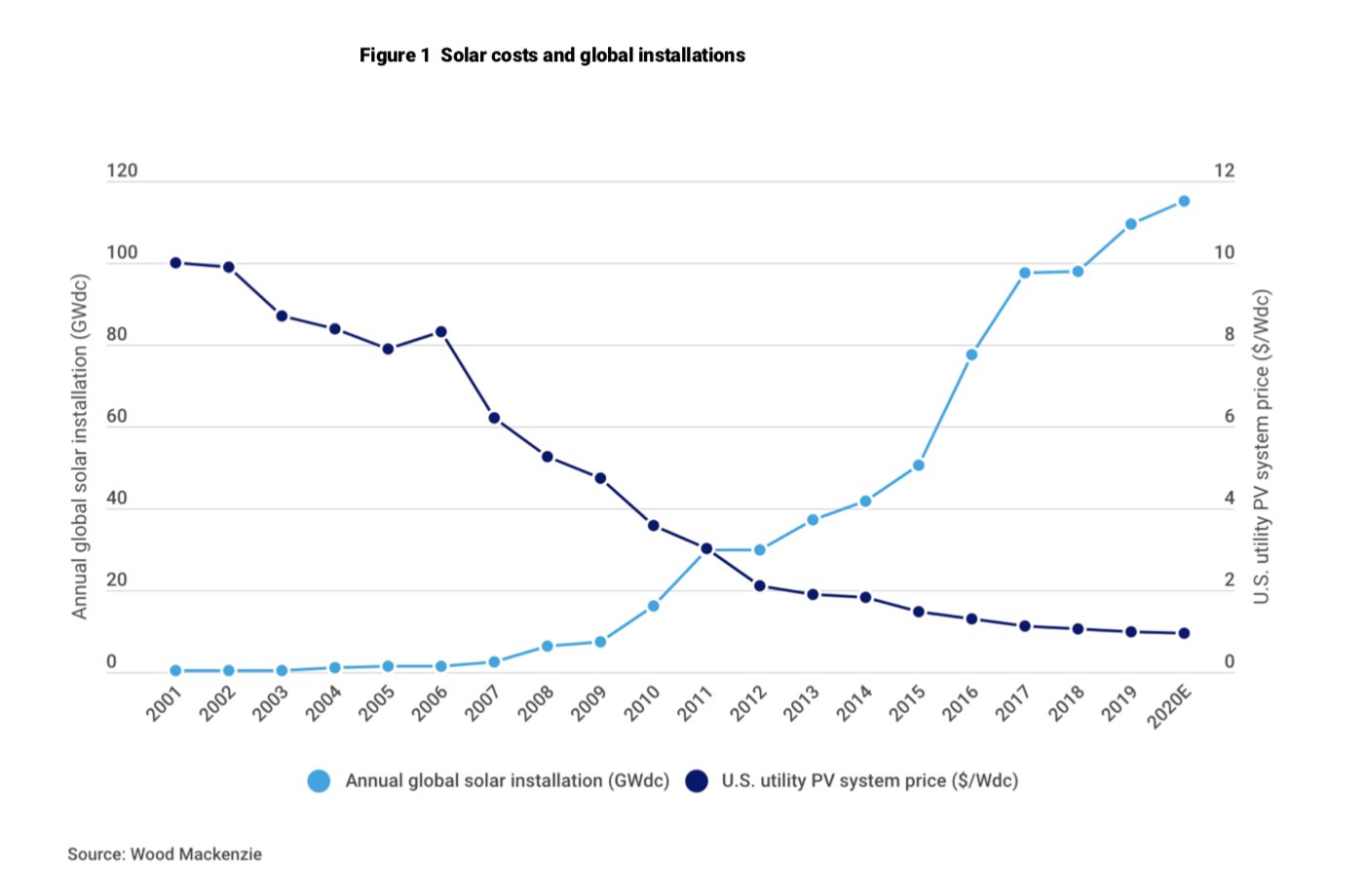

Cost declines have been the most integral tool in allowing large-scale solar to grow. Worldwide, solar system prices fell by more than 80 percent from 2000 to 2010, according to WoodMac’s analysis.

Meanwhile, installations grew.

Although SunShot floundered under President Trump, prices kept falling in the U.S. Overall, prices for the engineering, procurement and construction of large-scale solar systems fell by more than 30 percent during Trump’s presidency, according to WoodMac.

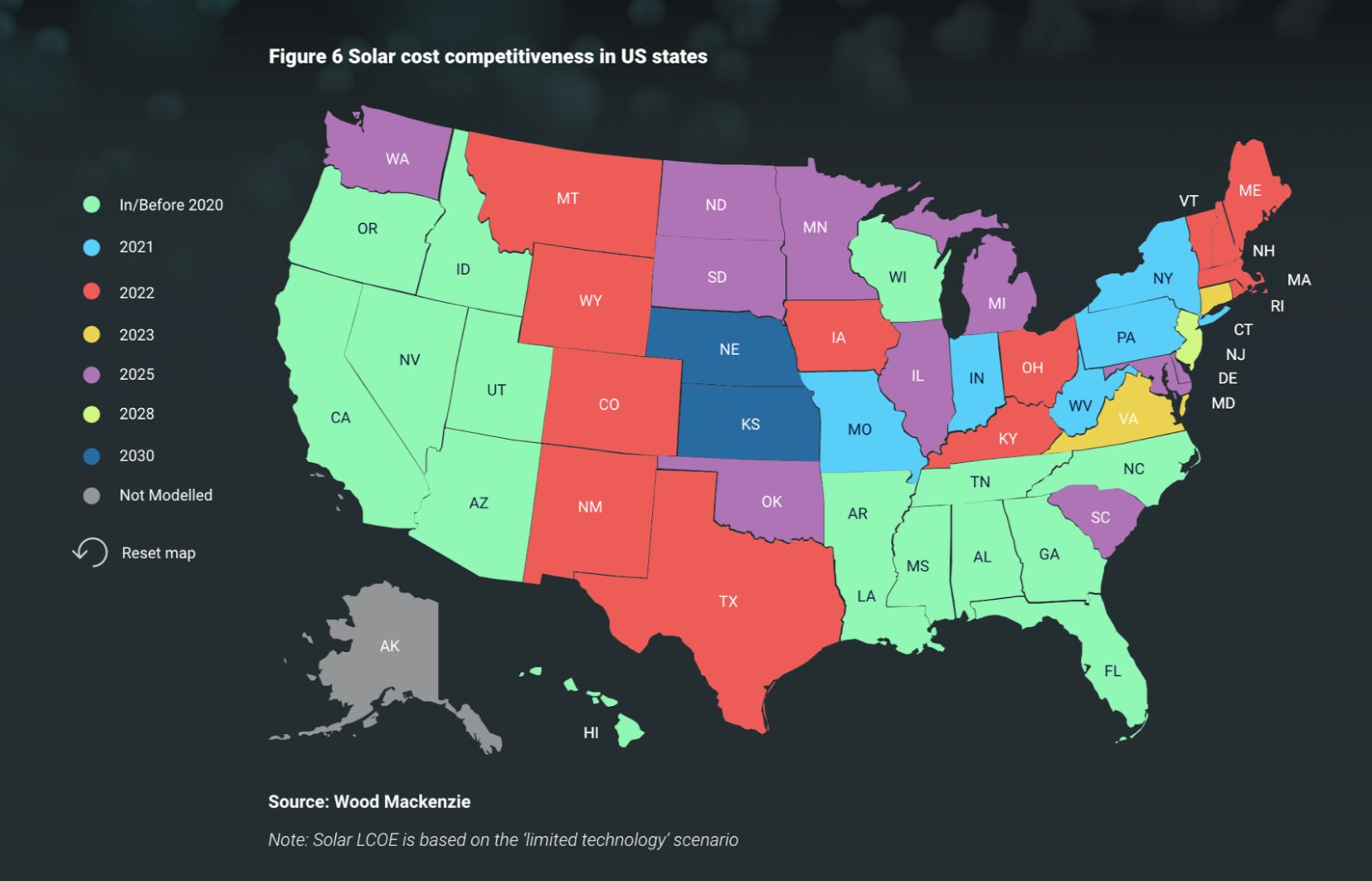

That happened amid uncertain policy; the Biden administration’s support should provide more stability to the industry. WoodMac expects that costs will continue dropping. Solar is already competitive in a swath of the West and much of the Southeast. That trend will make its way into more of the Northeast by 2021 and the Mountain West by 2022. It will come for the frigid northern Midwest by mid-decade.

By 2030, solar will be the lowest-cost source of generation across the entire U.S.

Corporate purchases

Solar power’s downward price trajectory has caught the eye of corporate buyers. That’s a big market for renewables: Commercial and industrial electricity consumption accounted for more than 60 percent of electricity sales in 2019. And large companies have already become some of the most significant buyers of renewable electricity. In Q4 of 2020, these buyers accounted for 20 percent of the contracted pipeline for large-scale solar. In 2019, commercial solar installations grew 10 percent over the previous year, according to tracking from the Solar Energy Industries Association.

Analysts expect continued declines in the levelized cost of solar energy to strengthen that demand, which in turn has significant potential to reshape energy markets. After signing onto a growing slate of contracts tied to renewables projects, many companies are now looking for even more control of their electricity supply. A recent statement spearheaded by the Renewable Energy Buyers Alliance, a group with members including Facebook and General Motors, lays out the energy policies corporations hope to see advanced under the Biden-Harris administration. Their asks include expanding wholesale electricity markets to smooth the trading of electrons across regions. Some companies, such as Google, have already joined regional transmission organizations to gain more leverage in determining how those markets function.

The ability for solar to compete on price alone means that more merchant-centric projects could also be on the horizon, according to WoodMac. Most solar projects in the United States have relied on long-term, contracted revenue streams that last for at least a couple of decades. But as investors have become increasingly comfortable — perhaps too comfortable, some might say — with the structure of solar deals and the returns associated with the projects, shorter contracts have become more common.

“There’s definitely a lot of buzz in the market about the prospects of having merchant-based projects. But in the truest sense of the word, I don’t think there is a single [merchant solar] project yet,” said Ravi Manghani, WoodMac’s head of solar research. “Developers would need to come up with the right sort of hedging tools, whether these are physical tools like potentially storage, or financial tools, like hedges or insurance products. Those will have to become more commonplace as these projects start to be truly merchant.”

The role of storage and transmission

Cost declines have helped solar gain momentum. But overall, solar provided only about 2 percent of U.S. electricity in 2019. And if the resource is to grow significantly enough to meet clean energy mandates and climate goals set out by states and countries, it needs more support.

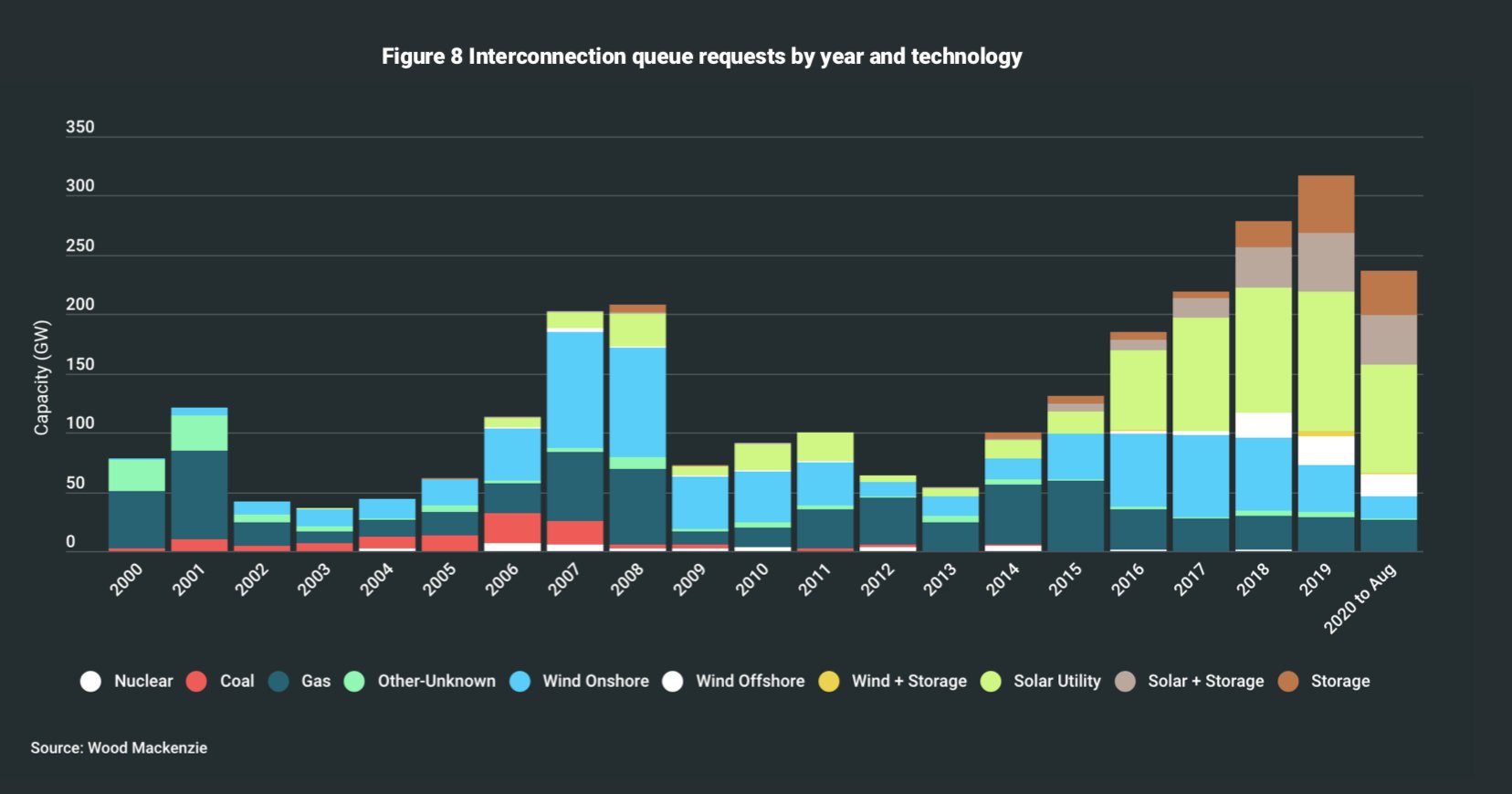

Energy storage is already being added to more utility-scale projects, and more projects are being designed to allow for its later addition, to help extend the hours in which solar projects can deliver electricity. Developers and asset owners such as Capital Dynamics have said storage is a consideration, if not the default, for every project.

“In the long run, as solar washes over the United States, storage follows along behind,” John Breckenridge, Capital Dynamics’ head of clean energy infrastructure, told Greentech Media this fall.

While storage will help balance uneven solar production, transmission is needed to carry it from where it's most cost-effectively generated to where it's most in demand.

Lack of transmission capacity has major potential to constrain solar growth, stymieing decarbonization efforts like those set out by the Biden-Harris administration. Already, experts and wonks are asking the new administration to confront that challenge. Clean energy groups supported by numerous past members of the Federal Energy Regulatory Commission highlighted that need in a report released this week.

“There is no climate plan that is serious if it does not anticipate a significant regional transmission upgrade,” said Pat Wood III, who served as FERC chair from 2001 to 2005, in an event spotlighting the report.

The administration appears to be paying attention to these issues already. An order President Biden signed this week urges the acceleration of federal permitting for transmission. And in a Wednesday Senate hearing on her nomination to head the Department of Energy, former Michigan Governor Jennifer Granholm named building out transmission to transport clean electricity as a “high priority” if she is confirmed.

“I’m very eager to work with FERC to get transmission lines established ASAP,” Granholm said Wednesday. “I feel like this is a conversation that’s been had for years, about having the right transmission lines in place to take power...(clean power especially) from places that are generating to the power and load centers.”

Aside from storage and transmission, which will make solar easier to use in more places and at more times of day, solar itself is becoming more efficient.

Bifacial solar, which allows for the absorption of sunlight on both sides of a panel, is perhaps the most significant solar technology improvement in recent years, or at least the one to become most mainstream. It’s already the default choice for numerous developers in the U.S.

The Section 201 exclusion that bifacial solar enjoyed for a time aided that development, though the exclusion was ultimately reversed by the Trump administration (solar groups are challenging the verdict).

Despite the policy confusion surrounding tariffs, analysts at Wood Mackenzie name bifacial among just a few technological innovations that are likely to boost solar production and help cut costs in the coming years. (Others are larger panels and wafer sizes, as I cover here, as well as improvements in solar trackers). Commercial bifacial solar modules offer production gains of 7 to 8 percent while costing not much more than single-sided panels. Analysts expect “the next decade will be marked by steady technological improvement along the entire solar value chain.”

“Every little improvement in generation or production means the capacity factor continues to go up, and that has direct implications in terms of the levelized cost,” said WoodMac's Manghani.