It's the year 2040, and all new vehicle sales in the United States, the European Union and China are electric. Coal demand has cratered, renewable energy use has skyrocketed and energy storage has been deployed at a massive scale to complement renewables growth.

But even so, keeping global warming under 2 degrees Celsius remains out of reach.

This is according to Wood Mackenzie's updated alternative energy outlook, Carbon-constrained scenario 2018: Navigating a challenging path to lower global emissions. The report explores how commodity demand and carbon emissions would respond to an accelerated deployment of low-carbon power and transport sector technologies, and finds that fossil fuels would still make up the vast majority of global energy demand.

"Fossil fuel use will not disappear any time soon," said David Brown, senior analyst at Wood Mackenzie. "Our scenario envisages fossil fuels having a 77 percent share of global energy demand — versus 79 percent in our base case — as major markets such as China and the EU reach similar levels of fossil fuel shares."

Fossil fuels won't go away in a carbon-constrained world, but the energy landscape will change dramatically.

Under WoodMac's base-case scenario, oil demand peaks in 2036. Under the accelerated decarbonization scenario, oil demand peaks five years earlier, in 2031, as the impact of EVs becomes unmistakable.

Under WoodMac's base-case scenario, oil demand peaks in 2036. Under the accelerated decarbonization scenario, oil demand peaks five years earlier, in 2031, as the impact of EVs becomes unmistakable.

WoodMac assumes that by 2040, the U.S., the EU and China will see electric vehicles account for 100 percent of new vehicle sales, collectively displacing 11 million barrels of oil per day. At the same time, the use of autonomous vehicles becomes more widespread.

In the base-case view, autonomous vehicle technology would mainly be applied to electric vehicles used as "robo-taxis," with around five times the utilization rate of traditional private cars. In a carbon-constrained scenario, the use of autonomous electric vehicles takes off earlier, around 2030 instead of 2035, driven by stronger policy incentives and fewer regulatory hurdles.

If global vehicle fleets accelerate the switch to electric, WoodMac calculates that by 2040 power demand from the transport sector is expected to total over 1,900 terawatt-hours — which is more than 1.5 times larger than India’s entire power market in 2017. By the same year, global oil consumption would fall to below 2013 levels.

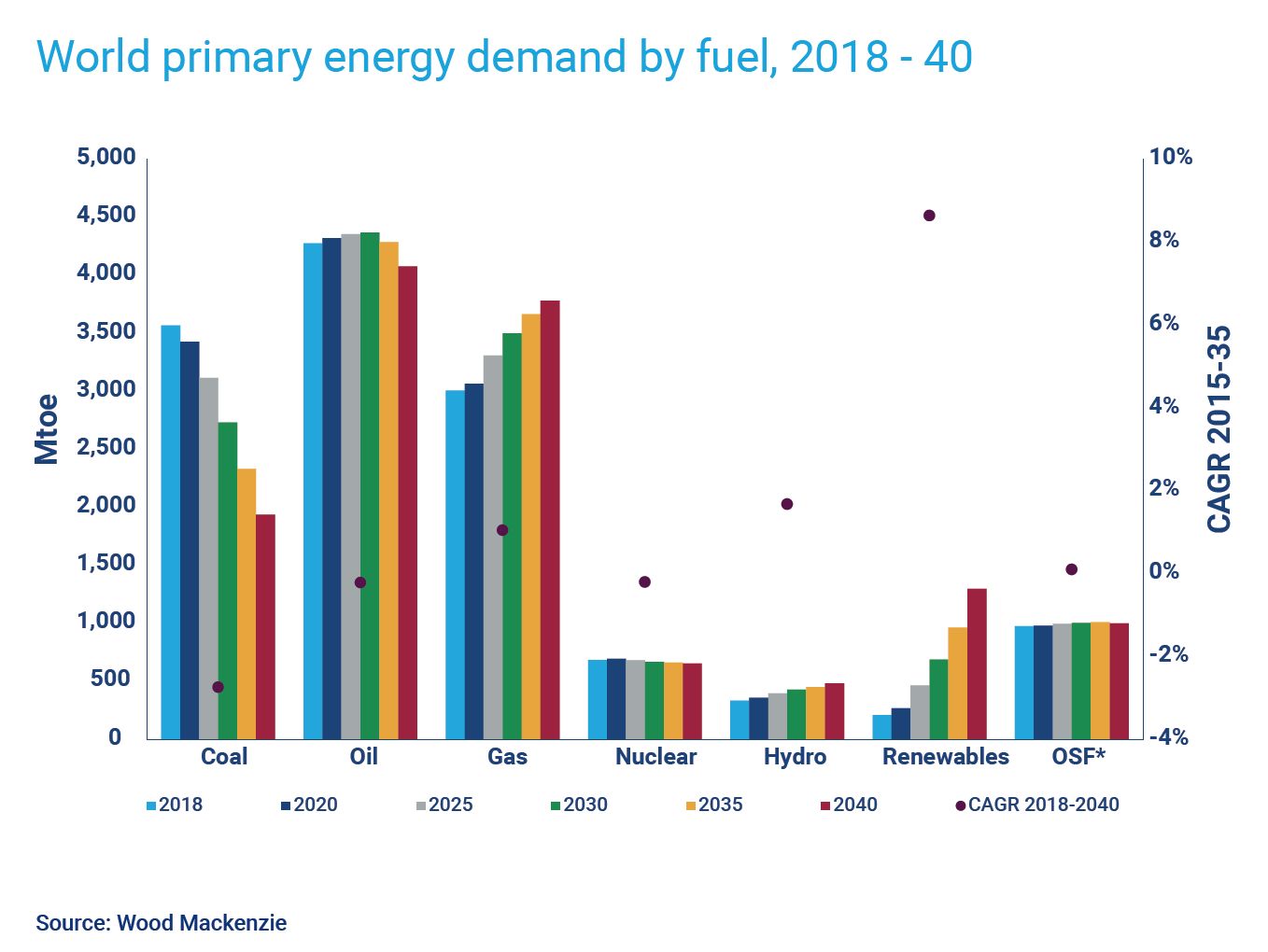

At the same time, renewable energy growth would accelerate in this carbon-constrained scenario, growing at an annual average rate of 11 percent between 2015 and 2035. Wind and solar capacity would grow ninefold from 7 percent of total power supply today to nearly 40 percent by 2040. With the rise of renewables, large-scale energy storage technologies would come to the fore, WoodMac predicts, with 780 gigawatts installed globally by 2040.

The future for natural gas remains positive in WoodMac's outlook, driven by growth in emerging markets in China, India and Southeast Asia. Asia-Pacific overall is forecasted to account for more than 60 percent of incremental demand from 2018-2040.

Coal will feel the most pain from this fast-paced energy transition. Demand is expected to decline by half by 2040, even without an international carbon dioxide pricing regime, as market forces drive the power sector to cleaner energy resources.

Despite all of these changes, fossil fuels are projected to remain king. According to WoodMac, peak fossil fuel was hit in 2012. But it continues to make up the greatest amount of global energy demand, and will continue to do so even if the adoption of clean energy resources picks up the pace.

"Even with an accelerated pace of change, a ‘2-degree world’ remains out of reach in our accelerated scenario," said Brown. "Much more needs to happen around lowering non-power sector emissions to achieve such an outcome. Political momentum will be crucial, and at present climate leadership is lacking."