EnerNOC (ENOC), the leading U.S. demand response provider, just reported record annual revenues for 2013 -- and apparently it’s decided to spend its hard-earned cash to expand its claims to Europe’s nascent demand response market.

The Boston-based demand response and energy efficiency software and services provider on Wednesday reported net income of $22 million, or 76 cents per share, on revenues of $383.5 million for fiscal year 2013. That’s up from 2012’s loss of $22.3 million, or 84 cents per share, on revenues of $278 million, and puts the company on the high end of its projected FY 2013 range of $380 million to $385 million in revenues.

EnerNOC also issued 2014 earnings guidance of $435 million to $460 million and earnings per share of 40 to 50 cents on adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) of $74 million to $78 million.

Those 2014 earnings projections would have been slightly higher, and revenues slightly lower, without the acquisition of two companies, also announced on Wednesday, which give EnerNOC a much stronger presence in European markets.

The first acquisition is Entelios, a startup that’s helped pioneer demand response for Germany’s grid, which has roughly half the peak load of mid-Atlantic grid operator PJM, the biggest market for EnerNOC and other U.S. demand response providers. Entelios, founded in 2010, hasn’t disclosed how much money it has raised, and financial terms of EnerNOC’s acquisition weren’t disclosed.

Entelios was also the first company to provide demand-based capacity for Germany’s secondary reserves market, which offers more lucrative payments for loads that can reduce power use within five minutes, rather than the hour-ahead or day-ahead requests for traditional demand response. German utilities and grid operators are struggling to integrate the country’s rising share of wind and solar power into grid operations and energy markets, making demand-side grid resources a potentially valuable addition to the country’s portfolio of fast-acting resources.

The startup has focused on big industrial loads, but according to a May 2013 presentation (PDF), it’s starting to integrate batteries, combined heat-and-power systems, and decentralized generation resources into its cloud-based virtual power plant operating system as well. It launched a partnership with giant German utility E.ON in April, and in November took its first step outside Germany in partnership with Austrian utility VERBUND (PDF).

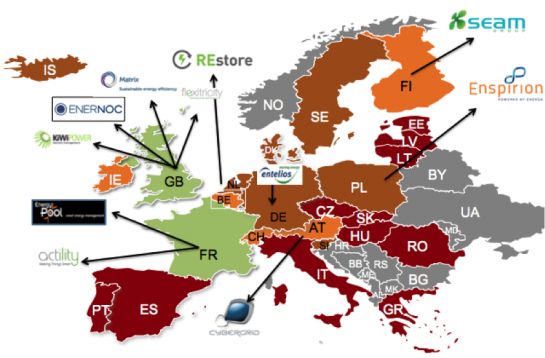

Competitors in the European demand response field include Energy Pool, which is majority owned by French grid giant Schneider Electric, as well as startups like Belgium’s REstore and U.K.-based Kiwi Power. Virtual power plant projects like the one that Siemens has created with German utility RWE could also be seen as contenders.

But each of these companies is very closely associated with the country in which it has grown its core business, as this map from the Smart Energy Demand Coalition, an industry group pushing for regulations to open more European markets to demand response, points out:

EnerNOC’s second acquisition is Activation Energy, Ireland’s first demand response provider. With only a few grid interconnections to England and a lot of wind power, Ireland is facing its own energy market disruptions, and Activation Energy would appear to have first-mover advantage for EnerNOC to exploit in that market. Terms of the deal weren’t disclosed.

EnerNOC has made a practice of buying its way into new markets and business lines, including its acquisition of Global Energy Partners in California in 2010 and its purchase of Energy Response in Australia, as well as M2M Communications for agricultural equipment demand management, in 2011. It moved into U.K.’s demand response market in 2010, and in December formed a joint venture with Japan’s Marubeni Corp. to land a contract with Tokyo Electric Power Company.

It’s also pushed into energy efficiency software and services, a field where it comes into competition with such energy services giants as Honeywell, Schneider Electric, Johnson Controls and Siemens, as well as a host of up-and-coming contenders. Both Entelios and Activation Energy offer energy management and efficiency services, as a necessary part of the work of introducing new load-management concepts to customers in markets where demand response is only beginning to take hold.

EnerNOC still gets the lion’s share of its revenues from its core demand response business, and most of those from PJM, which is an increasingly competitive market with declining revenues projected in the coming years, and other emerging U.S. markets also the targets of U.S. competitors such as Comverge, Constellation Energy and Energy Curtailment Specialists (now owned by NRG).

While financial terms for the deals weren't disclosed, EnerNOC CEO Tim Healy said in a Thursday conference call that the two acquisitions, along with its recent joint venture in Japan and its investment in energy rate and tariff software company Genability, added up to "roughly $30 million of cash spending," with most of that amount involved in the new purchases. While he didn't provide more details, he did make clear that Entelios' technology, enabling loads to participate in secondary reserves markets across Europe, was particularly valuable to EnerNOC's ambitions on the continent, highlighting the likelihood that a good portion of that $30 million went toward buying the German company.

Healy also noted that EnerNOC earned 19 percent of its revenues from international business in 2013, up 116 percent over the previous year, indicating its investments in Australia, New Zealand, Canada and the U.K. have been paying off. Taking over two companies deeply involved in the formative stages of their respective European national demand response markets seems to be a smart strategic move for EnerNOC to continue its international expansion. Now the question is how quickly those markets develop, and of course, whether EnerNOC finds those opportunities worth the price it has paid for them.