In order to hit the aggressive pollution reduction targets set last December at the Paris climate talks, renewable energy sources must continue to beat traditional sources on both price and attractiveness of financing. On the former, the cost of solar has seen the fastest drop amongst all renewables, down 78 percent from 2009 to 2014, allowing solar to beat hydrocarbons on price alone more often.

However, as solar becomes increasingly big business, energy customers want to know how they can use new financing structures to get in on the action.

The U.S. solar market has grown fortyfold over the past decade on the back of long-term financing structures, predominantly power-purchase agreements. The advantages of a PPA are numerous and clear, particularly for a new product and market: it’s simple to understand -- the customer pays little to nothing upfront, locks in a favorable rate for a long period, and takes no downside risk on the solar system.

These are compelling reasons indeed, and recent data shows that a lot of solar is sold to homes and businesses by pitching year-one savings and no upfront cost.

While the customer does see considerable value from these structures, Wall Street is reaping the bulk of the economic benefit, frequently earning 15 percent annual returns. By capturing the tax credits and depreciation for the first five years, and selling bundles of PPAs to the debt market, institutional investors are taking the upside and getting out well before the customer. What’s being sold in these PPA portfolios is really the customers, who are locked in for another 10 or 15 years.

In the last few years, however, homeowners and businesses are getting smart about solar’s value and financial upside, and pursuing financing pathways to own the solar systems on their roofs themselves.

This allows the home or business to capture more profit from the project, while retaining all the tax advantages. This is the driving force behind the growing market share of loans, which will jump from 28 percent of total home installations in 2014 to a projected 54 percent by 2020. Unsurprisingly, the most innovative companies in solar financing are now focusing on loans.

As customer mindsets shift from monthly savings to investment-minded ROI calculations, we’re seeing a corresponding focus on the length of a solar loan. Nothing eats up project profits like a long term, even at low rates. Simply put, shorter terms accelerate the path to owning the system outright and generating nearly cost-free electricity. It’s the fastest route to substantial cost savings for the solar customer.

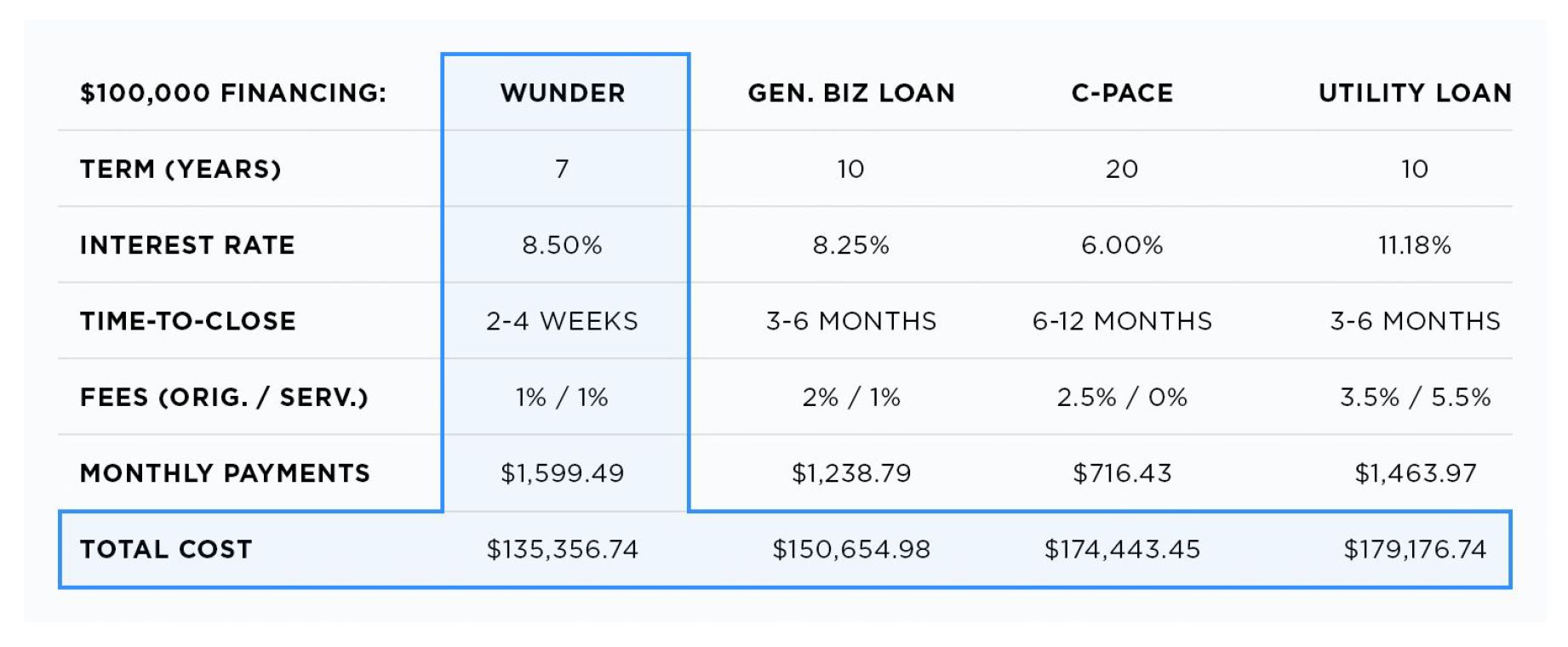

Below is an illustration of what a $100,000 loan would look like from different sources. (Disclosure: We are showing a loan from our company, Wunder Capital.)

Beyond capturing tax benefits and minimizing total cost, loans also often provide more flexibility for the customer. For example, some loan products allow customers to pay down a substantial portion of the principal with the proceeds of the Investment Tax Credit, or refinance before the end of the term if their creditworthiness improves or they can secure cheaper capital.

In fact, we’re so confident in this trend, we’ve just launched a seven-year complement to our 10-year commercial solar loan offering. It's cheaper than what long-term loans or PPAs can provide.

As solar continues to get cheaper and customer confidence in its value stronger, we anticipate more companies will start offering shorter-term loans to an increasingly savvy solar customer base. The first chapter of solar’s explosive growth has primarily enriched the big capital behind it, but the next chapter will see homeowners and businesses taking home more and more of the profits from the energy revolution.

***

Bryan Birsic is the CEO of Wunder Capital.