Vivint Solar, second only to SolarCity in U.S. residential solar installations in the third quarter of 2013, acquired Solmetric, a maker of tools for solar installers, for $12 million in cash. Solmetric was founded in 2005 by two ex-Agilent engineers.

Vivint Solar notes that the twenty-employee Solmetric Corporation "shares the goal of developing the most advanced site survey and CAD design technology that would support widespread adoption of solar energy installations."

Solmetric (based in Sebastopol, California) builds test and measurement tools that help solar installers assess a site before an installation, as well as providing performance testing and O&M after the install. The firm's products are:

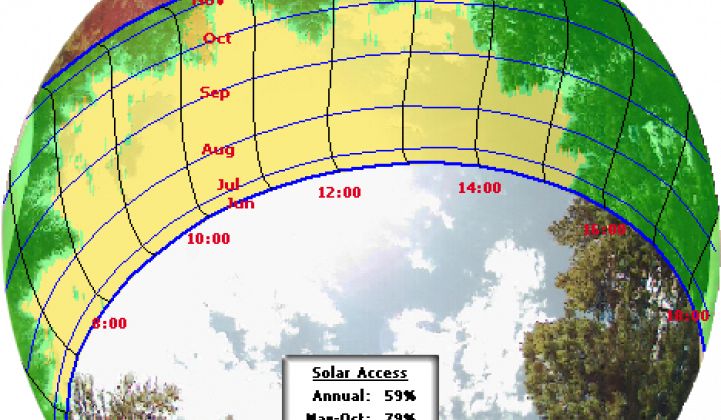

- A handheld electronic device that performs shade analysis

- Software that provides optimum layout design and energy production estimates

- An I-V curve tracer to verify performance or for troubleshooting

"Vivint Solar plans to open more than 30 new offices in 2014, and Solmetric’s SunEye and PV Designer software are key tools in our pre-installation site survey and CAD design process," according to a release. Willard MacDonald will continue to head the Solmetric business as VP of Technology at Vivint Solar.

Stephen Smith, CEO at PV consulting firm Solvida, told GTM, "The SunEye is a well designed and respected product that captures and stores critical data for properly sizing and siting residential and commercial systems. Given Vivint's door-to-door business model and Solmetric's tool functionality, it's feasible that, in the future, a short visit to a potential residential system purchaser could consist of a roof audit, accurate design/proposal creation, and deal closing all in one shot. Its a different twist on the Sungevity 'remote from home PC' design and quoting model because it gets a Vivint rep in front of the decision-maker right away."

He added, "This is a great move toward reducing customer acquisition costs and design bottlenecks for Vivint in the future. It's a technology play that could yield differentiation for [Vivint] in the system sales process. It will be interesting to see how Vivint/Solmetric handles its existing relationships with clients that, as a result of the merger, are now competitors."

MJ Shiao, Director of Solar Research at GTM, notes, "I don't think it'll revolutionize the industry -- but with the immense need to drive further cost reductions, every piece of the customer acquisition, design and installation process needs to be optimized. While install labor gets the bulk of the attention, minimizing the pre- and post-installation time is similarly crucial in driving operational efficiency."

Another source close to the deal noted, "Vivint is willing to spend to secure parts of its supply chain so it can't be attacked by SolarCity, as with the Zep acquisition." The source also sees the losers here as SolarCity and the rest of the installer community's supply chains.

One more piece of the story: Vivint Solar is the solar integrator and PPA financier unit within Vivint, one of the largest home alarm system and home automation companies, acquired by Blackstone for more than $2 billion in September of 2012.

As Jeff St. John has reported, "Vivint switched its name from APX in 2011 after a $565 million senior debt financing from previous equity investor Goldman Sachs, and has about 675,000 customers of its home security and automation services across the country." Vivint CEO Todd Pedersen told Fortune, "(I)t's possible that our solar division could do an IPO with our parent company remaining private." So, the acquisition of Solmetric provides the rapidly growing leasing company with a small but steady and simple product revenue stream that might help the Vivint Solar IPO narrative.