The motivating force behind utility smart grid deployments is changing as the majority of stimulus-led smart grid projects approach completion.

Now driven instead by regulatory requirements and operational efficiencies, North American utilities are looking for best practices and proven business cases to help them spend their money most effectively. Within these new market conditions, it’s essential to understand how utilities are approaching the smart grid market in order to predict where this industry is going and which vendors will succeed.

A new report from GTM Research, Utility Smart Grid Outlook in North America 2013: Technologies, Strategies & Case Studies, profiles 40 North American utilities that have shown ambition and success in their smart grid deployments to date. These profiles -- which detail each utility’s smart grid roadmap, communication networks, operations management systems, data management architectures, and consumer engagement initiatives -- can be used by other utilities to learn about the challenges and strategies at leading utilities, as well as by vendors, who can use the profiles to assess areas of opportunity and inform product development and marketing plans. The report provides a list of common trends and pain points at these and other utilities that are driving purchasing decisions.

The Top 10 Utilities by Maturity Rating

The report includes a detailed and comprehensive framework that can be used to measure the maturity of any utility’s smart grid project against those included within this sample. The 40 utilities -- which have customer bases ranging from just 15,000 to more than 5 million -- serve about a third of all electric utility customers in the United States and Canada, with a total of 46.6 million electric endpoints. As a whole, the group received an average rating of 2.79 of a possible 5.00.

The utilities that made the list of the top 10 by maturity ranking include IOUs and municipal utilities, and many are among the largest electricity providers in the U.S. and Canada. California utilities feature prominently on the Top 10 list -- in part due to the state’s market-leading and aggressive requirements for utility adoption of smart meters, renewables and efficiency measures -- but 60 percent are headquartered in the Southwest, Southeast and Midwest.

FIGURE: Utility Maturity Rankings By Tier

Source: Utility Smart Grid Outlook in North America 2013

The utilities on the Top 10 list have more than 19.2 million smart electric meters in operation today. All utilities are planning full deployment of AMI throughout their service territories, although they are at very different stages of deployment, ranging from having 3 percent to 100 percent of their AMI systems in operation. Commonwealth Edison, with just 15,000 of its planned 4 million meters currently deployed, has the most AMI work ahead of it, while the smallest utility on the Top 10 list, Burbank Water & Power, performed better than its size might suggest due to its extensive smart grid portfolio, comprehensive communications solutions and integrated networks.

Maturity in Different Aspects of the Smart Grid

The maturity rating system measures the stage of a utility’s smart grid project as it stands in 2013. The lowest rating of 1 represents early-stage and exploratory smart grid projects, while the highest rating of 5 is achievable with technology available today, although perhaps at too high a price point for many utilities. The rating system was designed to identify different stages of progress in utility smart grid deployment. Whether early, intermediate or advanced in overall maturity, all the utilities included have shown ambition in at least some aspect of their smart grid plans.

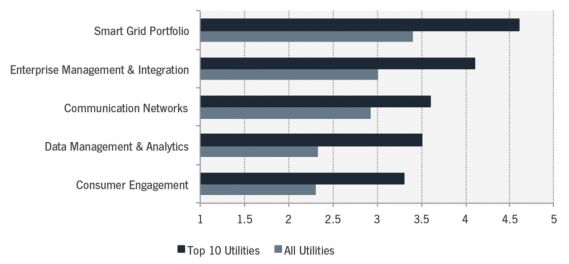

The maturity rating framework, included in the full report, can be used to measure any North American utility; however, it will have to be adjusted over time as new technologies become available, as the bar for smart grid maturity is constantly moving. The overall maturity rankings are determined by each utility’s ratings from 1 to 5 in five categories:

- Smart grid portfolio

- Communication networks

- Data management and analytics

- Enterprise management and integration

- Consumer engagement

FIGURE: Average Utility Smart Grid Maturity By Category

Source: Utility Smart Grid Outlook in North America 2013

The Top 10 performed better than the overall average in all five categories, but within each category, leaders emerged. Silicon Valley Power, for example, was one of seven utilities with the highest score in data management and analytics. With just 53,000 endpoints and less than 1 percent of its AMI endpoints deployed, SVP is already developing an advanced data management system using OSIsoft as an advanced analytics engine to pull in all generation, distribution and meter data in one data warehouse. SVP is also working on a dynamic system model with real-time views and analytics for revenue protection, reliability, and identifying unexpected customer EV and solar loads.

Another utility working on early-stage deployment, National Grid, came out in the bottom tier in overall maturity rankings; however, the utility was one of ten to receive the highest rating in communications for its network management plans. The report also identifies National Grid as a Smart Grid Visionary, an archetype made up of early-adopter utilities with ambitious smart grid plans that can benefit the industry as a whole.

Lakeland Electric and Consumers Energy received high rankings in enterprise integration, with the pair both tied with Hydro One for 11th most-mature overall.

North American Utility Smart Grid Trends

The report and maturity rankings are not only important for evaluating these 40 utilities; they also provide a way to judge the stage of maturity of the industry as a whole. In many cases, the maturity of a utility’s smart grid projects is limited by vendors that overpromise and under-deliver, or by a lack of available, affordable solutions. Even still, utilities are establishing aggressive goals for smart grid deployments due to internal and regulatory timelines, and we expect the maturity of utilities in all aspects of the smart grid to continue to progress.

Overall, utilities are most advanced in building broad portfolios of smart grid technologies to test in their service territories. One-fourth of utilities reported having trouble determining whether failures are related to communications or power equipment. Utilities are struggling with integration of enterprise management and communication systems, as well as with adjusting the structure of their teams to deal with IT/OT convergence and new data flows. One-third of the utilities in this report said they were highly concerned with data management and analytics, and are building tools in-house as well as integrating or seeking vendor solutions for data management, filtering and warehousing.

To learn more about the Utility Smart Grid Outlook in North America 2013: Technologies, Strategies & Case Studies report, visit http://www.greentechmedia.com/research/report/utility-smart-grid-outlook-north-america-2013.