In the last six months, YieldCos have fallen from stock market darlings to pariahs.

YieldCos are companies that buy clean energy projects such as solar and wind farms, and use the majority of free cash flow from these projects to pay dividends to investors. Many are listed subsidiaries or carve-outs of large developers of clean energy projects.

Last year, investors repeatedly punished leading solar developers and manufacturer First Solar and SunPower for their reluctance to launch YieldCos. When they finally relented and formed a joint YieldCo (later called 8point3 Energy Partners), both were instantly rewarded. Their stock prices each rose 20 percent over the course of two weeks.

Now, the situation is reversed, with many YieldCos trading at half their peak prices. The Global X YieldCo ETF (YLCO) is trading around $10, down one-third from its $15 launch near the peak of the YieldCo mania in May.

Is the YieldCo model broken?

Many market observers are questioning if the YieldCo model is broken.

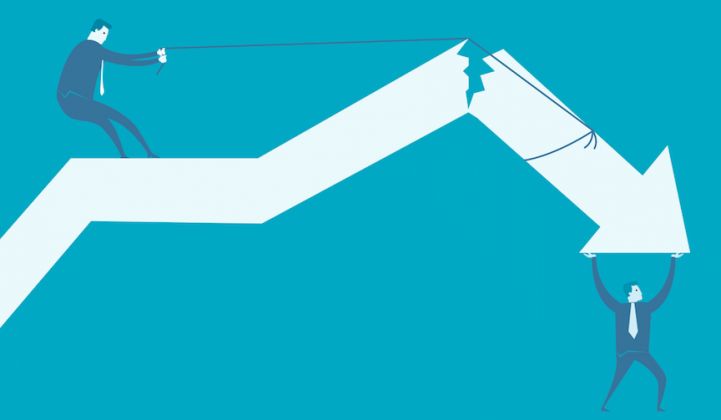

The YieldCo model has no official definition, but its detractors typically point to the rapid dividend growth targeted by many of the ones based in the United States when making their point. This dividend growth was achieved (as I explained at the time) by public offerings of stock at successively higher prices, which produced more capital per share to invest. More capital per share allowed dividend growth and higher share prices.

Each link in this virtuous cycle depended crucially on the last, and when share prices broke down, the ability to raise cheap capital did too.

What managers are saying

If the YieldCo model is broken, it is only this aspect of the model that's a problem. How YieldCo managers are confronting the new environment depends on how much they intended to rely on stock market capital before the crisis.

Below is what a selection of YieldCo managers said in their recent third-quarter conference calls. How bullish they are depended directly on how much they were relying on stock market capital for their growth plans, but all emphasized how they remain sustainable businesses even without growth.

Independent YieldCos, which often have other ways to access capital and less pressure to buy projects from their sponsors, were also generally more sanguine about the market turmoil.

Subsidiaries of clean energy developers

NextEra Energy Partners: “The YieldCo model can work and work well”

NextEra Energy is widely seen to be the strongest of YieldCo sponsors, and many investors appreciate this strength. Although NextEra Energy Partners shares have fallen significantly, Jim Robo, chairman and CEO of NEP, said, “The YieldCo model can work and work well for our partnership like NEP that has the right structure and the support of a world-class sponsor.”

He thinks “the capital markets' re-evaluation of the YieldCo space can play to our competitive advantage.”

But even NEP is cautious about raising new capital in the current market conditions. “We continue to evaluate the optimal capital structure for NEP. As it has some additional debt capacity that can help finance future transactions.” The YieldCo “plan[s] to issue a modest amount of NEP public equity” in 2016, but will both buy and sell NEP units based on market conditions.

Abengoa Yield: Working to “become a completely independent company”

Abengoa SA (ABGB) is in significant financial difficulty, so its YieldCo is taking steps to protect itself from any possible fallout. CEO Javier Garoz spoke about Abengoa Yield's plans in a conference call in early November.

“ABY has all necessary [elements] in place to achieve the run rate in 2016; concentrating on the execution and delivery of the expected cash flows…must be our top priority.” He continued, “We want to reinforce our autonomy from Abengoa to become a completely independent company. We will incorporate the necessary resources at the corporate and staff functions to avoid the current dependency.”

In addition to building its own management team, ABY is actively searching “for another sponsor, in addition to Abengoa.” Garoz reaffirmed 2016 dividend guidance of $2.10-$2.15 per share, emphasizing that it does not “depend on any additional acquisition.”

Like many other YieldCo managers, Garoz thinks his company's assets are undervalued by the market. “[E]ven considering an hypothetical worst case scenario, where ABY have no access to growth for some time, our current portfolio of assets have a very significant value not recognized by the market at this point.”

TransAlta Corporation will continue to pursue drop-downs to YieldCo

Unlike most YieldCos listed on U.S. exchanges, TransAlta Renewables (Toronto:RNW) never promised double-digit dividend growth rates. Because of this, its share price has suffered much less than those of its U.S.-listed rivals.

In a conference call on October 30, TransAlta Corporation (TAC) CEO Dawn Farrell emphasized that little had changed for the YieldCo. She stated that TAC will continue to “pursue asset drop-downs to TransAlta Renewables.”

She also felt it important to emphasize the YieldCo's value proposition, stating that management believes “TransAlta Renewables is a solid investment for shareholders who want stable and secure dividends with moderate growth.”

8point3 Energy Partners: Sponsors committed to drop-downs

In a call on October 29, First Solar (FSLR) CEO James Alton Hughes said that plans for 8point3 Energy Partners were on track. “Both sponsors at this point in time are committed to the drop-downs that we would envision in the first half of 2016. We've also indicated that we do not have a need to raise capital at this point in time. We've left enough capacity in 8point3 to manage those anticipated drop-downs.”

SunPower's CEO Tom Werner agreed, saying, “We think 8point3 can successfully buy projects without issuing equity for a period of time.”

The TerraForms: TERP and GLBL “maintaining liquidity” and “sufficient capital”

SunEdison's (SUNE) twin YieldCos have been suffering more than any of the others, because investors had previously looked at the YieldCos as the cure for SunEdison's over-leveraged balance sheet. With TERP's and GLBL's stocks in the tank, it looks less likely that the TerraForm twins will be able to access the market in order to buy more solar farms from SunEdison in exchange for much-needed cash.

Both YieldCos have been trying to soothe investors' worries with comforting talk about sufficient resources to fund existing commitments.

Recently replaced CEO Carlos Domenech stated that TERP has $1.5 billion in cash and an undrawn credit facility. The CFO, Alex Hernandez, pointed to a recent U.K. project financing which he said "demonstrates the company’s access to financing markets at an attractive cost of capital and ability to continue funding the growth of our business.”

He said TERP “remain[s] focused on further strengthening the company’s liquidity position and maintaining the quality of our balance sheet.”

Regarding TerraForm Global, Domenech said the company has sufficient capital to fund pending transactions, bringing the portfolio to 1.3 gigawatts. At the time, it had $1.1 billion in unrestricted cash and a $500 million credit facility.

On Monday, Domenech was replaced as CEO of both TerraForm YieldCos by SunEdison CFO Brian Wuebbels. And on Tuesday, SunEdison reversed its prior stance of not selling additional assets to the TerraForms, selling 425 megawatts of Indian solar to GLBL for $231 million. In order to buy these projects, the YieldCo canceled plans to buy other projects from third parties.

Was the deal forced, or were the Indian solar farms simply too good a deal to pass up? The timing, right after the replacement of Domenech, looks suspicious. At $0.51 per watt, the $231 million purchase price of the Indian farms seems very low, but without knowing how much debt was involved in the transaction and a number of other details, it's impossible to know how good a deal this was for Terraform Global.

In a transaction agreed on in June, NRG Yield bought 137.5 megawatts of the Desert Sunlight Solar Farm from GE Energy Financial Services for cash and the assumption of debt amounting to $4.16 per watt.

Independent YieldCos

Pattern Energy: Volatility in YieldCo sector “very healthy”

In a conference call on November 5, Pattern CEO Michael Garland said, “We believe [the recent volatility] is very healthy for Pattern and the sector, as it allows us to highlight the strength of our corporate strategy, the robustness of our cash flows and soundness of our growth strategy.”

He went on to discuss Pattern's ability to manage without returning to the capital markets. He stated, “[C]ash available for distributions is stable and sustainable...over the next 25 years. These assets don't require any additional equity capital.”

Pattern increased its dividend for the third quarter, but declined to give a dividend growth target for 2016, stating that growth would depend on market conditions. Garland emphasized the advantage of Pattern's private development arm, Pattern Development, which is not subject to stock market whims. If Pattern's stock price does not recover, Pattern Development will hold operational assets longer, rather than dropping them down to a YieldCo, which cannot finance them at attractive rates.

Hannon Armstrong Sustainable Infrastructure: YieldCo pullback is an opportunity

Hannon Armstrong does not have a development arm, but its expertise in energy efficiency finance gives it access to high-quality energy-efficiency projects beyond the scope of other YieldCos. It also invests in many of the same projects as other YieldCos, but generally as a more senior creditor.

In a conference call on November 4, CEO Jeffrey Eckel stated that there has been a “pullback of buyers of projects from the YieldCo issues. … [T]he required rate of return for investors in the equity has gone up. … [T]hat gives a little air cover for the senior slices of capital to go up as well.”

Hannon Armstrong reaffirmed its 14 percent to 16 percent annual per-share earnings growth target for 2015 and 2016.

Brookfield Renewable Energy Partners: “We're very different”

In a call on November 3, Brookfield CEO Sachin Shah emphasized that Brookfield does not have most of the characteristics that are leading investors to question the YieldCo model.

“We're very different. We have internal operating capabilities. We have our own development. We don't rely on a drop-down from parent. We fund our growth largely through our own existing cash flow," said Shah.

He added, “I think the opportunity set will actually get better if we see a weaker capital market, and we're one of the few organizations that is really well positioned to benefit from that. We saw YieldCos drive the cost of assets to levels that were really difficult for us to compete with, and this was largely off the back of them trading at a very, very low cost of capital and, really, the market believing that their growth into perpetuity could sustain itself."

Looking ahead

While most YieldCos are responding to low stock market prices by shelving plans for new share issuance and new acquisitions, the model of connecting low-cost stock market capital with capital-intensive clean energy projects is far from dead.

Even the growth of YieldCo dividends is not dead. Many YieldCos have considerable cash on hand, borrowing capacity, or (a few) retained cash flows. These companies are likely to take advantage of the new environment to scoop up a few choice assets on the cheap.

Investors would likely do well to do likewise and scoop up YieldCo shares on the cheap.

Listen to our conversation with Tom Konrad about the YieldCo bubble:

***

Tom Konrad is a portfolio manager and freelance writer with a focus on clean energy income investments. He manages the Green Global Equity Income Portfolio and is editor of AltEnergyStocks.com.

DISCLOSURE: Tom Konrad, his clients, and the Green Global Equity Income Portfolio own shares of NEP, ABY, TSX:RNW, CAFD, TERP, GLBL, PEGI, HASI, and BEP.